With the macro economy and capital markets in flux, the stakes around developing, owning, and operating real estate have risen to levels not seen in recent years. Market knowledge and real-time, actionable insights have become the entry fee for effectively owning and operating real estate assets. That’s where the tools and datasets provided by Placer.ai come into play. Fueled by proprietary location data blended with strategic data partnerships, Placer.ai provides its clients with unique insights on everything from the Return to Office, domestic migration trends and housing demand to consumer preferences. The Real Deal sat down with Ben Witten, Placer.ai’s Head of Real Estate, to learn more about this powerful platform and to hear his insights around some of the most relevant themes facing the US real estate market.

How is Placer.ai supporting confident decision-making?

Simply put, Placer.ai exists to surface actionable insights around economic activity in the physical world. Using de-identified mobility data, consumer trends, planned development, crime, event, and demographic data, Placer.ai delivers relevant insights about commerce, housing, the workplace, and economic development at large. While this may seem abstract at first, Placer.ai provides each client with an assigned customer success representative who guides them through using each of the firm’s tools, and shares best practices around discovering and supporting decision-making with meaningful insights.

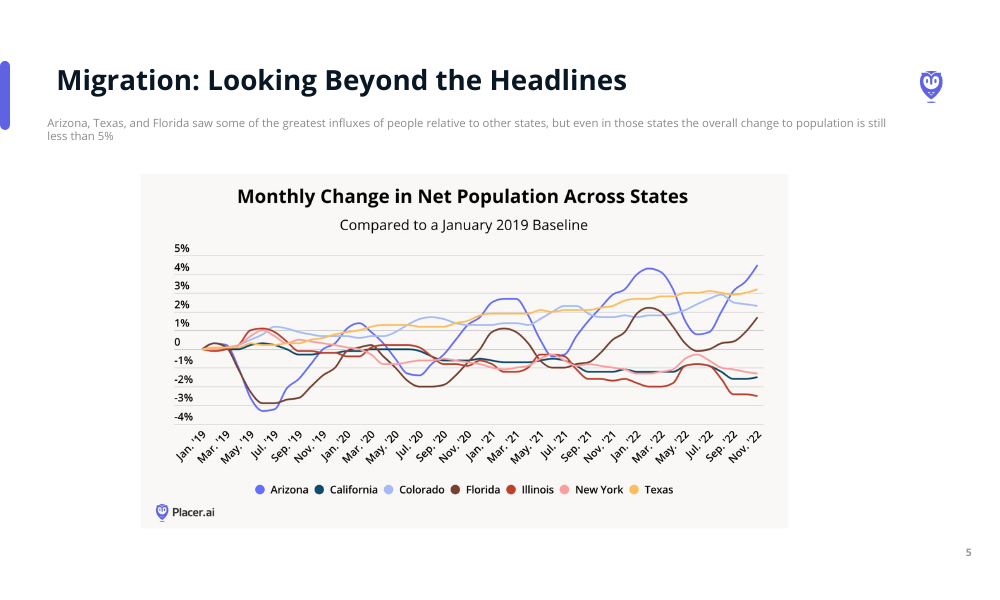

Witten, who began his relationship with Placer.ai as a client, and later joined the team after realizing the power and potential of Placer.ai’s tools, cites the changes wrought by the pandemic as an example of how to use these insights to reach better business decisions. “One thing we saw in the pandemic was an increase in migration because of work from anywhere,” says Witten. “Workers moved from NYC not just to Miami but also Tampa and Orlando at accelerated rates. Though people thought many of these migrants would go back to NYC after the pandemic, the data has clearly contradicted that.” If you’re a REIT or a developer, being able to track these kinds of trends in close to real-time is invaluable, and “Placer.ai provides its clients with that visibility.” Witten notes that Placer.ai’s clients appreciate having data that’s updated monthly, instead of having to wait 18 months for a new set of census data.

As a veteran of the real estate and finance industries with a focus on retail and mixed-use assets, Witten has been fascinated with the post-pandemic trends that Placer.ai’s data have revealed, specifically the complex ways different asset classes have been impacted.

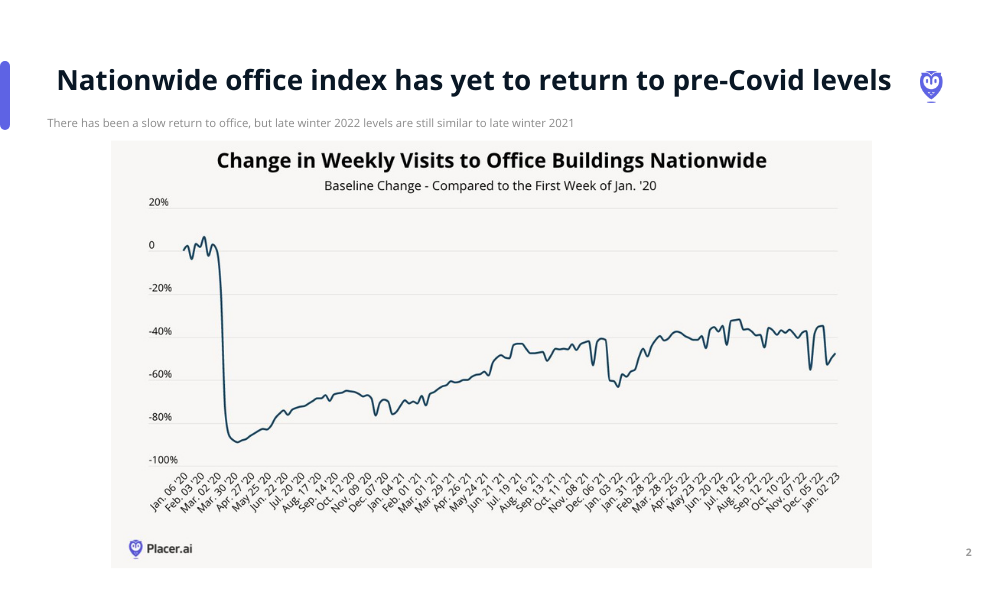

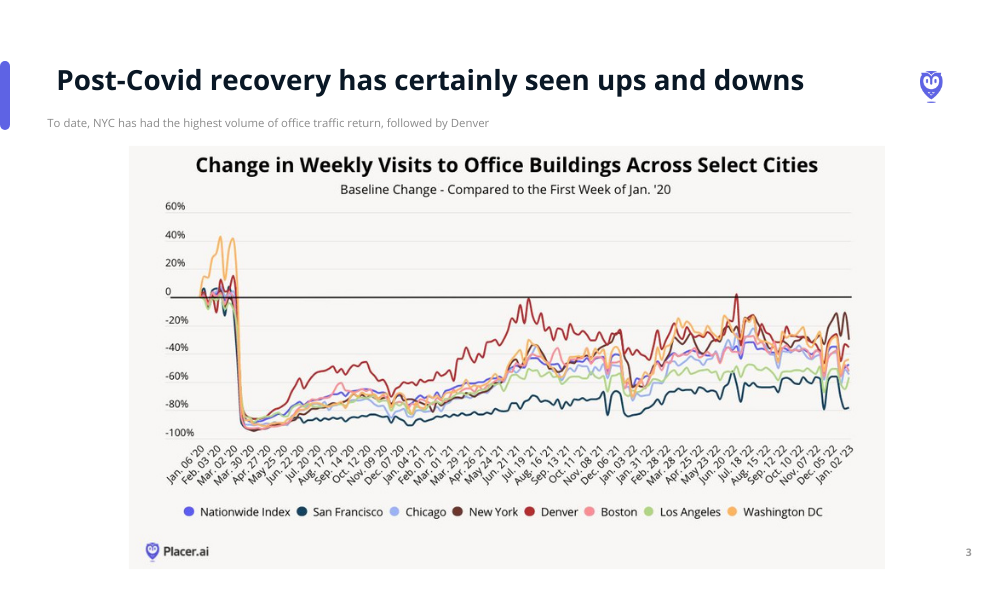

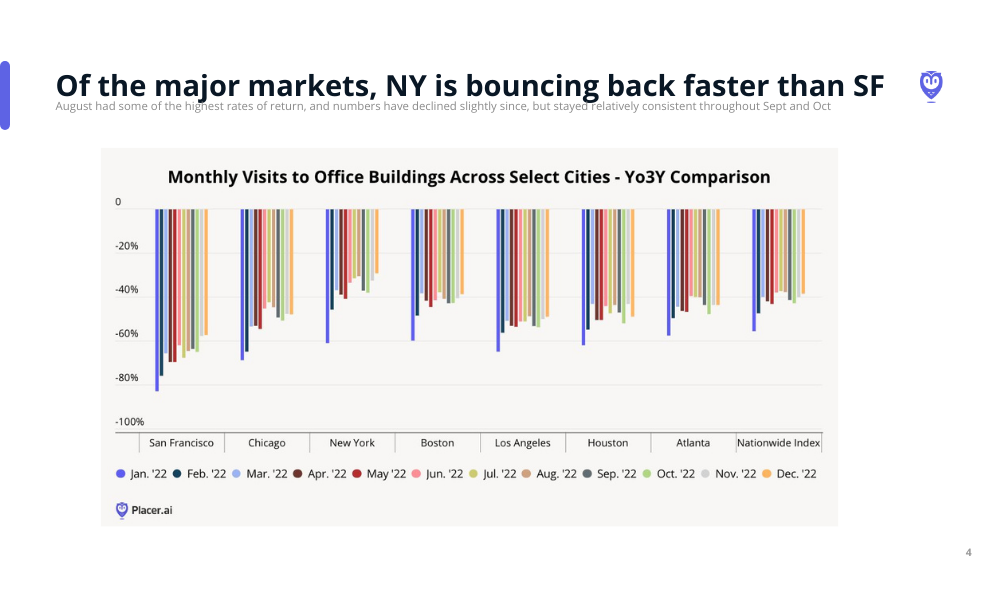

“Retail went through the apocalypse first, and now office is going through a trial by fire for different reasons,” says Witten.

As more workers seek to preserve the work-from-home arrangements they negotiated during the height of the pandemic, malls that have integrated flexible workspace closer to home have thrived. “Retail and coworking have demonstrated a symbiotic relationship. Take Scottsdale Fashion Square for example. It has an Industrious as well as amenities and high-end retail.” By diversifying tenants and adding synergistic, unconventional uses, malls like this have thrived, while many single-use traditional malls and office towers that relied on commuters driving for 60 minutes or more have become obsolete. While these trends can sometimes be understood from mere openings and closings, the ability of clients to parse the traffic and utilization trends using Placer.ai’s platform gives them a competitive edge when planning their next investment or development.

Opening Placer.ai’s toolbox

Head over to The Square on Placer.ai’s website to see some of these powerful tools for yourself. The Migration Trends Tool breaks down the net population change at the state level, with a deeper dive into individual ZIP codes available for subscribers, while The Nationwide Industry Trends Tool provides a granular look at the changes in foot traffic for all kinds of retailers, and can be viewed at either the national or state level. There are also tools that analyze brand dominance across the country, a holistic COVID-19 Recovery Dashboard, and even a specific tool to track the nation’s top restaurant chains, all of which can be tailored to answer your specific queries. Placer.ai’s platform and datasets are constantly being expanded and updated, giving users the ability to compare last weekend’s foot traffic at, say, grocery stores with the same data three weeks or three years ago.

Clients interact with Placer’s data in a number of ways, each of which can be further shaped to their needs with the consultative approach of Placer’s customer success team. Clients interact with the data primarily via Placer’s dashboard, which provides in-depth analytics that go beyond the higher-level insights available via The Square and lets them dig into details like customer dwell time, income and gender breakouts, cross visitation, and True Trade Areas, which show where your customers live and work. Placer.ai’s API allows clients to export the data to their own 3rd party software, while the firm’s XTRA advanced reports provide clients the ability to request specific analytic reports from the firm’s team of analysts. And tying it all together is The Anchor, a weekly newsletter featuring articles that take readers on deep-dives into various micro and macro trends revealed by plumbing Placer.ai’s bottomless well of data.

Who is taking advantage of Placer.ai?

Thanks to the power of Placer.ai’s data, the firm counts a wide variety of stakeholders among their clients.

“Our users two years ago were mainly commercial real estate brokers, retail investors, developers, and owner/operators,” Witten notes, “but since then the product has organically been adopted by the retailers themselves, as well as a very large segment of civic and economic development organizations.”

Whether they’re interested in tracking growth trends or measuring the specific distance beyond which commuters are less likely to make the daily trek to work, Placer.ai’s clients have unique insight into the nation’s daily economic activity, insight that helps them refine investment theses and track macro trends around migration and the return to office.

And Placer.ai will only become more powerful and resourceful for all as its datasets expand. As we wrapped up our conversation with Witten, he noted how far Placer.ai has come since he joined and how the firm is positioned to grow even more. “We closed a Series C round about a year ago for $100 million at a $1 billion valuation, which has accelerated the innovation and evolution of the product. On top of that, we’re nearing the 2,000 customer mark.” Each new client brings their own unique perspective and challenges to the platform, providing more opportunities for insight that stack on one another to create an increasingly-holistic picture of where we live, how we work, and what we buy. If you’re looking to make smarter decisions, reach out to Placer today and become part of this growing information sphere.