Sonida Senior Living has defaulted on a loan package from Fannie Mae, resulting in a forbearance agreement that covers more than half of the properties in its portfolio.

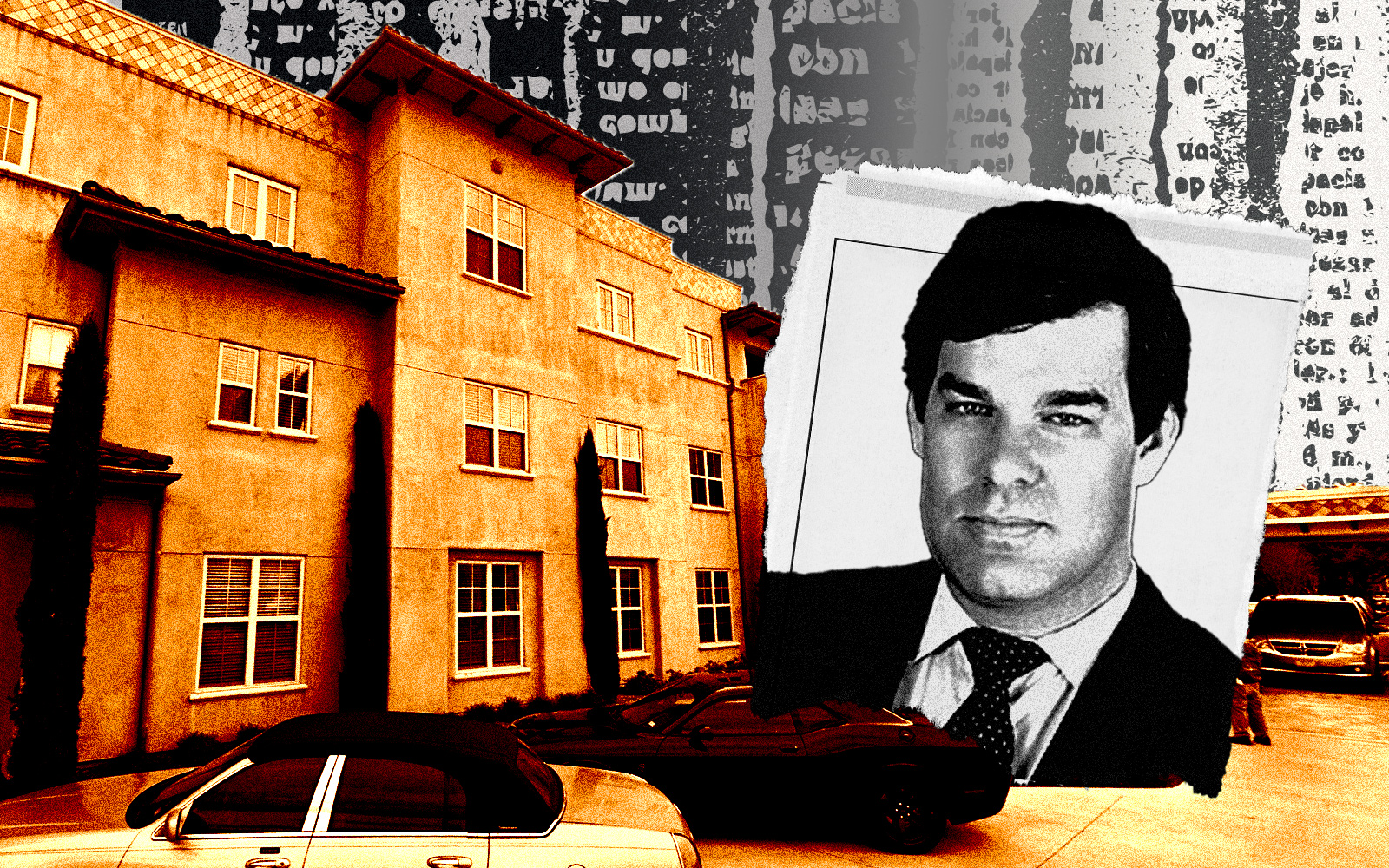

The Dallas-based assisted-living facility operator owns or manages 72 facilities nationwide, including the Waterford in Fort Worth and the Remington at Valley Ranch in Irving.

It entered forbearance on $427 million in debt, according to a Securities and Exchange Commission filing last week. It’s unclear how much of the loan package went into default. However, Fannie Mae reported that it incurred $167,482 in costs and fees, the filing shows.

The loan package is backed by all 37 of Sonida’s encumbered properties. The forbearance, which took effect on June 1, provides Sonida with reduced debt service payments and loan extension on 18 properties. In exchange, Sonida will be on the hook for a $5 million payment, most of which will go toward repaying the debt on Vintage Gardens in St. Joseph, Missouri.

The maturity date on the 18 properties has been pushed back to December 2026. The rest of the properties in the portfolio have existing maturities of December 2028.

Conversant Capital, Sonida’s largest shareholder, made an additional $13.5 million equity investment. The funds will serve as a sort of guarantee for Fannie Mae. If Sonida defaults on the forbearance agreement, the disbursement of the funds will be accelerated to cover the cost of curing any default.

Sonida is also negotiating with Alabama firm Protective Life Insurance to resolve “non-compliance” on $72 million in debt backed by four of its properties.

The deal comes just months after Sonida, which reported $54 million in losses in 2022, told investors that its ability to operate is a “going concern.” In an earlier SEC filing, the company identified upcoming debt maturities as a reason for its financial standing.

Read more