Retail is the play in Texas.

The four Texas Triangle metros — Austin, Dallas-Fort Worth, Houston and San Antonio — accounted for 20 percent of the nation’s net retail absorption over the past year. Average retail vacancies in Texas have dropped to 4.7 percent after 34 million square feet of net space was added during that time period, Chain Store Age reported.

The state’s retail market growth isn’t expected to slow anytime soon, considering the Texas Triangle is expected to grow by 1.4 million residents over the next five years, the outlet reported, citing Marcus & Millichap’s second quarter retail real estate report.

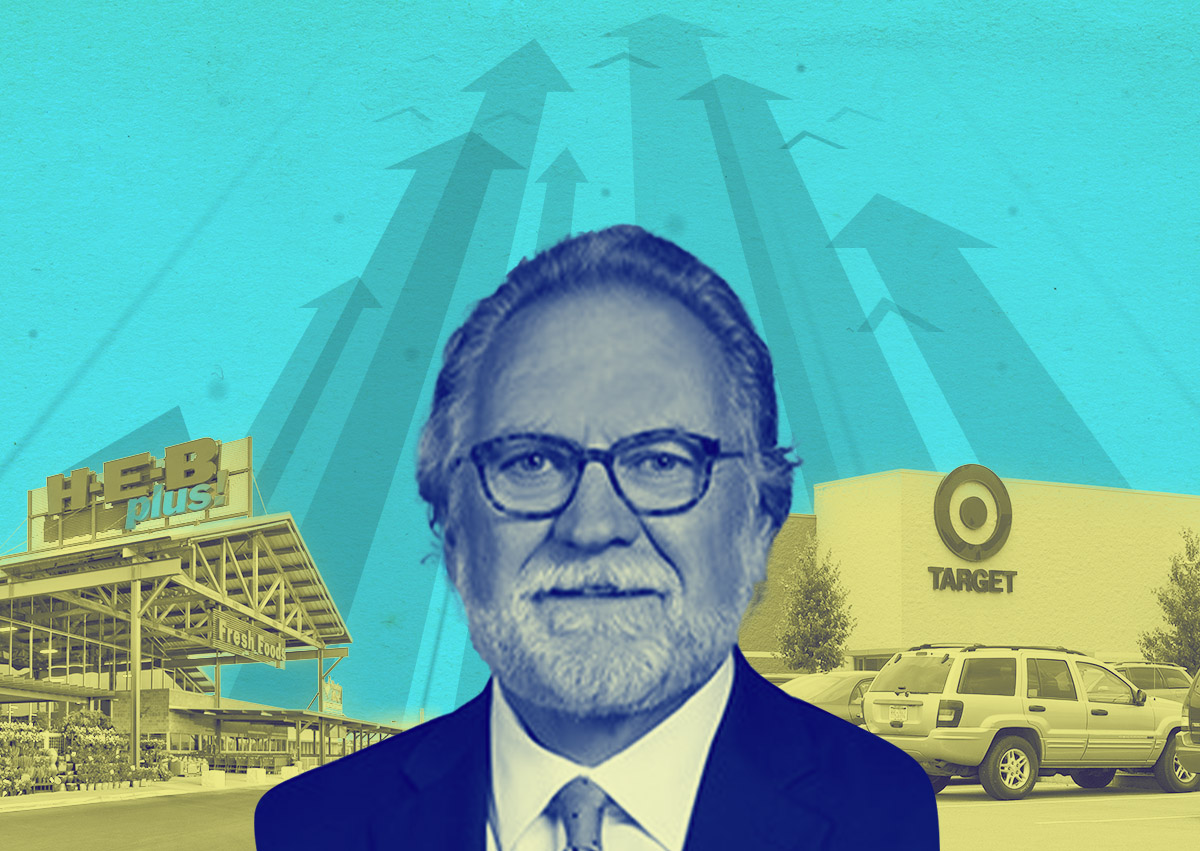

As retail firms up for investors, major Texas players have taken notice. Crow Holdings launched a 2.8 billion fund in May solely to invest in “small-format, convenience-oriented, open-air food and service shopping centers.”

The firm took notice when COVID didn’t hurt brick-and-mortar retail spaces nearly as much as expected, CEO Michael Levy told The Real Deal in an interview last month.

“Everybody hates retail, right? It used to be the whipping boy of real estate for a long time, now office is,” Levy said. “When you have an asset class that is out of favor, go back to contrarian investing.”

Some large scale investors avoid retail centers because of the modest returns and complexity in dealing with multiple tenants, he said. But for Crow, the typical neighborhood shopping center with tenants like Starbucks, Jersey Mike’s and a laundromat anchored by Home Depot have become long-term, value-add plays due to their consistent growth figures.

“We found that we’re able to drive rental rates on top of the occupancy from an institutional asset management perspective,” Levy said. For example: If a national retail or restaurant chain has a proven track record of paying rent on time for the past seven years at $28 per square foot, when it comes time to reup the lease, rent can be upped to $32 per square foot. Crow Holdings might be the largest owner of this type of retail asset class in the country, Levy said.

“We are some of the larger landlords now to these operators, and we just know what they are able to pay and willing to pay. So we’re able to drive double digit rental growth even if the space is fully occupied,” he said. “The value add is not in development, it’s in lease rollover.”

Austin leads the state in retail rent prices at $25 per square foot, followed by Houston at $20 per square foot. Dallas-Fort Worth and San Antonio average prices are both around $19 per square foot, according to Marcus & Millichap.

Austin also boasts the best vacancy numbers in the state at 3.5 percent, compared to 4 percent in San Antonio, 5.2 percent in DFW, and 5.7 percent in Houston. Austin is projected to deliver nearly 2 million square feet of retail construction before the end of the year while Houston and DFW should hit nearly 3.5 million square feet in deliveries each.

That figure is a huge jump for DFW in particular, since 2022 saw record-low retail deliveries with 538,000 square feet added. Most of that new construction will be grocery-anchored tenants, as they consistently generate the most demand due to foot traffic.

Read more