Even as Texas cities face record-high office vacancies, cranes are still visible across their skylines. But those projects might not be the biggest losers from all that new supply, according to the Dallas Fed.

Austin, Dallas and Houston are three of the 15 biggest markets for office space under construction; Austin ranked fifth, Dallas eighth, and Houston fourteenth. Austin has 6.2 million square feet of office space under development, 7 percent of its existing office stock. That is the highest amount of new construction as a share of existing office space of any city in the country. Nationally, new construction constitutes less than 2 percent of the overall office stock.

The most popular cities for new office construction were those with high concentrations of technology, financial services and professional services jobs. Those line up with Texas Triangle markets — for example, some 17 percent of all jobs in Austin are in technology, compared to just 9 percent nationally.

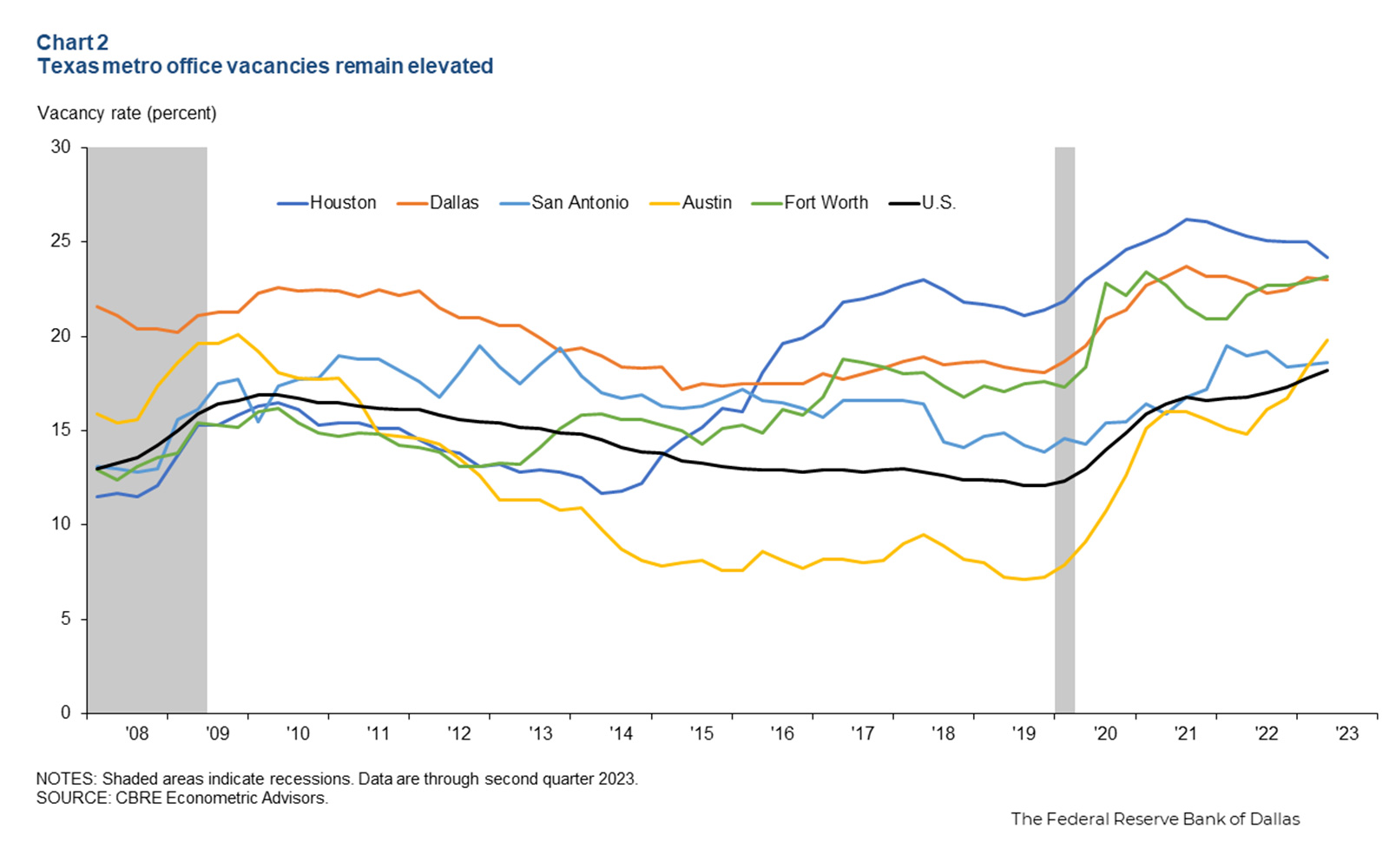

The new construction comes amid the worst time in Texas office markets in recent memory. Vacancy rates stand at even higher levels than they did during the Great Recession.

In 2022, Austin’s office vacancies shot up, meaning all major Texas metros had higher vacancy rates than the US average.

Construction for new projects typically takes two to four years, so many of those new offices broke ground before the pandemic. But even if the developers behind Texas’ booming pipelines got cold feet as the pandemic reshaped the office market, it may be too late for them to stop.

Those who can switch gears are doing so, such as Related’s plans to build pure residential at One Ladybird Lake, rather than office as previously planned.

“Construction in progress typically doesn’t immediately respond to changes in the market environment. Once construction begins, it is often most economical to finish a project,” the report’s authors write.

And once the developers finish their projects, they still won’t be out of the woods, as they will need to refinance their shorter-term construction loans. With soft tenant demand and higher interest rates, they will need to show lenders they can still meet mortgage payments.

Some 25 percent of workdays now take place at home, up from 5 percent in 2019, according to Stanford researchers. According to card swipe data, Austin and Houston workers are averaging two days a week in the office. Dallas workers average two-and-a-half days.

Subleasing has also risen sharply since 2019: It tripled nationally, but quintupled in San Antonio, quadrupled in Austin, and more than doubled in Dallas-Fort Worth.

The researchers expect the soft market may not cause issues for new buildings as much as they will for older buildings. With fewer amenities and worse locations, these Class C buildings will bear the brunt of the pain, as they already have for years.

Read more