From investment analysis to lease abstraction and property management automation, AI is transforming commercial real estate. However, as AI adoption accelerates, it also brings heightened concerns around data security, privacy, and regulatory compliance. Real estate teams manage large volumes of sensitive data, including lease agreements, financial statements, tenant records, and underwriting reports. If this data is not properly secured, it becomes vulnerable to cyberattacks, unauthorized access, and potential legal issues. Without security measures, AI-powered platforms may become liabilities rather than competitive advantages.

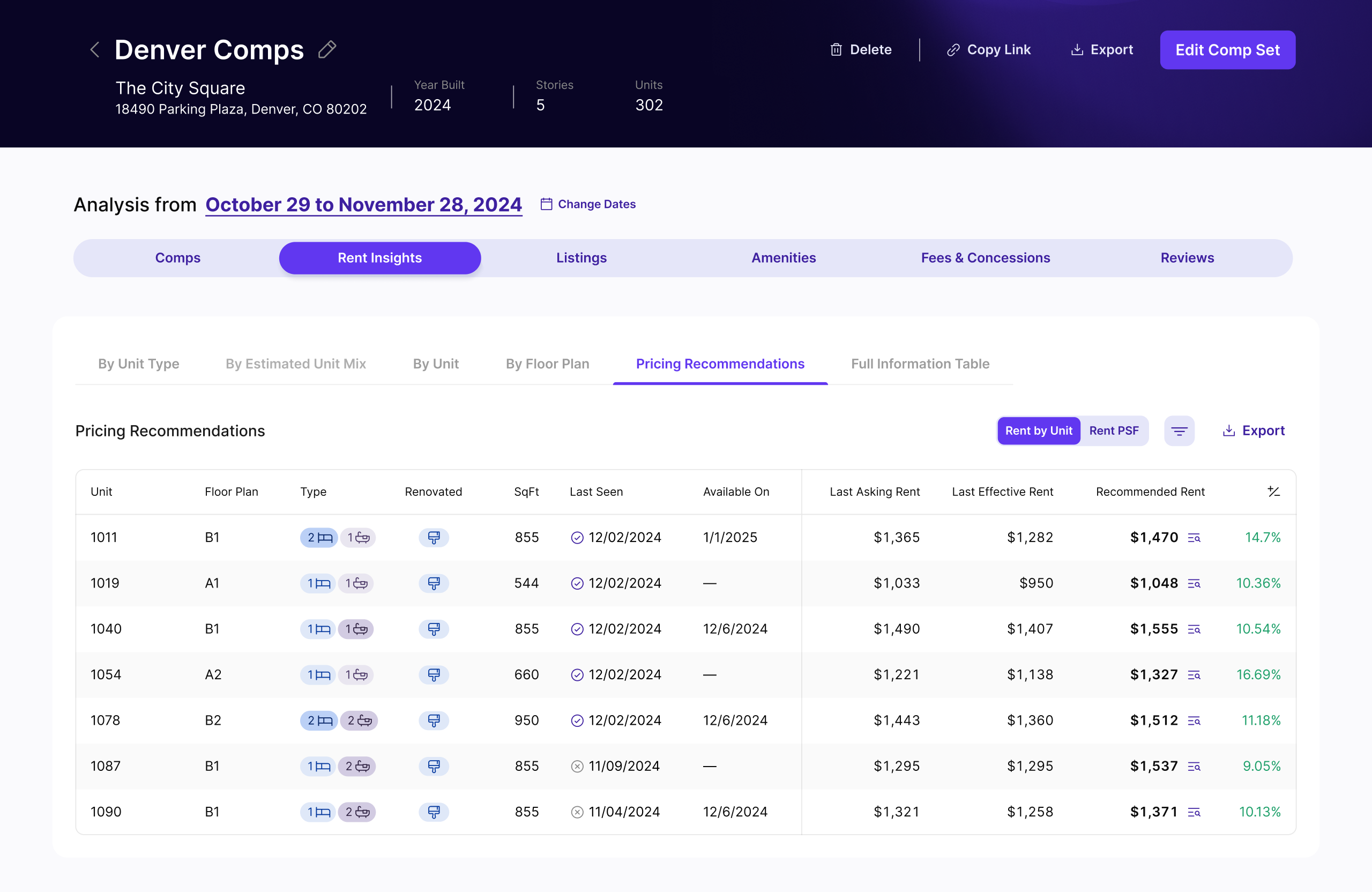

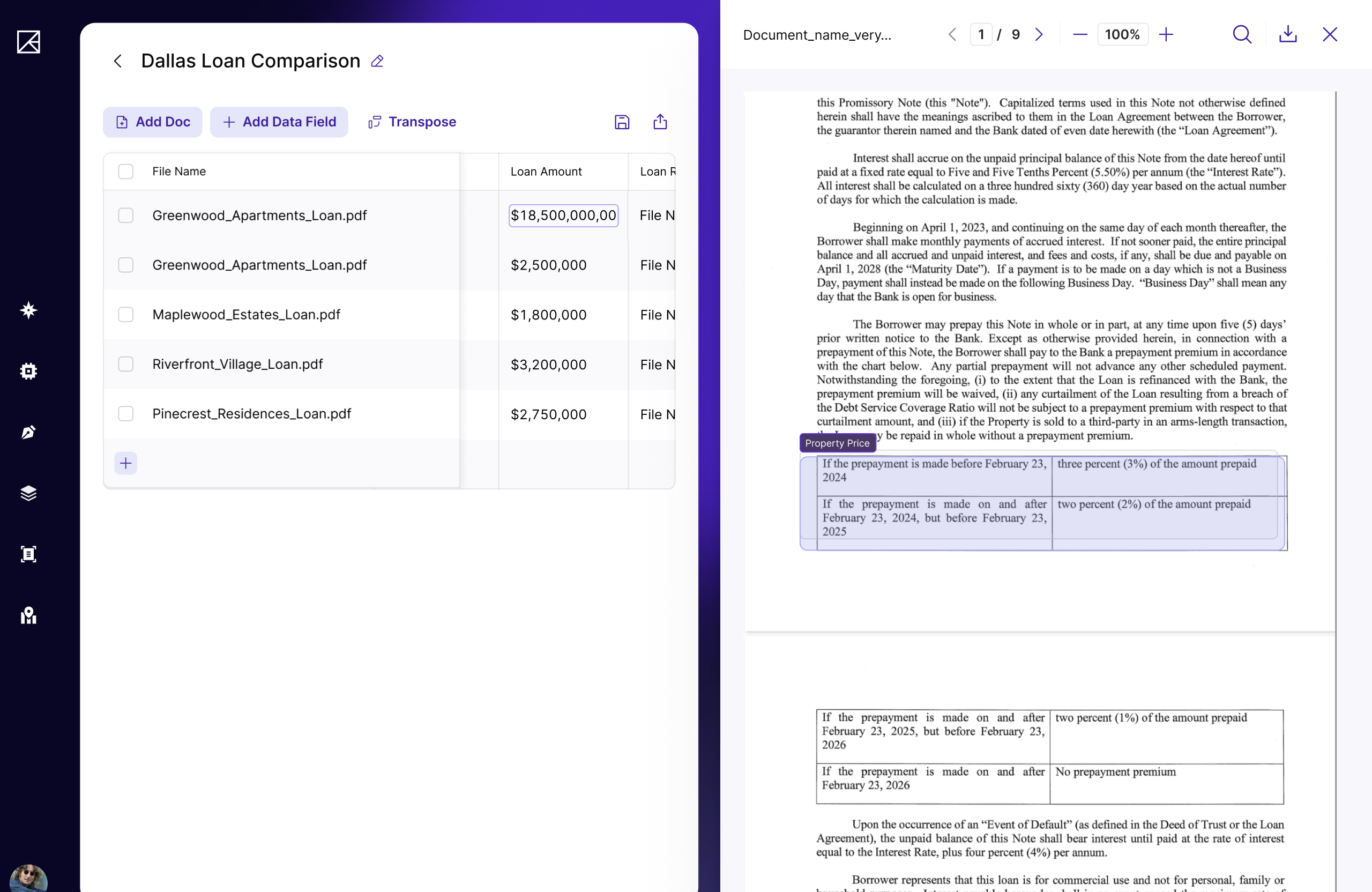

At Keyway—the AI-powered real estate investment and management platform—security is embedded into every aspect of its AI-driven solutions, KeyComps and KeyDocs. We spoke with Keyway Co-Founder and CEO Matias Recchia to learn more about how these tools help real estate teams leverage AI insights while maintaining strict security standards, ensuring that sensitive financial data remains protected at every stage of the investment and property management lifecycle.

Why AI Security Matters in Real Estate

AI Security is essential in real estate for multiple reasons, ranging from data protection to cyber threat prevention. Here are some use cases for AI Security:

1. Protects Sensitive Financial and Tenant Data

Real estate transactions involve highly confidential data, including details about rental payments, tenant creditworthiness, investor capital structures, and property valuations, among others. AI relies on this information to generate insights, but without proper security frameworks, this data can be exposed to cyber threats, unauthorized changes, or even internal misuse.

“A data breach in real estate could lead to significant financial losses, legal complications, and reputational damage,” Recchia said. For example, if a hacker gains access to a portfolio’s lease agreements, they could manipulate terms, delete clauses, or expose tenant information. To mitigate these risks, Keyway employs advanced encryption to protect data in transit and at rest. This ensures that unauthorized parties cannot alter lease and financial data, even if they attempt to access the system. Keyway also ensures strict internal controls so that only authorized users—such as asset managers, lawyers, and property owners—have access to AI-generated insights.

2. Prevents Cyber Threats and Unauthorized Access

As AI-driven real estate platforms integrate with property management systems, CRMs, and market research tools, cybercriminals increasingly target automated workflows, exploiting weaknesses in APIs, cloud storage, and authentication systems. As real estate companies increase their reliance on AI, securing these integrations is essential. Why? Unauthorized access through a single API connection can expose a company’s entire data infrastructure to external threats. To address these issues, Keyway enforces multi-layered security through role-based access controls (RBAC), multi-factor authentication (MFA), and secure API integrations.

- Role-Based Access Controls (RBAC): Ensuring that only designated personnel can access specific AI-driven insights.

- Multi-Factor Authentication (MFA): Adding an extra layer of security to prevent unauthorized logins.

- Secure API Integrations: Using encrypted communication channels to protect data flow between AI systems and external software.

These measures significantly reduce the risk of cyberattacks and unauthorized data exposure, helping property managers and investors use AI without compromising security.

3. Ensures Regulatory Compliance and Avoids Legal Risks

Real estate transactions are subject to strict legal and financial regulations, including SOC 2 compliance for data security, GDPR and CCPA for tenant privacy protection, and Fair Housing Act (FHA) regulations regarding rental pricing. Non-compliance with these standards can result in fines, lawsuits, and reputational harm. “AI solutions must align with industry regulations while maintaining full transparency in data usage and decision-making.” Recchia said. Keyway follows SOC 2 compliance standards, ensuring that all AI-driven data processing meets industry security best practices. Additionally, KeyComps and KeyDocs never use client data for AI training, eliminating concerns about unintended data leaks or bias in AI models.

How Keyway is Building a Secure AI Framework

“Keyway has developed a comprehensive AI security framework to ensure that data protection, compliance, and operational integrity remain at the forefront,” Recchia said. Keyway does this through secure AI deployment and risk monitoring. AI models are often deployed in third-party cloud environments, introducing potential security vulnerabilities.

Keyway offers multiple deployment options to give real estate firms complete control over their AI environments. For example, with on-premises AI, models can be hosted within a company’s private infrastructure, eliminating external exposure. With virtual private cloud, Recchia notes that work can occur in a cloud environment with isolated security controls, preventing unauthorized access. Keyway’s managed infrastructure is fully encrypted and SOC 2-compliant for secure data processing.

Lease abstraction is also a critical yet data-heavy process in commercial real estate. According to Recchia, KeyDocs extracts key terms from lease agreements, automating legal document review and compliance tracking. However, handling sensitive contracts requires rigorous security controls. Keyway’s KeyDocs platform ensures security by encrypting lease documents to prevent unauthorized tampering; implementing permission-based access, allowing only authorized legal teams to review documents; and maintaining an immutable audit log to track AI-generated lease summaries. These measures protect tenant and investor data while allowing real estate teams to leverage AI-driven lease insights with confidence.

Looking ahead, AI will play a more proactive role in identifying security risks and compliance violations. “Advanced AI models will analyze data access patterns, lease inconsistencies, and potential regulatory breaches in real time,” Recchia said. Future AI security enhancements may include automated compliance monitoring for evolving real estate regulations, AI-driven threat detection to flag suspicious activity in property management systems, and predictive risk analysis to help investors assess portfolio vulnerabilities before they escalate. These advancements will strengthen real estate companies’ abilities to mitigate legal and financial risks while optimizing AI-driven decision-making.

AI is revolutionizing how investors, lenders, and property managers operate, but security must remain a top priority. Without proper safeguards, AI-driven platforms could expose firms to cyber threats, compliance violations, and data breaches. “Keyway is leading the way in AI security innovation, integrating end-to-end encryption, secure deployment options, and advanced compliance tracking across KeyComps and KeyDocs. By embedding security into every stage of AI development and deployment, Keyway enables real estate teams to adopt AI without compromising data protection,” Recchia said.