Dallas-based Crow Holdings, a massive real estate investment and development firm, has gathered funding to bankroll $1.5 billion in development deals.

The national real estate heavyweight raised $750 million in its second real estate investment fund this month, according to the Dallas Morning News. Those funds will be used to invest or develop industrial buildings, apartments and other properties.

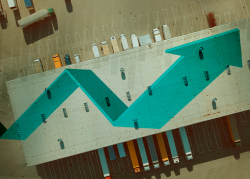

Over the past few years, the industrial market has been one of the hottest sectors in U.S. real estate as booming e-commerce has driven demand for logistics and warehouse space.

“The continued opportunity in the U.S. logistics and housing sectors is unprecedented in my 30-plus-year career,” Bob McClain, CEO of Crow Holdings Capital, said in a statement. “We maintain high conviction in these sectors and anticipate attractive risk-adjusted returns for further development, spurred by the importance of supply chain management, sustained consumer adoption of e-commerce, emphasis on housing affordability and shifting generational demographics — factors that, we believe, will continue to drive U.S. real estate opportunities for years to come.”

Earlier this month, Crow Holdings Industrial Properties Trust raised more than $600 million for investments in first-class warehouse and distribution buildings. The Dallas Morning News reported that the firm recently purchased industrial properties in Dallas-Fort Worth, Atlanta, Southern California, as well as New Jersey and Pennsylvania.

“The pandemic brought challenges, dislocations and new risks; however, our team remained active investors during a time when many pushed pause,” Michael Levy, CEO of Crow Holdings, said in a statement. “We remain committed to offering new ways for our partners to capitalize on opportunities as they arise.”

Crow Holdings has a 70-year operating history and $22 billion of assets under management, according to its website. Companies under Crow Holdings are Trammell Crow Residential, Crow Holdings Capital, Crow Holdings Industrial and Crow Holdings Office.

[Dallas Morning News] — Kathryn Hardison

Read more