Pictured: Sean Robertson, Jeff Rosenfeld

Volatility in capital markets in the wake of rising interest rates hasn’t slowed momentum for Churchill Real Estate. Just the opposite. In fact, lending volume in the firm’s ground-up multifamily division hit a record high in the second quarter and the third quarter is on a similar pace.

“We continue to grow our platform year-over-year, and we see opportunities to earn outsized returns in the market while other lenders in our cohort have pulled back,” says Sean Robertson, co-head of originations at Churchill Real Estate. One of the reasons that Churchill has continued to stay active is that the firm is well capitalized. “We are fortunate that our capital partners and investors, many of whom are foreign institutions, still believe that the rental housing market in the U.S. is a solid investment,” Robertson notes.

When The Real Deal spoke with Churchill earlier this year, the firm was busy expanding its residential construction lending platform outside of New York, and Churchill remains firmly focused on that strategy despite rising interest rates. “We believe that there are still a lot of tailwinds that will continue to push the multifamily market forward, or at the least keep it relatively stable over the next couple of years despite talk of a recessionary pullback,” adds Jeff Rosenfeld, co-head of originations at Churchill Real Estate.

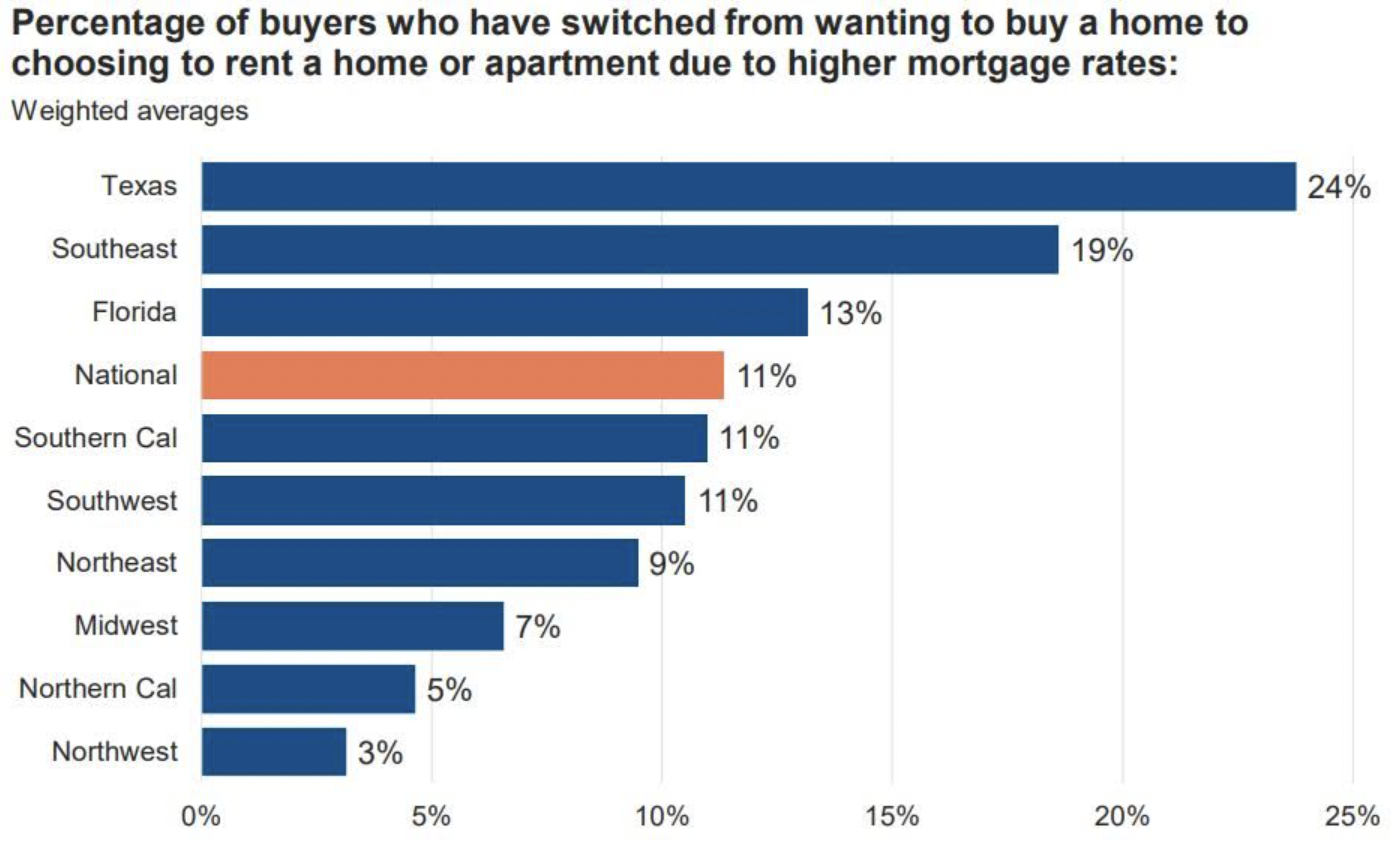

The housing shortage is fueling steady demand for rental housing. The latest research from the National Multifamily Housing Council and National Apartment Association estimates that the country needs to build 4.3 million units by 2035 to keep up with annual projected demand, including 600,000 to meet the current apartment shortage. In addition, rising mortgage rates is pushing the cost of buying a home further out of reach for many potential buyers, which also bodes well for new development. “We are voracious consumers of data, and when we see that the median monthly mortgage payment is almost 1.5x the median monthly asking rent, we perk our ears up and focus on markets where that’s most acute” adds Jeff Rosenfeld.

Source Credit: John Burns, https://www.wsj.com/articles/rising-mortgage-rates-complicate-decision-on-buying-versus-renting-11662065322

We are voracious consumers of data, and when we see that the median monthly mortgage payment is almost 1.5x the median monthly asking rent, we perk our ears up and focus on markets where that’s most acute adds Jeff Rosenfeld.

High-growth markets drive demand

As Churchill continues to expand its geographic footprint, the firm is focusing on high-growth markets in the Southeast and Southwest, as well as select areas in California and the Pacific Northwest. “We’re finding that some of the tailwinds that we saw in 2021 and early 2022 are more sustainable in certain markets whereas growth in other ‘work-from-home-oriented’ markets may have been more transitory in nature,” notes Rosenfeld.

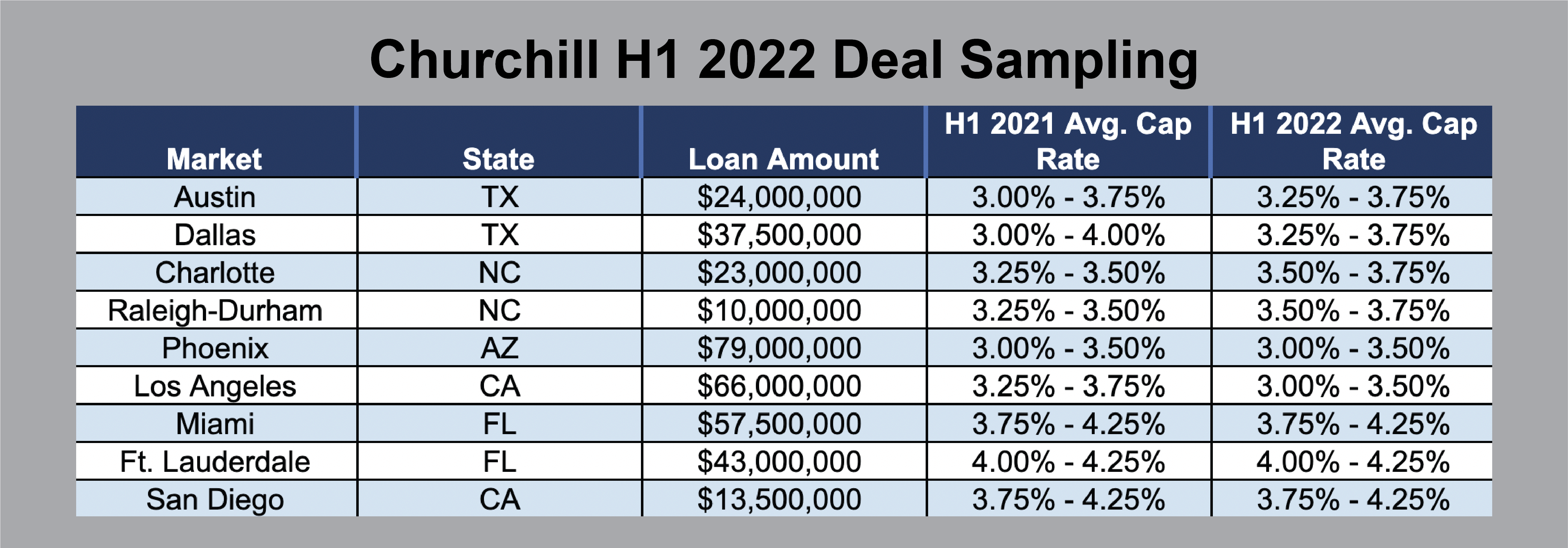

Churchill is actively lending in markets such as Phoenix, Miami, Austin and Durham, N.C. where there has been little movement in traded cap rates over the last six months. For example, cap rates in Austin have ticked slightly higher from between 3.0-3.75% in the first half to 3.25-3.75% at the start of the second half, according to CBRE.

(1)Data is from CBRE US Cap Rate Survey H1 2022

Trading up on loan quality

Churchill is taking a prudent approach to identify new lending opportunities that allow the firm to “trade up” on the quality of loans it’s doing while maintaining pricing. “The difference between our 2021 business and our 2022 business is that we’ve really increased our average loan size and had the opportunity to lend to better credit quality borrowers and projects in strong markets,” says Rosenfeld.

For example, Churchill Real Estate recently provided a $57.5 million construction loan for Fourteen Residences Allapattah, a two-building complex with 237 units planned for Miami. The workforce housing project is being developed by Neology Life Development Group, and it marks the firm’s third lifestyle-driven residential community in Miami’s historic Allapattah neighborhood.

A pullback from bank lenders is clearing the runway for Churchill to execute loans at non-bank pricing. Whereas banks were topping off leverage at 60-70% loan-to-cost in 2021, those lenders have since pulled back to 55-60%. “It’s a very different offering now from the bank market,” says Robertson. “We are seeing better credit deals bounce up to our territory, which is creating a good opportunity for us to improve the overall health of our balance sheet.”

Prudent underwriting

It is not entirely business as usual. Churchill is adapting to current market conditions. “We understand that the market for permanent financing has changed, and as such, we have adapted our underwriting standards accordingly,” says Robertson.

The leverage our borrowers achieve upon stabilization is really what guides our loan sizing.

Whereas Churchill was financing construction loans up to 80% loan-to-cost in 2021 and early 2022, it is becoming harder to find deals that work for 80% loan-to-cost in today’s market.

Typically, the permanent lenders, including the agencies, underwrite loans based on a 1.20x or 1.25x DSCR. So, higher interest rates naturally support lower loan proceeds. Likewise, when it comes to sizing its construction loans, Churchill is more constrained. Although leverage has pulled back slightly, Churchill still offers a very competitive option compared to other lenders, particularly the banks. “Relatively speaking, we’re still a compelling stretch senior whole loan solution for many Borrowers, even if we are not reaching the same loan-to-cost levels that we saw in 2021 or earlier this year,” says Robertson.

A number of bank construction lenders have moved to the sidelines and put things on hold, at least through 2022. “We’re continuing to double down on our general thesis that rental housing in core growth markets in the United States is the best place to put capital. That said, given the volatility in the market, we’re able to trade up in credit quality,” Robertson says.

Robertson continues to note so, we’re going into those better segments of the market, getting better credit quality, lending to better borrowers and really focusing on workforce housing, which we believe will be a bit more recession-resistant.