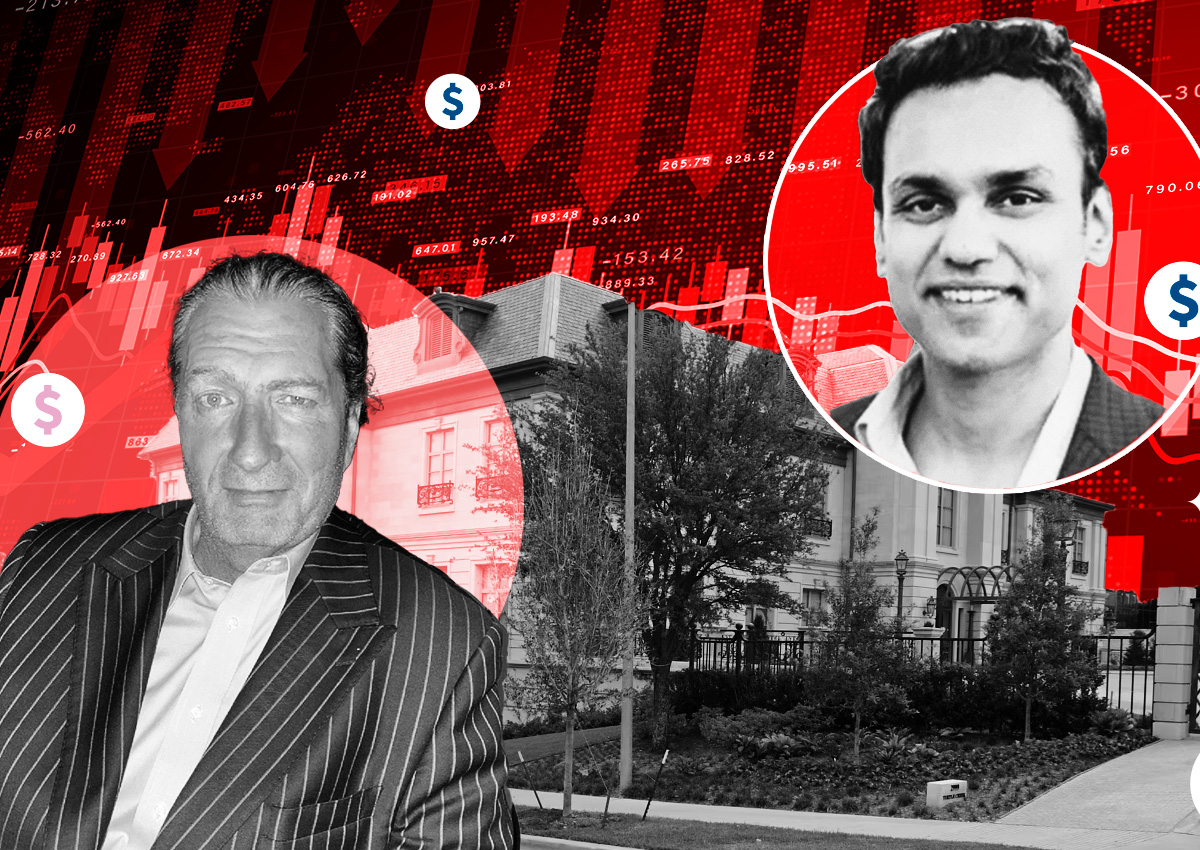

Texas real estate investor Raheel Bhai pleaded guilty to wire fraud in March. That legal saga involved criminal indictments and the alleged cross-border escapes of alleged co-conspirators and resulted in a prison sentence of up to 20 years for Bhai.

Now one of Bhai’s creditors, Benefit Street Partners, is going after his father, Ismail Essa Bhai. The firm filed a complaint against the patriarch in a Texas bankruptcy court last week, accusing him of running a “shell game” that made millions of dollars disappear. Ismail Bhai could not be reached for comment.

The dispute centers on a $149 million bridge loan that was supposedly meant to help Raheel Bhai launch a REIT called IBF Properties. The financing was backed by a package of Walgreens leases that Bhai’s company had for 24 locations across 10 states. As part of his guilty plea, Raheel Bhai admitted to embellishing the terms of the leases.

The Bhai family allegedly played a role in the fraud, with Raheel funneling $21 million to family members through a front company, Bisnow reported.

When Benefit Street discovered the scheme, Bhai, along with family members and business associates, left the country, allegedly leaving behind bags of shredded evidence, empty jewelry boxes and counterfeit cash. Five million dollars was converted to cryptocurrency to fund the younger Bhai’s escape, according to a lawsuit filed against Di Hao Zheng, an alleged co-conspirator.

Bhai eventually returned to the United States and pleaded guilty. However, Benefit Street claims that was part of the Bhai family’s plans. Benefit Street accused the elder Bhai of running a “family business that’s dedicated to defrauding lenders and business partners.“

“When the family was ready to return, the end portion of the shell game became clear: Defendant’s son is accepting criminal liability for the fraud, Defendant has filed for bankruptcy relief, and millions of dollars in assets that the Defendant and his family previously enjoyed access to are inexplicably nowhere to be found,” the complaint read.

Ismail Bhai filed for bankruptcy protection in Dallas on April 5, declaring estimated liabilities of between $100 million and $500 million.

“Defendant has continued his fraudulent conduct in this bankruptcy case. He is not an ‘honest but unfortunate debtor,’ and this Court should not countenance his dishonesty,” the complaint read.

Benefit Street, a New York-based asset management firm, is seeking a judgment that would deem the debt non-dischargeable.

Read more