As Houston investor Tenant Managers sees it, the right time to buy an asset is when others are running away from it.

The firm just acquired its third office building in Houston’s Westchase submarket, putting it halfway to its goal of owning 1 million square feet of office space in Houston. The acquisitions come at a time of uncertainty for older offices nationwide.

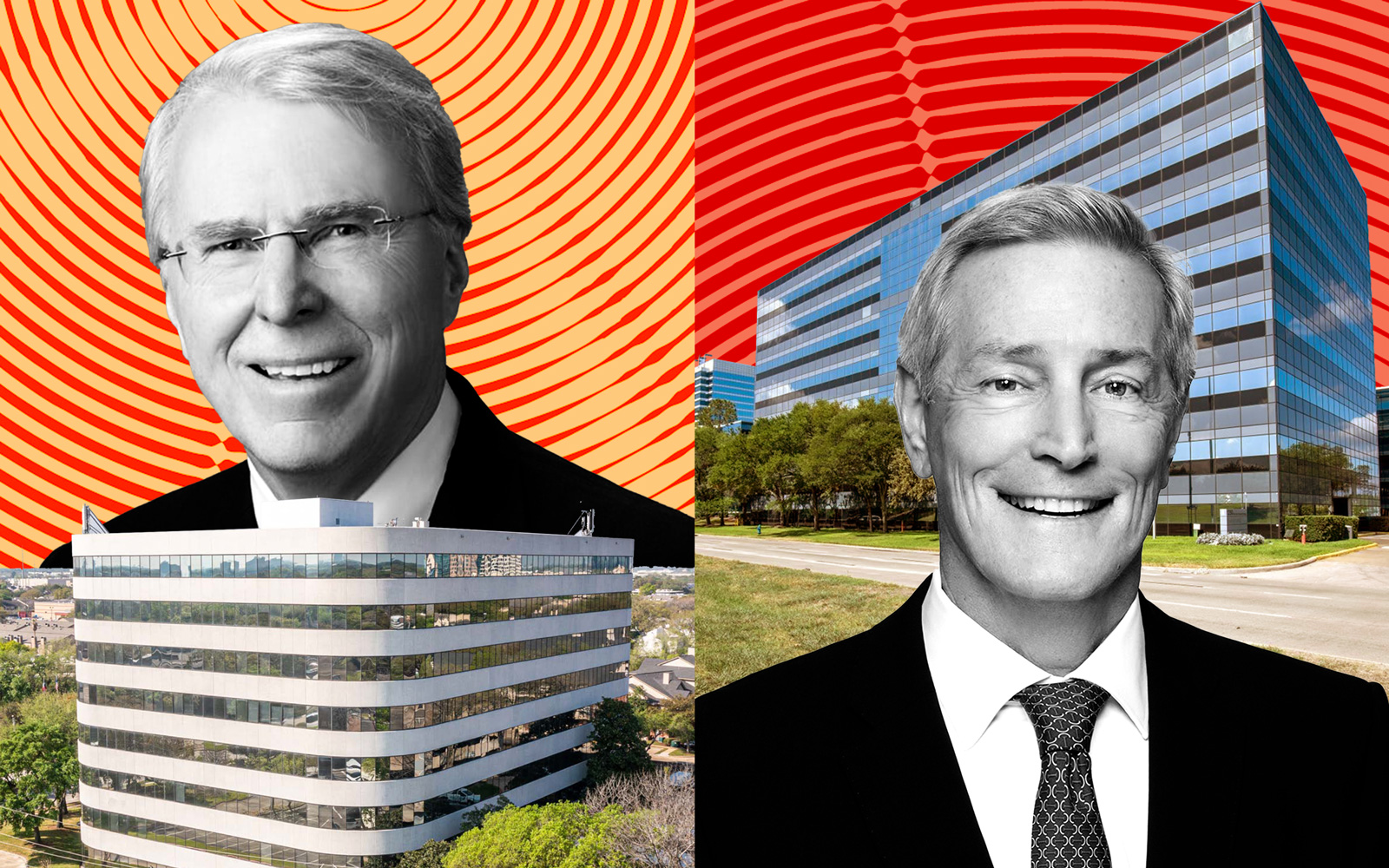

The local firm, led by CEO Nirav Shah, bought 2929 Briarpark Drive from a company associated with New York-based commercial real estate lender Argentic. The six-story building spans about 140,000 square feet. It was built in 1981 and renovated in 2012.

The price wasn’t disclosed, but the building was valued for tax purposes at almost $10.5 million this year, according to the Harris Central Appraisal District. The appraisal dropped about $4.5 million from last year.

The firm also bought offshore oil and gas services company Fugro’s USA headquarters at 6100 Hillcroft Street this month. That seven-story building, also built in 1981, spans about 137,000 square feet. The building is likely to be repurposed as a nonprofit office hub, Shah said.

In 2021, Tenant Manager bought 1500 CityWest, at 1500 Citywest Boulevard. That 10-story building was built in 1981 and renovated in 1994. It spans 192,000 square feet, and it was 60 percent occupied when the firm bought it. With recent signings, it will be 100 percent leased next month, Shah said.

“These are generational buys,” he said. “We’re long-term holders; we’re not flippers.”

The family started out in hospitality, and later, Shah’s mother had success with a Century 21 franchise. From there, they started buying industrial and multifamily assets “when they were not sexy,” Shah said.

Because the firm is cash rich, it’s not forced to buy with debt. It is investing in tenant improvements, and when the market is more favorable, it can look to financing.

The three buildings are within a few miles of each other in Westchase, where office vacancy was hovering around 30 percent in the second quarter, compared to about 26 percent across the Houston metro, according to Avison Young.

While offices are considered a lagging asset class because of remote-work trends and the high cost of insurance, Houston is one of the top-performing office markets in the nation. Yardi Systems ranked it third behind Boston and Miami, based on sales data from the first quarter, which totaled $431 million in Greater Houston. At the same time, it has faced higher foreclosure and distress rates than other Texas markets.

Tenant Managers believes Texas’ population will continue to boom, and it remains bullish on the Houston office market. Wholesale Electric Supply Company and a petroleum company have signed full-floor leases with Tenant Manager recently, Shah said.

It has several letters of intent, and Shah believes the firm will reach its goal of owning 1 million square feet of office space by the end of this year.

“We just keep evolving,” he said. “We’re true value-add buyers.”

Read more