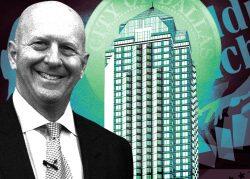

When word of a half-billion-dollar Goldman Sachs tower hit Dallas in May, the city promptly rolled out the incentive red carpet. The proposed mixed-use development capable of accommodating 5,000 workers spurred an offer of $18 million in tax and other incentives, which the city council passed unanimously on June 22.

Upon completion — which was initially planned for the end of 2028 — the tower would soar 80 stories above the 2300 block of North Field Street near the Perot Museum of Nature and Science. The 11-acre site is currently home to the Northend Apartments, a 540-unit complex that has stood since 1997.

The incentives agreement obliges Goldman to close on the lease on or before the end of 2027, with a 15-year minimum stay. The terms also include a $390 million-minimum real property investment within that same period and a minimum capital investment of $90 million for improvements, furniture, and equipment by the end of 2028.

On a practical level, the Dallas Business Journal reports the Dallas office could serve as a dual headquarters for the company, hosting back-office employees and other core roles, including some top executives. Needless to say, many economic and political leaders in Dallas are thrilled at the prospect.

“This is exactly the kind of company I do think we should be investing in,” gushed city council member Cara Mendelsohn after the June 22 vote. “I think the people who are going to work there are going to help contribute not just for property tax, but they’re going to help by donating to our social services. They’re going to help our arts organizations. This is a generation of leaders for our entire city.”

Read more

It’s not yet clear whether the Dallas presence will merely be a major regional office or an Amazon-style HQ2, but some local boosters dare to dream that DFW might even one day lure the investment bank’s main office away from Wall Street.

At the June council vote, Robin Bentley, the city’s director of the Office of Economic Development, said that Goldman was considering “the full spectrum of headquarters services,” in its plans for the Dallas office expansion.

Goldman is expected to sign its lease soon, according to DBJ’s latest update but the status of the negotiations is currently unknown. When reached for comment late Friday night, a Goldman spokesperson told the DBJ that the lease hadn’t been signed yet. CBRE, who is representing the bank, didn’t respond to requests for comment.

While there’s been little news on the mega-development since the June city council vote, The New York Times reported on Monday that Goldman is preparing to lay off between 1 percent and 5 percent of its workforce this month, due to “shaky” economic conditions.

Yearly layoffs of this size were routine for the banking giant before they were paused during the pandemic. But on a second quarter earnings call in July, Goldman reported a nearly 50 percent drop in profit from a year earlier.

“No question that the market has gotten more challenging,” David M. Solomon, Goldman’s chief executive, said on the call. “We have made the decision to slow hiring velocity and reduce certain professional fees going forward.”

— Maddy Sperling