Despite rising interest rates and apartment rent growth slowing, investors are still looking for a piece of the Texas multifamily market.

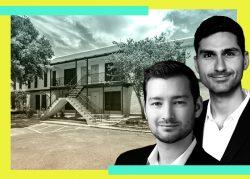

Insurance giant Pacific Life and real estate players Walker & Dunlop Investment Partners and Magma Equities threw down $189 million for two apartment complexes in Houston and Dallas-Fort Worth.

The joint venture bought The Village at Bellaire, a 580-unit apartment complex in the wealthy inner Houston enclave of Bellaire, and Lost Spurs Ranch, a 240-unit property in Roanoke, near the Dallas-Fort Worth metroplex.

“This investment underscores our continued confidence in the stability and growth potential of multifamily properties across the country,” said Mitchell Resnick, president of Walker & Dunlop. “Magma has a long track record of bringing a heightened level of professionalism to the management of apartment communities. This makes them a very attractive sponsor, and we’re excited to partner with such an industry leader to create value at these properties in two of Texas’ biggest metros.”

The properties were previously owned and operated by the seller, who was not disclosed.

Maryland-based Walker & Dunlop is active in the Texas market. In April the company brokered Tides’ $30-million purchase of the MARQ at Mueller near the University of Texas at Austin.

Walker & Dunlop is also involved in Austin-based development firm Good + West’s $150 million construction plan for a build-to-rent portfolio in Dallas and Austin.

Magma plans to renovate the complexes’ interiors and raise rents.

“With upside potential in each property and strong supply and demand dynamics in both markets, these assets are very strong additions to our Texas portfolio,” said Scott Ogilvie, Magma Equities’ director of acquisitions. “Because of our proven platform and our strong relationships across the industry, we are seeing a strong pipeline of compelling investment opportunities, and we aim to continue growing our multifamily holdings across the Sunbelt in the coming years.”

Read more