EXECUTIVE SUMMARY

While there has been uncertainty around the future of office real estate as a result of the pandemic, the asset class is performing better than some have expected. As the vaccine continues to become more widely distributed, utilization rates in office space continue to steadily increase. More than 95 percent of employers are anticipating a nearly full-return to office, which is significant considering occupancy was less than 50 percent in June of 2020. Life science and medical office space in particular, which provide the most stability during times of economic downturn, have been helping to bolster office performance. IIn this article we will cover:

- The office industry and the case for investment in this asset class

- The progression of modern office space

- Life sciences and the impact Covid-19 has had on the industry

- The evolution of the life science industry since the early 2000s

- The future of office and the life science industries

COUNTERINTUITIVE: WHY YOU SHOULD INVEST IN OFFICE RIGHT NOW

During the pandemic, companies around the world had to switch from collaborative office environments to remote working. An estimated 62(1) percent of employed Americans worked at home during the crisis, compared to 31 percent prior to the pandemic. The resulting rise in U.S. office vacancy rates and the declining average gross asking rent caused concern for the future of office real estate.

According to CoStar, office-using employment fell 7.8 percent from February to April of 2020, but then increased by about 5.5 percent during the summer. The result was that office-using employment was only down about 2.8 percent from the February peak. Despite widespread fear of vacant offices, as of Q2 2021, the office vacancy rate exceeded 12%, up 2% year-over-year.

The reality is that while there has certainly been an impact on occupancy, the office sector is not only a safe bet, but continues to be a strong investment option. It is predicted that employees will be returning to office space earlier than anticipated. During his discussion with Willy Walker in Q4 2020, Owen Thomas, CEO and Director of Boston Properties, predicted that occupancy of his own buildings could be up to 20 percent by the end of the first quarter 2021, 50 percent by Labor Day, and up to 75 percent by the end of the third quarter.

Additionally, niche office sectors, such as life science and medical office which remain stable even during economic downturns, have bolstered the office market’s strength.

EVOLUTION OF OFFICE SPACE: NEW OPPORTUNITIES

Studies have shown that employees are eager to return to the office, but changes will need to be made to accommodate the evolving needs of tenants. According to a survey conducted by Deloitte, 68% of employers plan to implement some type of hybrid workplace model in 2021, while only 1% will remain fully virtual. With hybrid work schedules and increased flexibility, there will need to be more incentive for employees to make the trek into the office.

Additionally, the role of office space is shifting toward community and collaboration. Employees will re-enter the office as a means to build personal and professional relationships and connect with the culture, purpose, and mission that the company has to offer.

Investors and developers have an opportunity to reposition office space and gravitate toward a space that reflects the needs of the future. Physical and virtual experiences must be fully integrated into office space to ensure connectivity among all employees. Just as new technology must be integrated into the office space, companies need to invest in home tools and resources so that collaboration is seamless regardless of physical or virtual presence.

93% of people believe that a sense of belonging drives organizational performance (Deloitte 2020 Human Capital Trends). The future of office space will require a design that encourages reconnection, community, and inclusivity. The most successful office spaces will be ones that fully embrace the collaborative environment that corporate America is gravitating toward.

LIFE SCIENCE

COVID-19 ’S IMPACT ON THE LIFE SCIENCE INDUSTRY

Life Science companies are now at the forefront of public interest because of Covid-19 and the rush to develop a vaccine. As the life science industry continues to display remarkable resilience amid the economic downturn, investors and developers have a heightened interest in the space. As a result, institutional investment in the space has been growing at 15 percent per year, totaling more than $6 billion in 2020.

The need for more life science space also creates the need for new construction, as not all office buildings are capable of housing life science tenants due to the demanding lab requirements including high floor loads to handle equipment, proper ventilation, and safety infrastructure.

Buildings are constructed for a specific use, and traditional office structures have a predetermined capacity of weight the building can withstand. While traditional office spaces tend to use lighter materials and can therefore easily accommodate a variety of tenants, life science lab materials include heavy equipment, specific electrical wiring, complex systems, and more. If a building can structurally withstand the load bearing requirements, they can potentially redevelop space to fit a life science tenant’s needs. Still, significant capital expenditures would also need to be invested. If the life science company requires a more traditional or medical office space, such improvements are easier to accommodate.

Although it may seem as though investors and developers are now hopping on a hot trend, the life science industry has been experiencing exponential growth since the early 2000s.

LIFE SCIENCES SINCE THE EARLY 2000’S

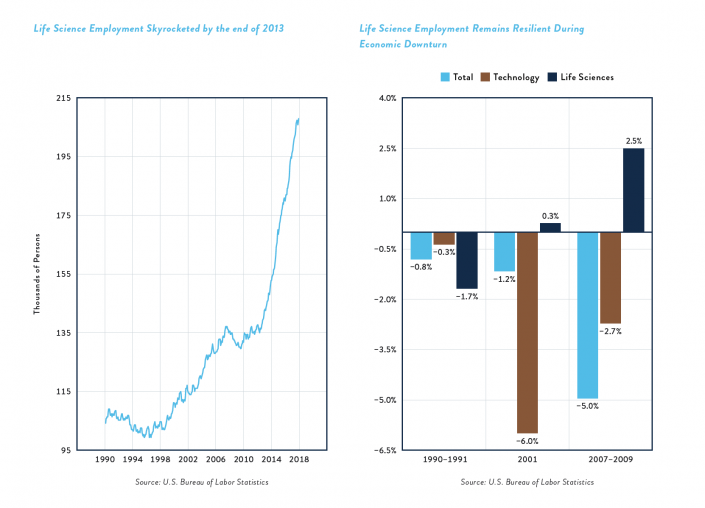

An emphasis on individualized and preventative treatment has been a powerful driver of the life science industry for nearly two decades. The sector has also benefitted from technological advances in medicine, changes in healthcare delivery mechanisms, and an aging population. As this demand has grown, so has employment. Since the end of 2013, the number of life science jobs has increased by 70,000 jobs per year.

Life science tenants have proven to be resilient. Even during both economic downturns since 2000, life science industry employment has continued to increase. The powerful drivers of life science industry growth support lab space even during a recession. A high importance is being placed on life science employees, as their average salary has experienced more than 19 percent growth in the last five years. In this same time span, the total number of life science institutions has increased by more than 13 percent, further solidifying the industry’s value (1).

OUTLOOK ON LIFE SCIENCE

The world population continues to grow and age, and there is no shortage of diseases that plague the human population. As the need for treatment, cures, and innovations continues to grow, venture capital investment in the space will continue to increase as well. Investment from government grants and large pharmaceutical companies will also help stimulate the sector and stabilize it during turbulent cycles.

Since custom buildout for life science space requires significant capital, landlords can command higher rents compared to traditional office. As a result, there are high barriers to entry within the life science market. The recent modernization of zoning regulations throughout the U.S. have led to an increase in life science developments. From 2009 to the end of 2019, the amount of lab space in the United States grew from 17 million to 29 million square feet (1). To put that in perspective, the New York office market alone contains 1.4 million square feet.

There is high demand from institutional capital looking to get into these high-demand markets. From a capital perspective, there will continue to be a massive flight of investment capital from real estate ownership to invest and own properties in the space.

Life science industry growth is aligned with global healthcare expenditures which are expected to rise at a rate of 5.4 percent annually, from $7.7 trillion in 2017 to an anticipated $10.1 trillion by 2022 (2). Additionally, revenue in the industry has been growing at a steady pace throughout the past decade.

Based on the trajectory that the life science industry has had since the early 2000s, along with the newfound recognition of its true necessity post Covid-19, industry growth is expected. Consult with our New York Capital Markets experts for your life science or office industry questions or transaction needs.

- https://news.gallup.com/poll/306695/workers-discovering-affinity-remote-work.aspx

- https://www2.deloitte.com/content/dam/Deloitte/us/Documents/human-capital/us-2021-return-to-workplaces-survey.pdf

- https://www. globest.com/2020/10/16/when-office-to-life-science-conversions-make-sense/

- https://www2. deloitte.com/content/dam/Deloitte/global/Documents/Life-Sciences-Health-Care/gx-lshc-hc-outlook-2019.pdf

- JLL Life Science Report