Blackstone’s yearly report card will feature a larger stake in student housing after the firm’s biggest move in the sector yet.

The company has agreed to buy American Campus Communities in a deal that values the student housing provider at $12.8 billion, including debt, the Wall Street Journal reported. The Austin-based company is the largest publicly traded student housing owner and developer in the United States.

Blackstone is paying $65.47 per share to buy the company, a 14 percent premium from Monday’s closing price, the Journal reported. The firm plans on taking ACC private through its Blackstone REIT and Blackstone Property Partners.

ACC owns 166 student housing buildings in the United States, including some on or near large campuses like Arizona State University and Cal-Berkeley. Approximately 25 percent of the properties are situated directly on a campus.

Blackstone plans on building more properties under the ACC banner to meet the demand for student housing across the country.

Read more

The sector showed resilience in the wake of the pandemic, which didn’t hurt rent collections as much as expected. As more students return to campus and student housing construction remains limited, the Journal reported the sector appears set for increased growth.

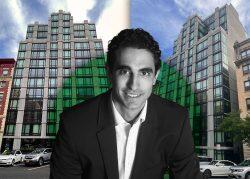

“We think student housing is a compelling sector because it’s performed through cycles and has been really quite resilient over time,” Nadeem Meghji, Blackstone’s head of real estate for the Americas, said.

Shares of ACC ended last year at an all-time high of $57 and have managed to largely maintain that level ever since, despite company net income falling by more than half last year to $36 million.

While this is Blackstone’s biggest acquisition in the student housing sector, it’s not the company’s first foray into the market. Blackstone Real Estate Income Trust in August announced a $784 million joint venture with student housing developer Landmark properties to acquire and recapitalize an eight-property, 5,400-bed student housing portfolio.

[WSJ] — Holden Walter-Warner