What You’ll Learn

- How a cash-out refinance affects your home equity

- Popular reasons homeowners opt for a cash-out refinance

- Lender limits to the amount of cash you can typically access

The thing about owning a home is that a large chunk of your money is tied up in your home. While you’re paying off the mortgage, your lender owns a portion of your home. The portion of the home you own is your home equity. As you pay your mortgage—and your property value increases—your home equity grows. A cash-out refinance (refi) is a convenient way to unlock your home equity.

In a nutshell, a cash-out refinance lets you refinance your current mortgage for more than what you owe so you can keep the difference in cash. Once the refi is done, you’ll get a new loan consisting of your previous mortgage balance plus the cash you took out.

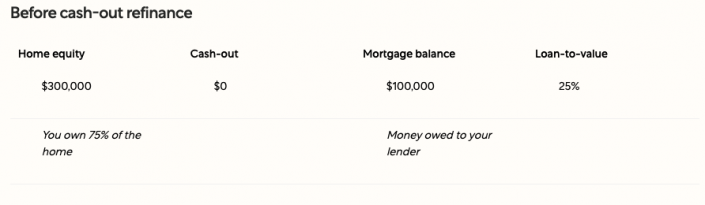

A cash-out refinance by the numbers

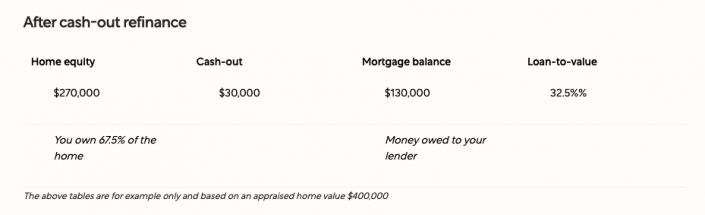

Let’s say your house is worth $400,000 and you have $100,000 left on your current mortgage. That means you have $300,000 in home equity. If you wanted to liquidate $30,000 of this equity, you would then get a new loan worth $130,000 (the $100,000 balance from your original mortgage balance plus the $30,000 you took out in cash).

What this cash-out refi would look like:

Reasons for a cash out refinance and common cash-out uses

How you choose to spend the money from a cash-out refinance is up to you. But typically, homeowners use a cash-out refinance to cover these expenses:

- Home renovations: People often use their cash-out to reinvest into their home in the form of improvements, repairs, or even major remodels. Whether you use the money for a roof replacement or to add another bedroom, there’s a chance that these improvements can help boost your home’s value (and your equity) in the long run.

- Debt consolidation: Some people do a cash-out refinance to pay off other loans like credit card debt, student loans, or a second mortgage. Since mortgage rates are relatively low, moving your high-interest debt to your mortgage might help you save a significant amount of interest in the long term. For example, In 2020, U.S. households paid an average interest rate of 14.65% on credit card debt1, while the average mortgage interest rate for that year was 3.11%, more than 10% lower.2 The interest you pay on mortgages is usually tax-deductible. Mortgages also give you a more extended repayment period, offering another opportunity to make paying your monthly debts more manageable.

- Personal costs: Some people use a cash-out refinance for education or medical expenses if they do not have access to other funds. Others who are low on savings may choose to transform their home equity into an emergency savings fund that they can turn to in case of future unexpected expenses. For these personal costs, a refinance can be an alternative to a personal loan, which usually has a higher interest rate and commonly has a shorter timeframe than a mortgage to be paid off.

- Investing elsewhere: Some homeowners use the money from their cash-out refi to help fund their retirement, long-term savings plans, another property, or other investments that could provide larger returns than the interest they are paying on their mortgage. Make sure to talk to your financial advisor before pursuing this path.

Cash out refinance LTV and how much you can borrow

The amount of equity you can access with a cash-out refinance is limited by your loan-to-value ratio (LTV). Most lenders require that your cash-out refinance LTV stays at or below 80% (for a single-unit primary residence; maximum LTVs for other properties may vary). That means that if you’re still paying for private mortgage insurance because the down payment on your home was less than 20%, it’s unlikely that you’ll be approved for a cash-out refinance.

The requirement to maintain an LTV of at least 80% once you’ve done the cash-out refinance is because lenders consider these refinances as riskier than rate-and-term refinances; it’s also why interest rates on cash-out refis are generally higher. However, if rates have dropped or your credit score has improved since you got your original mortgage, you may still be able to get a better interest rate than your current financing, even when taking cash out.

Cash-out vs. HELOC

Another way to get access to the cash equity you have in your home is to get a home equity line of credit (HELOC). While both a cash-out refinance and a HELOC help you utilize the equity you’ve built up in your home, they differ in a few key ways. A cash-out refinance liquidates your equity in a lump sum, but a HELOC does so through a credit line secured by your home. In addition, a cash-out refinance actually replaces your existing mortgage, while a HELOC is a second loan on top of your first one. Cash-out refinances also offer the option of a lower, fixed interest rate, while HELOC interest rates are always adjustable, changing (usually upward) in conjunction with the market index.

Cash-out considerations

There are some cases when a cash-out might not be the best move. If you use it for something like a new car, vacation, wedding, or risky business venture, there’s a good chance you’ll have little to no return on your money. You’ll still be on the hook to pay that debt off (with interest), and if you’re unable to pay, you could put your home at risk.

How to weigh the benefits of a cash-out refi

If you’re wondering whether a cash-out refinance is the right option, consider how you’re going to use the money against the effect it might have on your mortgage interest rate, term, and monthly payments. A cash-out refinance might be a good option if you’ll be using that money to invest in an appreciating asset, like education, home improvements, or your financial security. On the flipside, it might not be the best choice if there isn’t a clear financial benefit.

Need some help talking through your options? We’re here to help. Our home advisors can help you find the best refinance for you, and because they don’t work on commission, they’re always looking out for your best financial interests, not their own.