Dallas/Fort Worth was named the top CRE market in the nation this year, and the city’s 10 largest office sales raked in over $1.58 billion. Check out the top 10 office sales in the Dallas/Fort Worth metroplex in 2022, compiled by The Real Deal, with data from JLL.

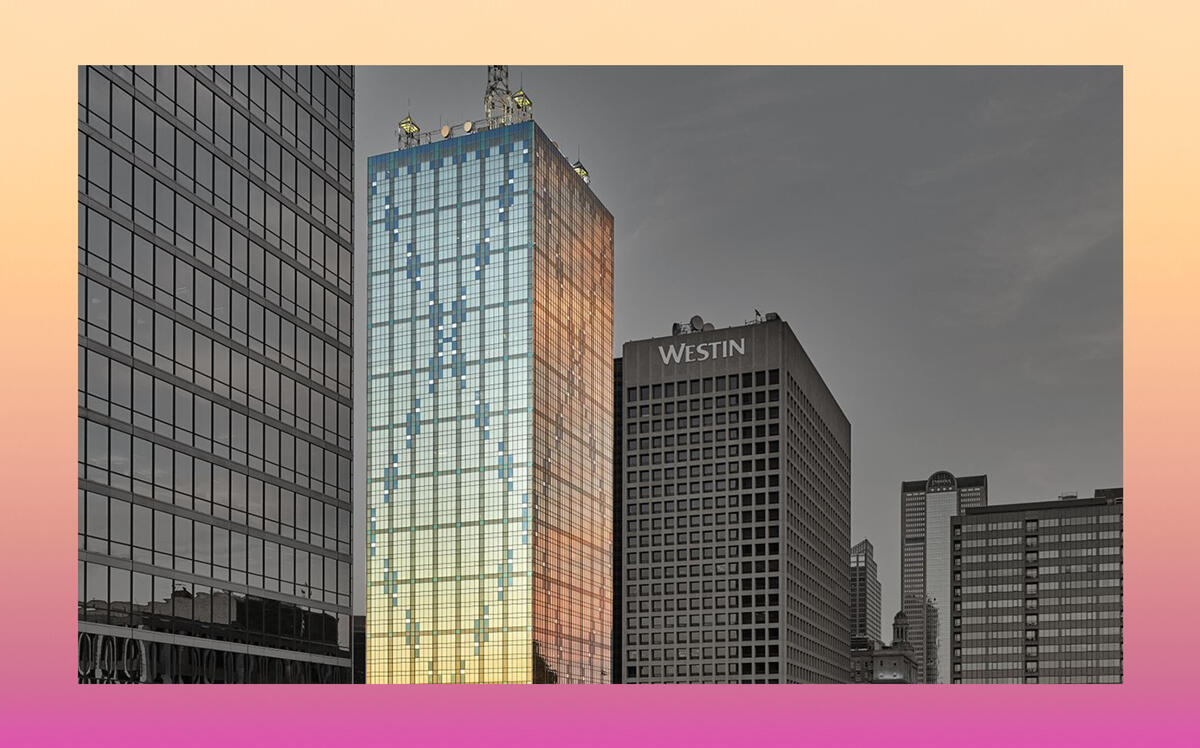

Trammell Crow Center, 2001 Ross Avenue, Downtown Dallas

2001 Ross Avenue (LoopNet)

JPMorgan Asset Management’s sale of 2001 Ross Avenue to California-based Regent Properties tops the list of 2022 Texas office sales.

The New York-based corporation sold the 1.2 million-square-foot building for $615 million, or about $493 per square foot, in February. JP Morgan recently spent about $180 million renovating the 37-year-old Trammell Crow Center with a new lobby, added outdoor space and an attached parking garage with access to retail and restaurants. Those improvements attracted several new tenants, including Goldman Sachs, Orix USA, and Vinson & Elkins.

Goldman Sachs, the building’s largest tenant, is only temporary, as it is planning its own $500 million office complex in Dallas.

The Webb @LBJ, North Dallas

11830 Webb Chapel Road (LoopNet)

Irving-based Evoque Data Centers purchased this 370,000-square-foot building, at 11830 Webb Chapel Road, for $205 million, or about $554 per square foot, from Austin-based Digital Realty Trust in August.

Digital Realty Trust bought the asset, built in the 1960s as part of a regional shopping mall, in 2004. The one-story telecom hotel/data hosting building, renovated in 2018, is just southeast of interstates 35 and 635.

1925 West John Carpenter Freeway, Irving

1925 West John Carpenter Freeway (LoopNet)

Rosewood Property Co. purchased the 403,000-square-foot office building 1925 West John Carpenter Freeway from JP Realty Trust for $137.5 million, or about $341 per square foot, in June.

The five-story building, constructed in 1987 and renovated in 2018, sits on 30 acres and is 100 percent leased as the headquarters of Vistra Energy.

Aimbridge Hospitality, Plano

5300 Headquarters Drive (Google Maps)

A San Francisco-based investor snapped up the 4-year-old office building at 5300 Headquarters Drive in June.

Drawbridge Realty bought the four-story, 249,000-square-foot building for $130 million, or about $522 per square foot. Cawley Partners developed it, and Aimbridge Hospitality has leased the full building since 2019.

Spectrum Center, Addison

5080 Spectrum Drive (LoopNet)

Acram Group bought the 614,000-square-foot 5080 Spectrum Drive from Granite Properties for $114.3 million, or about $186 per square foot, in March.

The 12-story building was purchased as part of a joint venture with New York-based Oak Hill Advisors and added to Acram’s 1-million-square-foot stake in the Dallas-Fort Worth metro area.

Renaissance Tower, Dallas

1201 Elm Street (CBRE)

GrayStreet Partners acquired the 1,739,000-square-foot building at 1201 Elm Street, in a leasehold, from Square Mile Capital for $98 million, or $56 per square foot, in May.

The 56-story building was built in 1974, and financing for the purchase was provided by an affiliate of Square Mile Capital, which had owned the property since 2021.

Riverside Commons, Irving

5000 Riverside Drive (LoopNet)

Wolverine Interests bought a 458,900-square-foot four-building office campus at 5000 Riverside Drive from Brookfield AM for $77.5 million, about $159 per square foot, in August.

The offices are situated at the south end of the Las Colinas Urban Center. They were 90 percent leased at the time of purchase and added to Wolverine’s existing repertoire of Las Colinas office properties.

Sabre Headquarters, Southlake

3150 Sabre Drive (Google Maps)

BDP Holdings LLC picked up the 265,900 square foot property at 3150 Sabre Drive for about $76.5 million, about $288 per square foot, from Dallas-based Cawley Partners and Staubach Capital and California-based PCCP in October.

The two-building complex where the technology company has been headquartered since 2002. It was renovated in 2021.

The Luminary, Dallas

409 Houston Street (LoopNet)

Harwood International acquired the 102,300-square-foot office building at 409 Houston Street from Long Wharf RE Partners and Crescent Real Estate for $68 million, about $665 per square foot, in July.

The Class A office building is located in downtown Dallas’ West End and was about 67 percent leased at the time of purchase. The advertising agency LERMA/ added a full floor to its lease at the Luminary this month.

Legacy Center, Plano

5445 Legacy Drive (LoopNet)

Larson Capital Management bought the 175,000-square-foot building at 5445 Legacy Drive for $59 million, about $337 per square foot, from Cawley Partners in May.

The purchase increased Larson’s holdings in the larger Legacy Business Park. The Missouri-based investor purchased another 130,000-square-foot building in the complex around the same time.