Policymakers looked lost Tuesday in a hearing about a proposal related to property appraisal appeals.

Texas state lawmakers had to ask the person who was testifying for basic clarifications about the appeal process during the Texas Association of Appraisal Districts’ testimony against the bill.

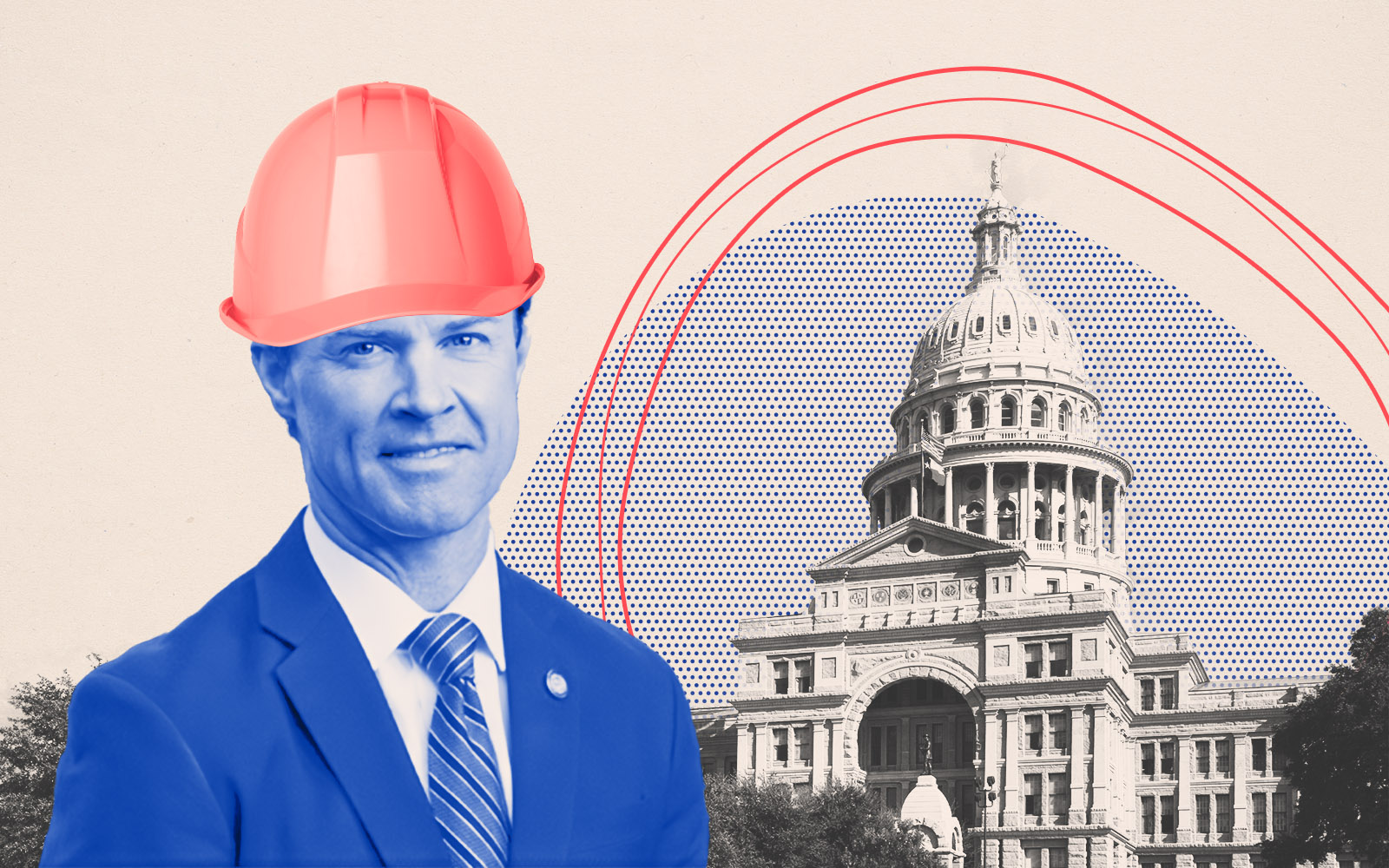

“I’m just a small town country boy, so I’m kinda getting lost in this fancy lingo here,” said Rep. Cole Hefner, who worked in construction for 16 years and now owns his family’s commercial construction company.

As Texas considers how to use its nearly $33 billion budget surplus, state leaders have pledged to spend a massive chunk of that money to lower property tax bills. Problem is, they can’t agree on a way to do it.

Governor Greg Abbott set aside $15 billion of the surplus for “property tax relief,” and the state House and Senate have each put forward multi-billion-dollar plans that would drastically alter the way properties are appraised and taxed. Either proposal would spend $5.3 billion to extend existing property tax cuts.

Tax and appraisal policy has more fine points than a pencil sharpener, and even the people tasked with calling the shots are weighing competing proposals, with experts and industry voices divided over the best course of action.

“You’ve got the people deciding what’s going to happen with one of the biggest budget drivers in all of Texas, and they’re asking, ‘How does this work again?’” said Tony Trahan, a property tax consultant at KE Andrews. “It’s a little scary when that’s sort of the question that you get.”

The Senate plan

In late March, the Senate unanimously approved a $16.5 billion package of three bills. The headline piece of the proposal, Senate Bill 3, would raise the homestead exemption, a break that limits the taxable amount of a home’s value, from $40,000 to $70,000. The plan would also increase business personal property tax exemptions from $2,500 to $25,000.

Notably, the Senate’s approach to property tax relief would decrease homeowner taxes by shifting the onus of funding public schools from local property owners to the state. At present, much of a property owner’s taxes go toward public schools, so districts in wealthier, more developed municipalities tend to raise more tax dollars. Through a system nicknamed the Robin Hood program, those wealthier districts send surplus tax revenue to the state, which redistributes it to poorer school districts.

The new Senate proposal would decrease those recapture payments, leaving a far greater amount of tax revenue in the hands of wealthier school districts. However, a 2019 law limited the amount a district’s property tax revenue can increase annually to 2.5 percent, meaning those school districts would need to lower their property taxes to keep from exceeding the growth cap.

As an example, Plano’s school district had an operating revenue of $466 million in 2020. However, it had to send $192 million, roughly 40 percent of that total, back to the state for redistribution to other school districts. If the Senate plan passes and those recapture payments are cut down, Plano’s school district can’t just put that money back into its schools — effectively, it will have to give it to property owners.

The House plan

House Speaker Dade Phelan, no stranger to real estate, has his own vision for property tax relief.

The House proposal is built around a $17.3 billion property tax cut that slashes school district property taxes by 28 percent. The more controversial part of the bill, though, ropes in commercial properties as well as residences.

According to the House’s plan, school districts couldn’t increase the appraised value of homes or commercial properties they tax by more than 5 percent in a year. At present, residential property values cannot increase by more than 10 percent, and commercial properties have no cap. The cap would last until a property is sold, at which point the appraisal would reset at current market value.

The plan, which has garnered some bipartisan support in the Republican dominated Texas Legislature, might seem advantageous to property owners. But according to Trahan, it could have some unsavory consequences for commercial property owners.

“It really disincentivizes transactions,” Trahan said. By the time of a sale, he reasons, “the assessor will be so behind on the true market value of those properties that he’s going to try to do a stepped-up basis on that property value.”

In Texas, property sale prices are not required to be disclosed. California also limits property tax increases for homes under continued ownership, but it also mandates price disclosure, which allows for more nuanced appraisals when houses finally trade hands.

Texas appraisers work with a far more limited dataset, making them more reliant on comps, and appraised values often lag far behind actual market values in the state. That means that under the House proposal, if a property sold and the price were leaked, its appraised value would shoot up far higher than that of its peers. It would also set a high expected appraisal for those properties should they sell, encouraging owners to hold their assets for as long as possible.

Ditto for new construction, which is easier to appraise accurately, as construction costs are generally easier to suss out. If two identical warehouses sit near each other, but one sells, and its appraised value rises by more than 5 percent, its owner will have to raise rents above its competition.

Read more

“If I’ve got to go tell a tenant that its property taxes just went from $2 to $4 per foot, there’s a way larger risk that that building will sit vacant,” Trahan said.

Texas Realtors, one of the state’s most powerful real estate lobbies, opposes appraisal caps on residential and commercial properties. “Artificially limiting the appraisal value of a home through a government overreach program sets a dangerous precedent,” the group wrote in its legislative priorities document this year. “Vilifying appraisal increases is dangerous rhetoric and can lead younger populations to shy away from homeownership.”

Even if a property owner went to court and tried to challenge the appraisal on the basis that a building should be taxed like its peers, Trahan sees little chance of success.

“If you sit before a jury and tell them ‘I just paid $180 million for this, but these other six buildings tell me I should be valued at $80 million,’” Trahan said, “They’re gonna laugh in your face.”