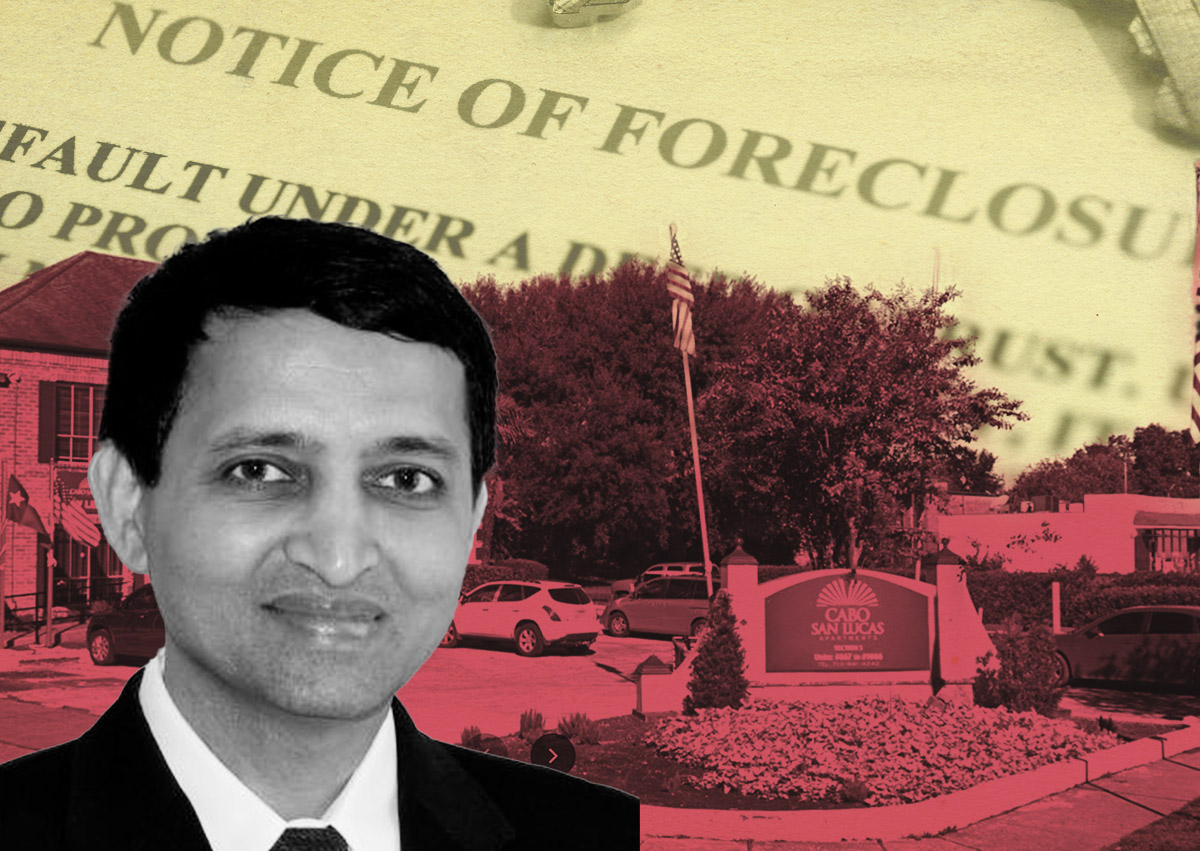

Add another legal scrape to what’s been a tumultuous year for Applesway Investment Group.

A group of 123 investors filed the latest on Wednesday, alleging that they paid Applesway, an investment firm led by Jay Gajavelli, $12.4 million on a deal that never happened, Law360 reported.

The investors told a Texas court that they spent the $12.4 million to acquire an apartment complex in Houston. However, Applesway allegedly spent the money on an unrelated transaction that fell apart, leaving the investors without the apartment complex they thought they were buying for their money.

Applesway used the $12.4 million intended to purchase the Houston property in a desperate attempt to revive the other deal, offering it as a nonrefundable down payment, the lawsuit alleges.

“Despite plaintiffs’ March 2023 demand for the return of their investment money, defendants have offered no help beyond lip service or their endless assurances to trust them in fixing the problems,” Reza D. Farahani, the investor who filed the lawsuit, told the outlet.

Applesway has been at the center of multiple high-profile foreclosures in recent months. The firm was the primary property owner in Arbor Realty Trust’s $229 million portfolio that foreclosed in April. Earlier this week, a foreclosure suit was filed on a $65.2 million loan tied to another one of Applesway’s multifamily properties in Houston.

—Quinn Donoghue

Read more