The country’s largest self-storage landlord is packing up its headquarters for Texas.

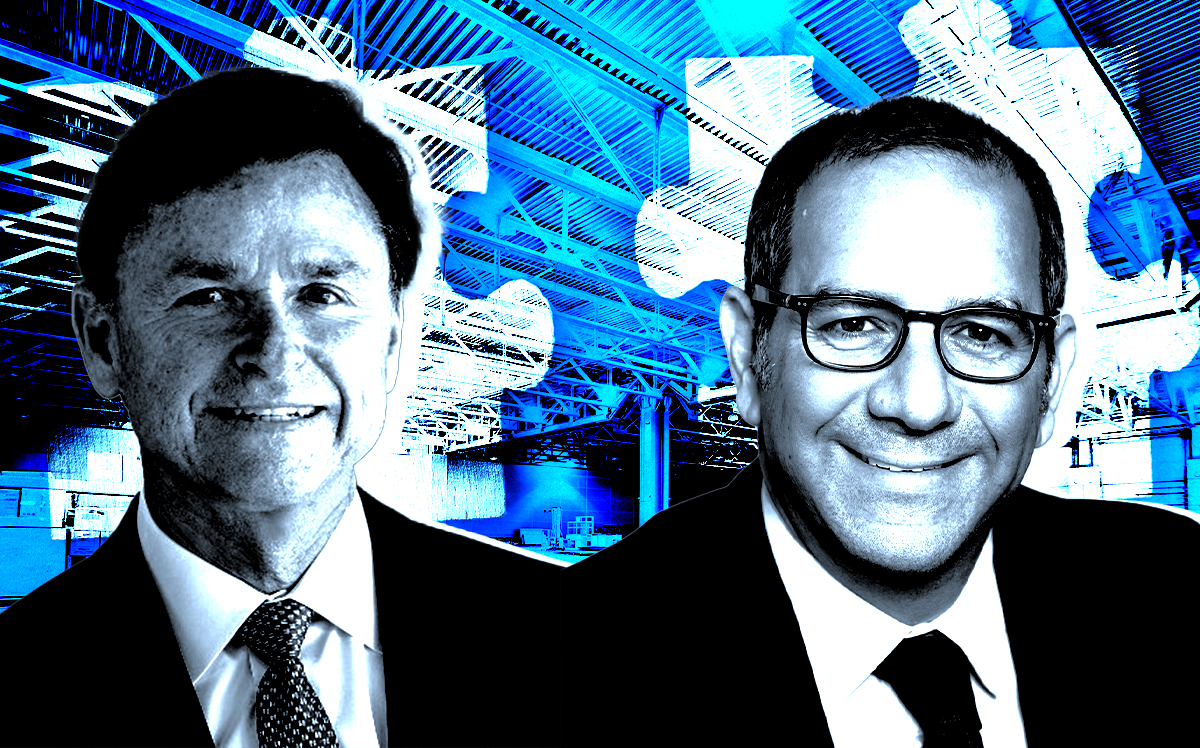

Public Storage announced it will relocate its corporate headquarters from Glendale, California, to Frisco, cementing North Texas’ status as a magnet for corporate relocations. Chron.com reported that the move comes as the real estate investment trust prepares for a leadership handoff and a broader strategic reset.

The company will occupy 119,000 square feet at 2811 Internet Boulevard at Craig Hall’s Hall Park, according to the outlet. Public Storage said it will retain a long-term presence in Glendale, where it has been based since its founding in 1972, but cited North Texas’ “depth of talent and innovation” as a draw.

Frisco has become one of the region’s busiest corporate landing pads, joining a Dallas-Fort Worth metro that ranked as the nation’s fastest-growing headquarters market between 2018 and 2024, according to Visual Capitalist. In recent years, the suburb lured companies including Ruiz Foods, PGA of America, TIAA and Brightline Dealer Advisors.

The relocation is in line with what Public Storage is branding as “PS4.0,” the fourth era of leadership in the company’s history. Chief Financial and Investment Officer Tom Boyle will succeed CEO Joe Russell, who plans to retire March 31, and remain as a consultant for another year.

The executive shuffle runs deeper. Joe Fisher of Denver-based UDR REIT will join as president and CFO. Natalia Johnson has been elevated to chief digital and transformation officer. Chris Sambar will serve as chief operating officer, and Ayash Basu of Boston Consulting Group will step in as chief marketing and revenue officer.

At the heart of the PS4.0 rollout is “PS Next,” a digital-first operating platform designed to streamline leasing and improve customer acquisition — a nod to the increasingly tech-driven nature of even the most utilitarian real estate sectors, according to the publication.

Public Storage owns or operates more than 3,500 facilities nationwide and has deployed over $12 billion in capital in the past five years.

— Eric Weilbacher

Read more