W.P. Carey is parting ways with 11 office and industrial assets in Texas as part of a spinoff aimed at relieving the firm of of its office portfolio.

New York-based W.P. Carey, one of the largest global real estate investment trusts, plans to offload 59 properties in the United States and Europe though a spinoff, a publicly traded office-focused REIT called Net Lease Office Properties, the Dallas Business Journal reported.

The portfolio comprises 8.7 million square feet of office space, with 7.9 million square feet located in the United States. They are capitalized with $169 million in existing mortgage debt and a new $455 million debt financing package. W.P. Carey expects to net $732 million in the spinoff.

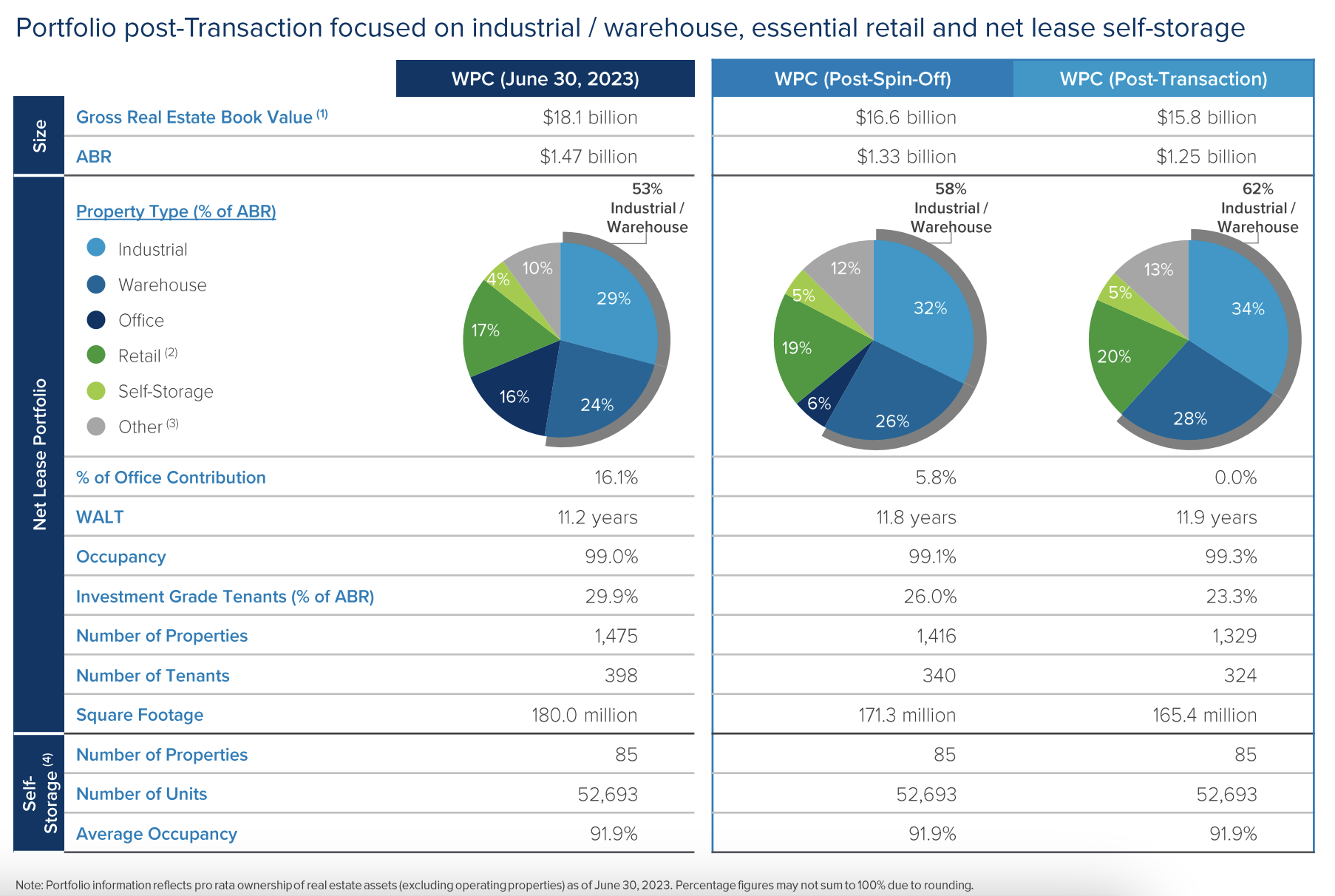

The spinoff is part of W.P. Carey’s efforts to ditch its entire office portfolio, in a move toward industrial warehouse and retail. It is expected to take effect Nov. 1. Net Lease Office Properties will gradually sell the assets, citing their “favorable exposure to investment grade credit,” to reduce debt and enhance shareholder value.

Source: W.P. Carey

In North Texas, some notable properties affected by this move are the 386,000-square-foot J.P. Morgan Chase operations center in Fort Worth’s CentrePort Business Park and a 166,000-square-foot building in Plano’s Legacy Business Park, which is leased to Intuit.

Outside of DFW, there are 10 Texas properties that will be part of Net Lease Office Properties’ portfolio, including a 120,000-square-foot building leased to iHeart Communications in San Antonio, a 22-story tower in Houston and a 200,000-square-foot building leased to U.S. Oncology in The Woodlands, north of Houston. Along with two more buildings in Houston, the other properties are leased by broadband provider Radiate Holdings in Corpus Christi, Odessa San Marcos and Waco.

The spinoff does not require investor approval and is set to trade on the New York Stock Exchange when completed. The portfolio’s U.S. properties have an impressive average occupancy rate of 96.8 percent, while the ones in Europe are fully leased.

W.P. Carey also plans to offload 87 office assets in Europe.

—Quinn Donoghue

Read more