Los Angeles-based private equity firm Cottonwood Group has acquired a 480-unit multifamily portfolio in Fort Worth, in collaboration with Dallas-based Texsun Holdings.

Although the financial terms of the transaction were not disclosed, the company said it plans to renovate and reposition the nearly 342,000-square-foot portfolio with a budget of about $5 million.

The portfolio consists of the Woodstone Apartments on 6051 Bridge Street and the Bridge Hollow Apartments on 5801 Bridge Street. Cottonwood acquired the properties through its Cottonwood Real Estate Founders Fund, which it has used to invest in several properties across the nation.

While the company’s main focus is multifamily, the fund also provides loans for other sectors as well, including residential, office, lab/life sciences, student housing, hotel, retail and medical.

“Given supply and demand dynamics, Cottonwood remains bullish on the multifamily sector overall, especially in markets that offer a combination of job growth, an attractive climate, and relatively low living costs,” the company said in a statement.

Cottonwood has financed and developed projects in Boston, New York, Los Angeles, and San Francisco, with an AUM of over $3 billion. And this investment is not its first rodeo in Texas.

Just last month, it acquired two major multifamily assets in San Antonio— the San Mateo Apartments and Heights on Perrin Apartments in San Antonio — also in partnership with Texsun. The entire investment encompassed over 636 units, and will include a renovation worth about $7 million.

With the Fort Worth acquisition, they now have four multifamily assets in Texas totaling approximately 1,000 units.

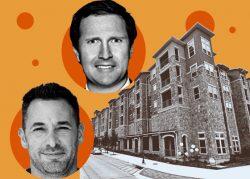

“We are thrilled to complete another transaction with Texsun and to add such a high-quality asset to our Texas portfolio,” said Mark Green, Chief Investment Officer at Cottonwood, in a statement. “While other traditional investors may be pulling back due to economic and market uncertainty, we remain bullish on the multifamily sector.”

Texsun Holdings is a privately-held private equity firm with a specialty in investing in multifamily, according to their site, and has covered over $150 million in transaction value.

Read more