After seven years, Emerald Fund had paused plans to redevelop the former California College of the Arts in Oakland with nearly 450 homes.

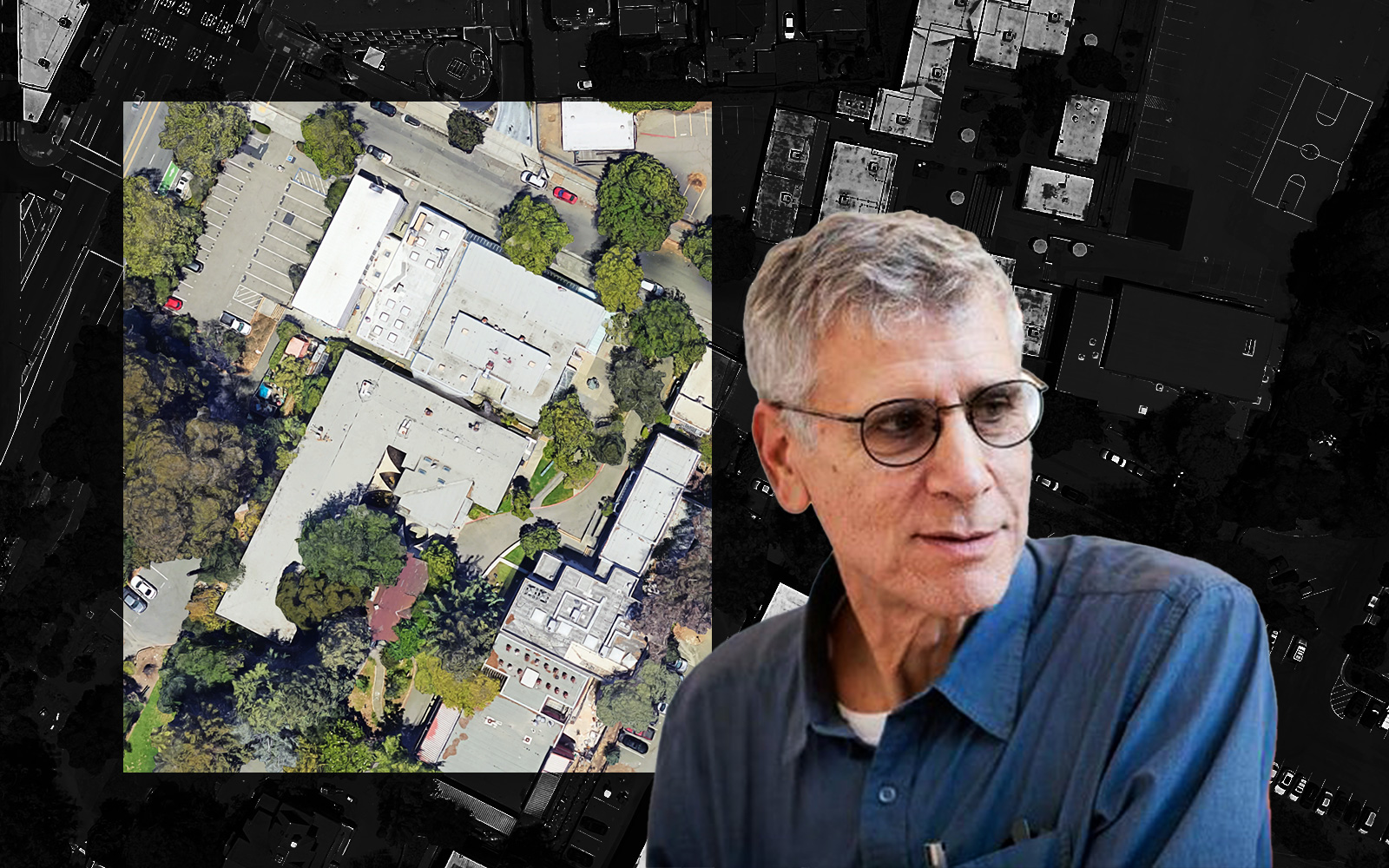

Despite a new environmental study, the San Francisco-based developer says economic conditions forced the firm to put the campus project on hold until further notice at 5212 Broadway, in Rockridge, the San Francisco Business Times reported.

The 4-acre campus was to be redeveloped in tandem with CCA, which owns the property, and San Francisco-based Equity Community Builders. It’s not clear if the latter, not mentioned by the newspaper, still has a role in the project.

The latest plans called for two apartment buildings with 448 units, 6,600 square feet of shops and restaurants and a 1.5-acre park. The number of affordable units, if any, were not disclosed.

Initial plans had called for 589 housing units, a 19-story residential tower and 35 artist homes in a refurbished dorm. It was then scaled back to 510 homes, including 51 affordable apartments.

Ten of the school’s dozen buildings would be demolished. California College of the Arts opened in Berkeley in 1907 and moved to Oakland in 1922. A century later, it abandoned the property for a new campus on Potrero Hill in San Francisco.

Oakland just released the final Environmental Impact Report for the project, now slated to go before the Landmarks Preservation Advisory Board and Planning Commission next month. It will then head to the City Council for final approval.

Regulatory approvals aside, the developers say their project missed its “development window” and won’t break ground until market conditions improve.

“It’s great to get approval. Unfortunately, we’ve missed the development window. The cost to build the building is a lot more than it’s worth when you’re done,” Marc Babsin, president and principal of Emerald Fund, told the Business Times.

Rising construction costs and low rents caused by an uptick in completed housing developments have made residential projects less financially feasible.

When the Federal Reserve cut interest rates last week, local developers said it’s not enough to make projects pencil, according to the newspaper.

Babsin of Emerald Fund agreed, but didn’t disclose a potential time for development.

“There will come a day, hopefully, when all the other stuff is aligned and then interest rate savings would actually come into play and matter, but we’re not at that day,” Babsin told the Business Times.

“You’re having projects being sold at one third below replacement costs. So I can build this building or I can, for a third of the money, buy a similar building down the block and I don’t have any construction risks,” he said. “It’s quite something — it’s historic.”

— Dana Bartholomew

Read more