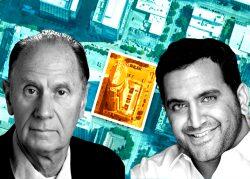

World Class Holdings CEO Nate Paul’s investment empire continues to be sold off in bankruptcy proceedings.

A bankruptcy court in Austin approved the sale of 13 single-story office buildings and a retail strip center in the Domain, one of Austin’s fastest-growing neighborhoods, to a mystery buyer. World Class defaulted on a series of loans and was forced to sell the properties after a lengthy court battle while looking to delay the forced sale.

Paul, a real estate investor and developer, quickly amassed a multibillion-dollar real estate empire before he turned 30. But he’s been hit with multiple foreclosures and bankruptcies, plus a raid by the FBI in 2019.

The Domain lies north of the central business district and includes offices for tech giants like Amazon and IBM, as well as Q2 Stadium. The buildings lie at the intersections of West Braker Lane, Kramer Lane and Metric Boulevard.

Keen-Summit Capital Partners brokered the sale, with bids starting at $75.5 million.

The high sales price represents the competitive auction environment, upside potential for increasing occupancy rates and the possibility to redevelop a portion of the property for multi-family use, said Harold Bordwin, principal of Keen-Summit.

The portfolio has been in the lurch since last May, when World Class put it into bankruptcy to avoid a foreclosure claim by lender Karlin Real Estate. A judge scheduled a UCC auction for the ownership entity’s shares in September, but the sale was delayed.

Paul’s business troubles first set off in 2019, when the FBI and Treasury Department raided his personal office and home. The same year, a debt fund alleged that Paul had defaulted on a $64 million loan. In 2020, creditors claimed they were owed roughly $135 million through 16 bankruptcies tied to 28 properties.

Over the past few years, World Class has filed at least two dozen bankruptcy cases, though a few have since been resolved. Real estate activity by Rising Tide shows how Paul is reinvesting the proceeds from offloading $588 million of his portfolio in the spring of 2022. World Class reportedly netted at least $95.5 million from the deal, though $82 million was held in reserve for unresolved claims, so it’s unclear how much Paul made.

After selling off the majority of his self-storage properties out of bankruptcy last year, Paul told The Real Deal he’s planning to rebuild his empire.

“Are there things that I wish could have been done differently or some regrets?” Paul said. “Yeah, there are, but I really focus now on how can we continue to go out there and make the best decisions.”

Read more