CBRE Group’s outlook on the remainder of 2023 appears bleak.

The global investment and services firm, based in Dallas, projects its earnings to drop 20 to 25 percent this year amid a delay in the expected capital markets recovery, the Dallas Morning News reported.

While CBRE anticipates growth this year in its loan servicing, property management, investment management and workplace solutions ventures, the firm’s income from property leasing and sales is way down compared to last year, according to its latest quarterly report, the outlet reported.

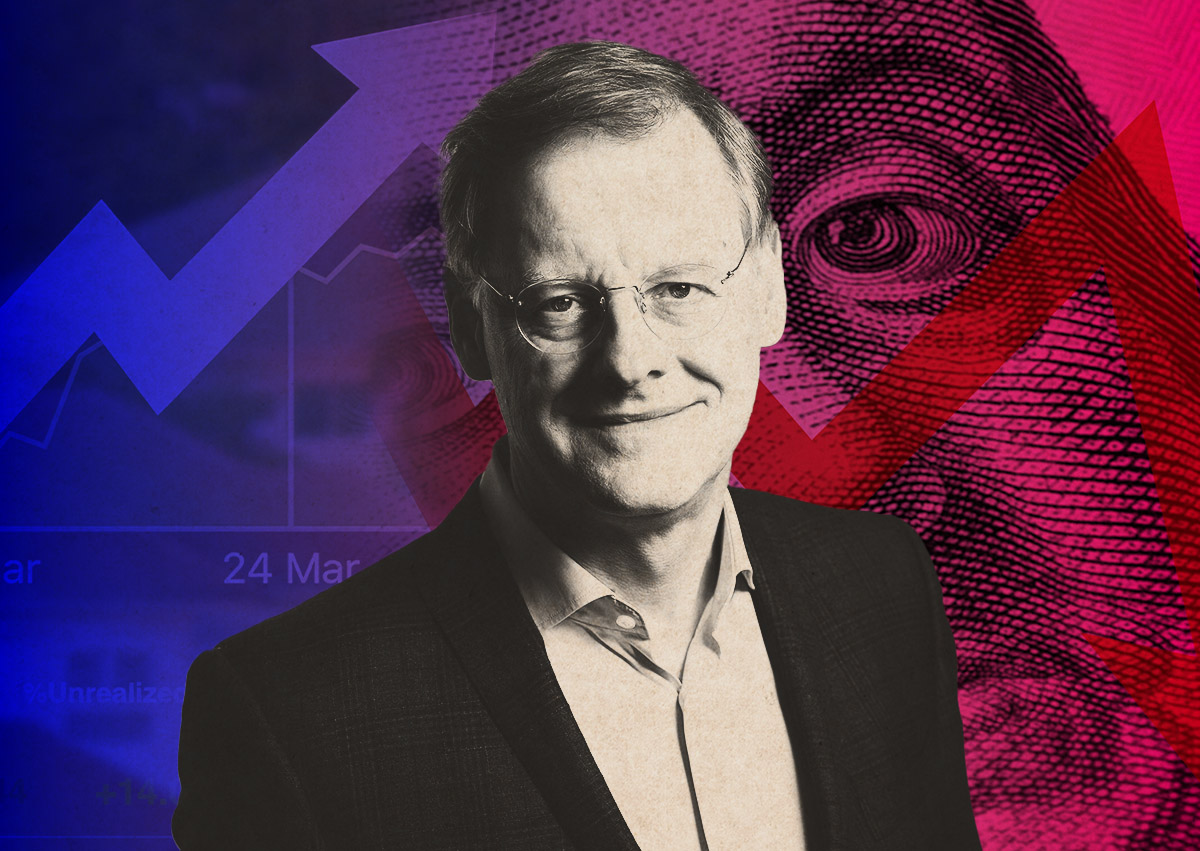

“The economy performed better than we had anticipated going into the quarter in terms of both GDP and employment growth,” CBRE CEO Bob Sulentic said in a statement to investors.

“However, the opposite was true with interest rates, where increases in the last 90 days, coupled with expectations that rates will end the year higher than anticipated last quarter, pressured the elements of our business that are sensitive to commercial real estate capital flows, particularly our sales and financing businesses.”

CBRE may struggle this year, but the company expects to bounce back in big, as executives predict record earnings in 2024. CBRE is exploring opportunities for mergers and acquisitions. It is working on a number of $1 billion “M&A deals,” Sulentic said.

CBRE’s net revenue was $4.5 billion last quarter, down seven percent year-over-year. Its quarterly net income was $201 million, which was a 58 percent drop-off from one year prior. The firm’s property sales in the Americas declined 22 percent year-over-year last quarter, as well.

Sulentic anticipates a mild recession later this year.

—Quinn Donoghue

Read more