Last month, the Federal Reserve took the first step toward “the new normal” by cutting its target rate by 50 basis points, to 4.75%-5.0%, in what analysts believe to be the first of several downward adjustments (US News, 2024). This rate cut comes as a relief to the US real estate industry, where more than two years of mortgage rates at over 5%— and at times as high as 7.5%— have led to a decrease in both supply and demand. But what will lower US interest rates mean for the value of the dollar, and ultimately, will it make the New York City residential real estate market more attractive to foreign investors, as an investment class as a whole?

In general, higher interest rates in the US mean more money flooding into the country, which pushes the value of the dollar upward. (The Real Deal, 2016). Conversely, when US interest rates trend downward, the demand for dollar-denominated fixed income assets diminishes, and the dollar’s exchange rate loses terrain to other major currencies like the euro. If the dollar depreciates sufficiently, foreign investors in US real estate could be poised to get more “bang for their buck” when buying— capitalizing on the ability to invest in larger properties (e.g., one bedroom vs. studio) or nicer properties (e.g., new development vs. resale).

Correlation between exchange rates and new development pricing

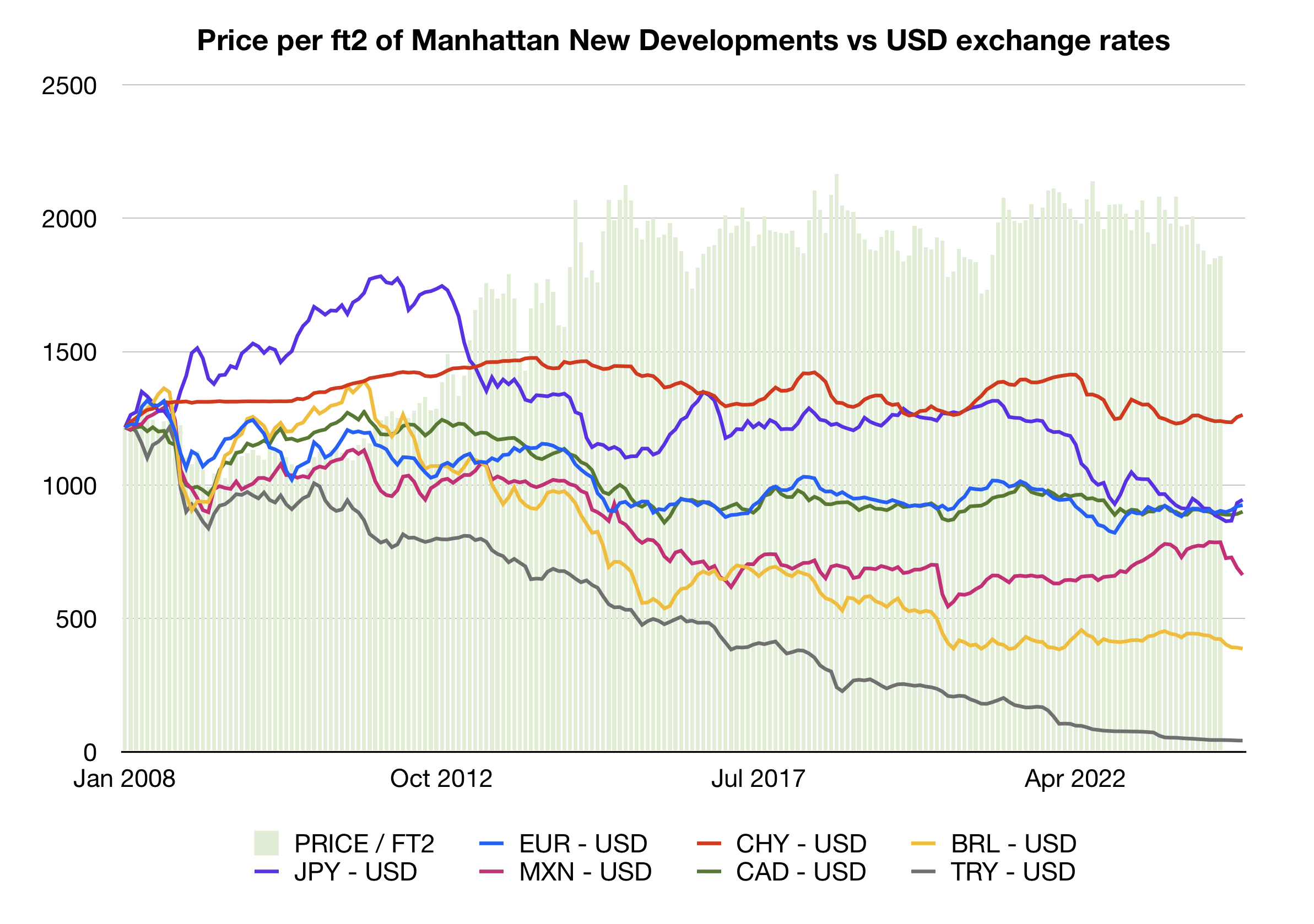

To demonstrate this correlation, we evaluated the price per ft2 of new development condominiums in Manhattan— a favorite among foreign investors due to impressive sales galleries and an extended sales cycle— and compared this data with the monthly exchange rate of the US dollar to the euro, Chinese yuan, Japanese yen, Brazilian real, and the Mexican peso.

Dollar exchange rate on first day of the month, 2008-01-01 = 100 – OFX.com

The above graph depicts the price per ft2 of new developments in Manhattan in comparison with the USD exchange rates, along with the currencies associated with nationalities we encounter often in New York City real estate. First, the data shows that after the financial crisis, the US dollar appreciated significantly against most major international currencies. Second, after a steep ascent of ft2 prices between 2011 and 2015, Manhattan real estate values remained rather flat since 2016. In our own team’s experience, this coincides with the diminishing demand for New York City real estate we have seen from these countries since 2016, in which both price increases and less favorable exchange rates have made Manhattan real estate at least twice as expensive for foreign buyers, as compared to only a few years prior.

The NAR National Foreign Buyers Survey

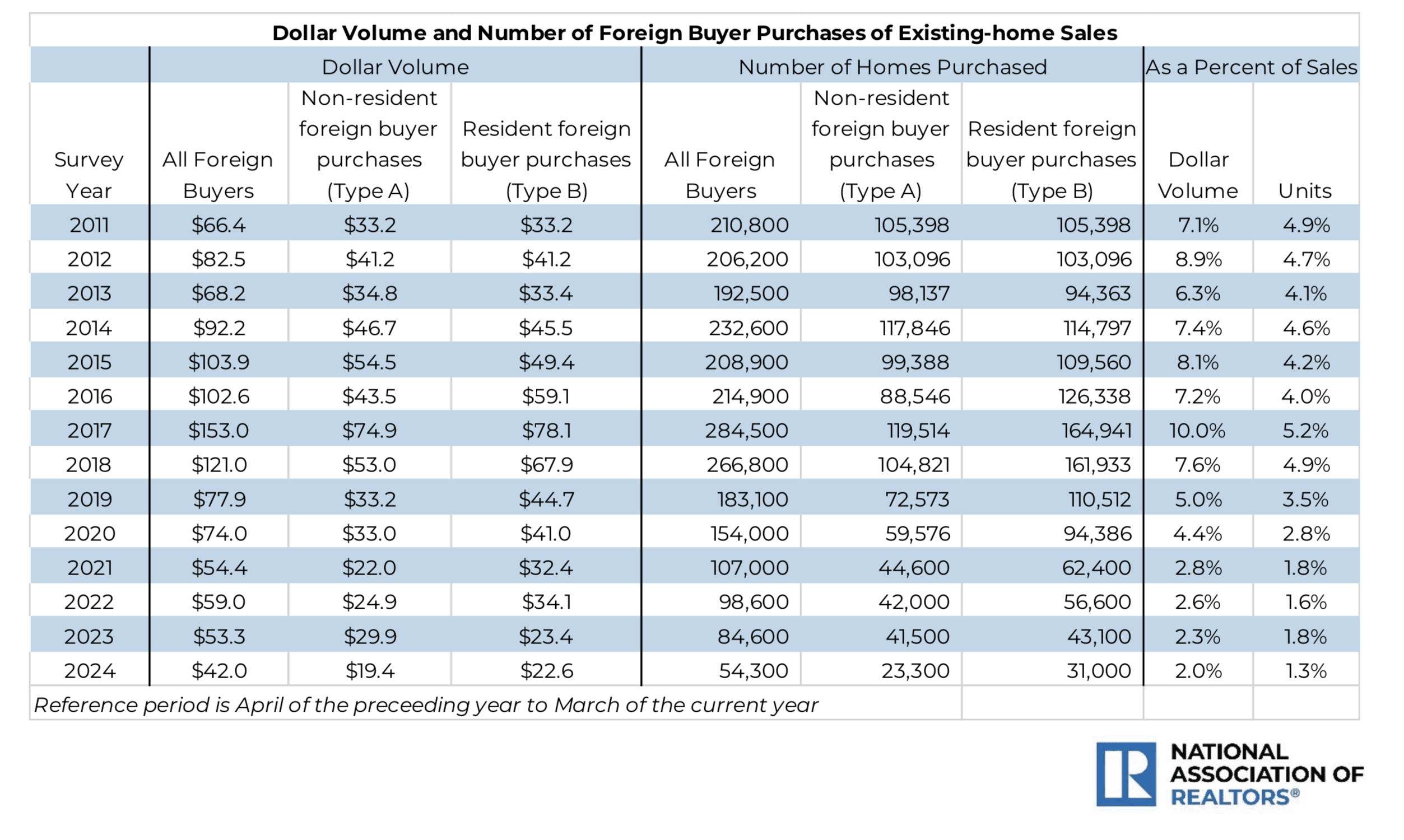

Now let us compare our findings to the NAR 2024 Profile of International Transactions in US Residential Real Estate, representing information regarding REALTOR® transactions with international clients who purchased and/or sold US residential property from 2011 to 2024.

It is indeed clear that the highest volume, as well as the highest percentage of sales nationally occurred in the years between 2011 and 2018. Sales have been at much lower levels since the pandemic, having reached their lowest number within the last year, when interest rates and the value of the dollar were both at their highest. This correlation leads one to wonder— will we see foreign buyers return when rates are cut further and the dollar becomes more affordable to them?

Brazilian real

In 2014, one of our prominent Brazilian clients bought several apartments pre-construction, which closed in 2015 and 2016. The properties were then rented for many years, but as tax abatements expired and the rate of return diminished, the client approached us to sell the assets as the leases expired. Although the properties sold for essentially the same amount initially paid, the client ended up in the green due to the favorable exchange rate between the dollar and the Brazilian real. In fact, the client nearly tripled his investment in this situation.

Chinese yuan

In New York, the Chinese have clearly been the #1 foreign buyers of New Development properties. Investing in properties, both nationally and abroad, is culturally ingrained in the Chinese mindset. From 2012 until the outbreak of the global pandemic, the Chinese were the largest real estate investors in the US. The Chinese yuan has been the strongest of the foreign currencies in comparison to the dollar, and despite further constraints imposed by the Chinese government, owning property in the United States remains in high demand among the Chinese upper class, given the ability to successfully transfer the money abroad.

Turkish lira

For Turkish nationals, New York City is viewed as a stable investment that protects their wealth from currency volatility at home, as well as an attractive education option— sending their children to desirable schools like NYU and Columbia. Over the last 15 years, the lira has lost almost 95% of its value comparatively, meaning that those clients who invested in New York City real estate after the financial crisis have succeeded in protecting at least a portion of their wealth.

Mexican peso

For Mexican clients, the stronger dollar has increased the perceived return on investment. With post pandemic rents increasing and the dollar now being worth 25% more than before, the cap rate went from just 2.9% to 4.2% in dollars, and exchanging those dollars back to Mexican pesos results in a cap rate of over 5%. This has prompted our Mexican clients to return for more and consider larger investments in Manhattan new developments.

The eurozone

The demand for New York City real estate from European based clients is mostly based on asset diversification and personal use. Capital and low-rate mortgages are more readily available in the eurozone, and with prices often considerably lower than Manhattan, their home markets are typically their go-to real estate investments. Prior to the pandemic, the interest rates in some European countries were edging negative, which did indeed prompt some investors to look at the US as an alternative, obtaining extremely inexpensive loans in their country of residence and applying those funds to US-based real estate investments. With the stronger dollar of late, we have mostly seen European clients buying for personal use— using properties as a pied-a-terre or as primary residences for school-attending family members, for example.

Italian investors are particularly drawn to buying properties in New York City for several reasons. The city’s global reputation as a financial and cultural hub makes it a highly desirable location, offering both prestige and potential for long-term appreciation, and the stability and diversity of the NYC real estate market provides a hedge against economic uncertainty. Additionally, Italian buyers often see NYC as a gateway to international business opportunities, and they appreciate the relative transparency and legal protections offered by the US property market. Fluctuations in the dollar-euro exchange rate greatly impact Italian buyers and sellers in the NYC real estate market— when the euro strengthens against the dollar, Italian buyers find properties in the city more affordable, potentially increasing their purchasing power and overall interest in investing. For sellers, a long-anticipated decrease in interest rates provides encouragement for potential buyers to enter the market.

Conclusion

Due to the high price points (often in the multi-millions) and their status as a safe-haven for international investors, new development sales in NYC are sensitive to shifts in the dollar exchange rate seen in, for example, the Brazilian real, the Canadian dollar, and the Chinese yuan. If the dollar weakens, it may bring investors back who have been sidelined by their currency over the course of the last 7 years, increasing the velocity at which remaining luxury new products are absorbed. With so few projects in the Manhattan and Brooklyn pipeline, will the mere scarcity of “new” product, combined with lower mortgage rates and a weaker dollar drive up the price per ft2 of new developments once more?

About the author:

Philip Hordijk is the CEO and founder of LEVEN Real Estate, a cosmopolitan real estate brokerage headquartered in New York City which connects high-end properties to sophisticated buyers worldwide. The LEVEN Real Estate Team has sold over $1.2B in New York City real estate, speaks over 17 languages, and has done business with over 51 nationalities. Click here to learn more about Philip and LEVEN Real Estate.