The Dallas-Fort Worth metroplex has seen a dramatic increase in homes up for sale over the last few weeks as sellers look to take advantage of the hot market while it lasts.

The number of active home listings the week of May 21 spiked 41.6 percent from a year prior for the fifth consecutive week of gains, the Dallas Morning News reported. The region saw the highest annual growth for any week on record since Realtor.com began tracking this figure in 2017. Realtor.com reported supply declines in the D-FW area every week since March 2020 until April of this year.

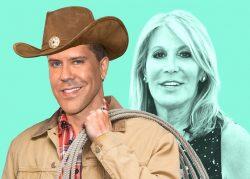

“Sellers have been hearing for about two years what an amazing time it is for them to sell … and they’ve seen their equity just grow like crazy,” said Mike Reddell, senior executive vice president and managing director for Douglas Elliman Real Estate in Dallas.

Read more

“With the stock market being wobbly and mortgage rates rising, I think sellers that have been thinking about this for a while, more of them are pulling the trigger and putting the house up for sale,” he continued.

New listings in D-FW rose 32.4 percent, according to the publication, signalling a huge influx of sellers putting homes on the market as summer approaches. Even Reddell said he would sell his house right now if he were in a position to.

“We’ve got more seller participation in the housing market this year than we had last year,” said Danielle Hale, chief economist for Realtor.com. “The real estate market continues to be one that favors sellers, home prices are high and homes continue to sell relatively quickly.”

Hale notes that the market is still influenced by the pandemic, so some sellers have pushed back plans from last year. Redfin reported on May 15 that new listings throughout the U.S. climbed nearly twice as quickly as they did at the same time last year.

“Rising mortgage rates have caused the housing market to shift, and now home sellers are in a hurry to find a buyer before demand weakens further,” said Daryl Fairweather, chief economist for Redfin, in a statement.

[Dallas Morning News] — James Bell