In an industry where manual processes have long reigned supreme, Keyway, the VC-backed AI real estate investment platform, is at the forefront of a new, technological transformation that is helping real estate teams to navigate a more complex, data-driven world. By automating time-consuming tasks and providing actionable insights, Keyway is helping real estate teams—from investors to asset managers to property developers—to work more efficiently, make data-driven decisions, and reduce human error. Their latest tools, KeyComps and KeyDocs, offer advanced AI-driven solutions for generating multifamily property comps and managing critical real estate documents, respectively.

We sat down with Keyway Co-Founder & CEO Matias Recchia to discuss how AI is reshaping commercial real estate, the challenges in the industry, and how cutting-edge tools like KeyComps and KeyDocs are helping real estate teams stay ahead.

Keyway recently launched KeyComps. Can you explain how this tool is addressing challenges for multifamily real estate teams?

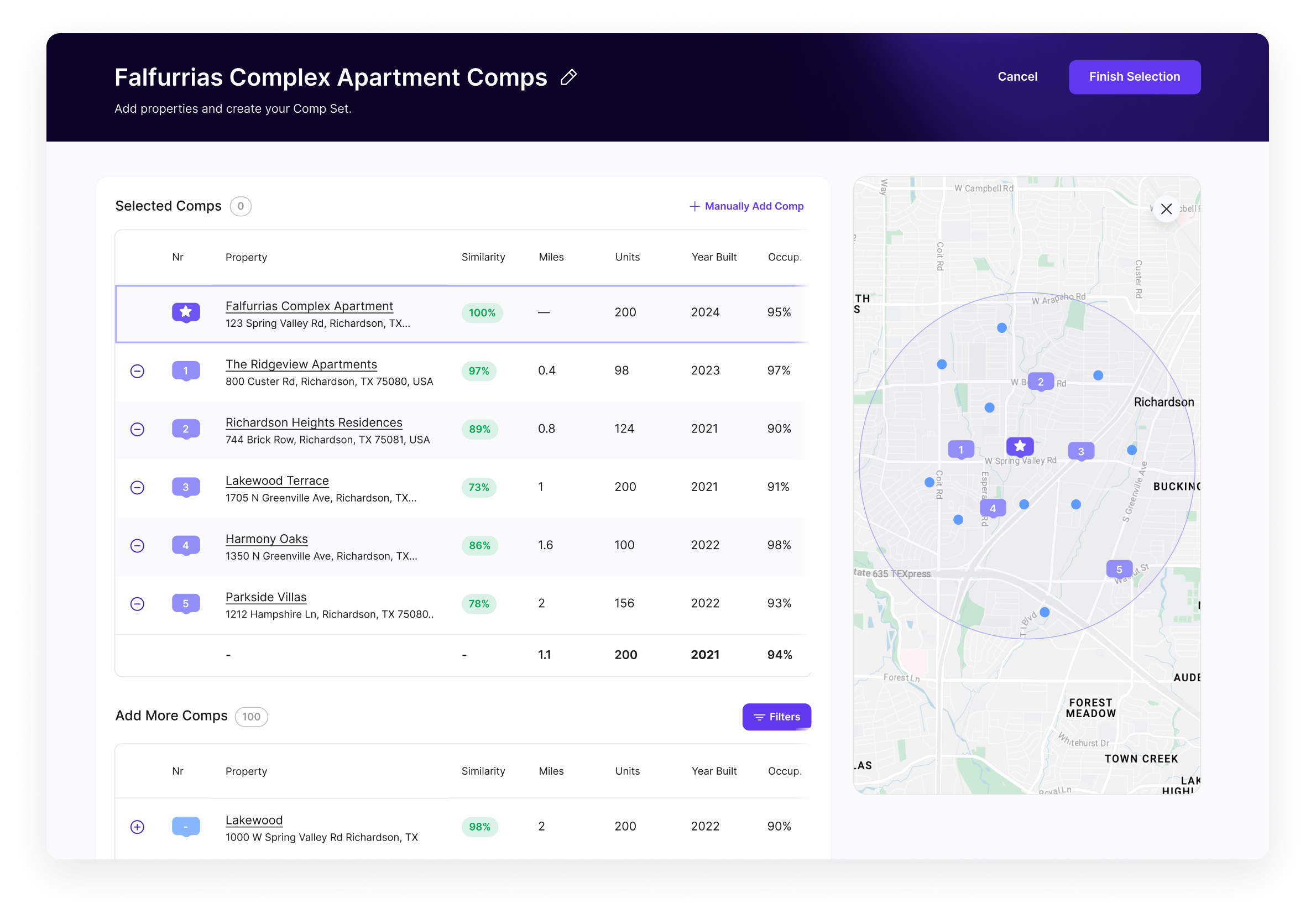

KeyComps is designed to tackle one of the most time-consuming aspects of real estate—generating rental comps. In the past, real estate teams had to manually gather data from different sources, and that process could take days and sometimes even weeks. The data was often incomplete or inaccurate, which created inefficiencies and increased the likelihood of mistakes.

With KeyComps, we’ve developed an AI-powered tool that offers real-time comps for multifamily analytics. The platform pulls from over 12,000 public data points to deliver unit-level rents, concessions, historical trends, and market data in an instant. This real-time intelligence helps real estate teams make informed decisions faster and with more accuracy. KeyComps also provides a deep dive into submarket comparisons, rent seasonality trends, and even tenant sentiment. All of this is done without the need for manual data gathering.

What are some specific use cases for KeyComps in multifamily property management?

One great example is optimizing rents. KeyComps gives real estate teams the ability to analyze unit-level rents, fees, and concessions and compare these across submarkets. For example, if you’re managing a portfolio of multifamily properties, KeyComps can tell you where you have opportunities to increase rents and where you need to adjust to stay competitive.

Another use case is identifying seasonality trends. Rental demand often fluctuates throughout the year, but many property managers don’t have the data needed to adjust pricing accordingly. KeyComps gives teams the real-time data they need to fine-tune their leasing strategies and capitalize on peak rental periods.

KeyComps also helps with tenant satisfaction and renewal probabilities. By analyzing rent trends and tenant sentiment, real estate teams can anticipate when tenants are likely to renew or vacate, allowing them to proactively address potential vacancies.

KeyDocs is another AI-powered tool developed by Keyway. What problems does KeyDocs solve for real estate teams?

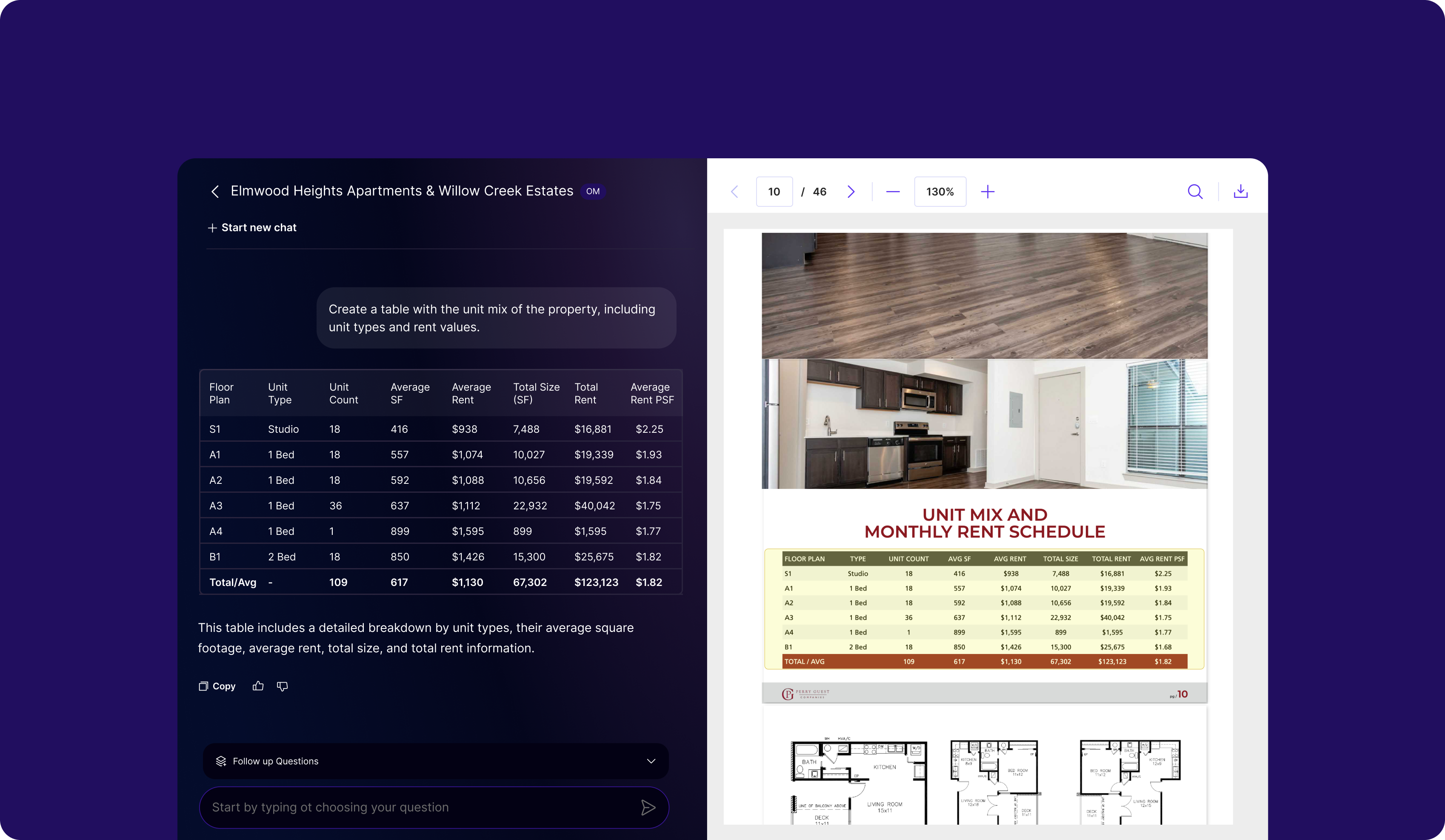

KeyDocs is the first AI-powered document management tool tailored for real estate teams. KeyDocs was designed to address one of the most significant pain points in real estate—document management. Real estate transactions involve a massive volume of documents from offering memorandum (OMs) to lease agreements and due diligence reports. Reviewing, organizing, and analyzing these documents manually is not only time-consuming but also can lead to missed details that could impact the success of a deal.

KeyDocs solves these challenges by automating the extraction and analysis of critical information. We use AI and machine learning to convert unstructured data into structured, actionable insights. For example, acquisitions teams can use KeyDocs to quickly analyze OMs and extract important details, while due diligence teams can use it to summarize zoning reports and environmental assessments.

KeyDocs also streamlines lease management for asset managers. It monitors debt covenants, lease performance, and ensures compliance with all lease terms, which helps real estate teams stay on top of their portfolios and avoid costly oversights.

AI is becoming more integrated into real estate, but there’s often concern about AI replacing human jobs. Do you think KeyComps and KeyDocs will replace the need for human real estate professionals?

At Keyway, we don’t see AI as a replacement for human expertise—quite the opposite. AI enhances the work that real estate teams are already doing by automating repetitive, time-consuming tasks. By doing so, it frees up professionals to focus on higher-level strategy and decision-making.

For example, with KeyComps, AI handles the heavy lifting of gathering and analyzing data from thousands of sources, but it’s the real estate professional who uses those insights to decide how to price their properties or where to invest next. Similarly, KeyDocs automates the process of extracting critical details from documents, but the final decision-making still relies on the judgment and experience of the team.

AI is a powerful tool that can process vast amounts of data quickly and accurately, but the human element remains essential in interpreting that data and applying it in a way that maximizes value.

What are some of the biggest problems in commercial real estate today, and how is Keyway solving them?

Commercial real estate has historically been slow to adopt technology. A lot of real estate teams still rely on manual processes—whether it’s entering data into spreadsheets, manually generating comps, or reviewing hundreds of pages of documentation. This leads to inefficiencies, increased errors, and missed opportunities.

With KeyComps, we’re addressing the inefficiency and inaccuracy of manual comp generation. Our AI-driven platform provides real-time, precise rental comps that allow teams to make better decisions faster. It’s about giving teams the tools they need to work more efficiently and stay competitive in today’s market.

KeyDocs, on the other hand, addresses the sheer volume of documentation that real estate teams need to manage. By automating the review and analysis of critical documents, KeyDocs ensures that teams don’t miss any key details and can move deals forward more quickly. This kind of automation reduces the risk of costly mistakes and increases operational efficiency.

Where do you see the biggest opportunities for Keyway’s AI-powered tools in the future?

One of the biggest opportunities lies in the continued growth of multifamily real estate. The market is highly competitive, and investors need real-time data to stay ahead. KeyComps and KeyDocs are specifically tailored to meet the needs of multifamily investors, helping them optimize rent pricing, manage assets efficiently, and make data-driven decisions in real time.

There’s also a significant opportunity in scalability. As real estate portfolios grow larger and more complex, teams will need tools that can centralize and streamline processes. AI-powered solutions like KeyComps and KeyDocs allow teams to scale without increasing their manual workload, which enables them to manage larger portfolios more efficiently.

Finally, I think sustainability and ESG (Environmental, Social, and Governance) considerations are becoming more important in real estate. AI tools can help real estate teams monitor and report on energy usage, emissions, and other key metrics, which will be crucial as regulatory requirements evolve.

For more information on how Keyway’s AI-powered tools can transform your real estate operations, visit Keyway’s website.