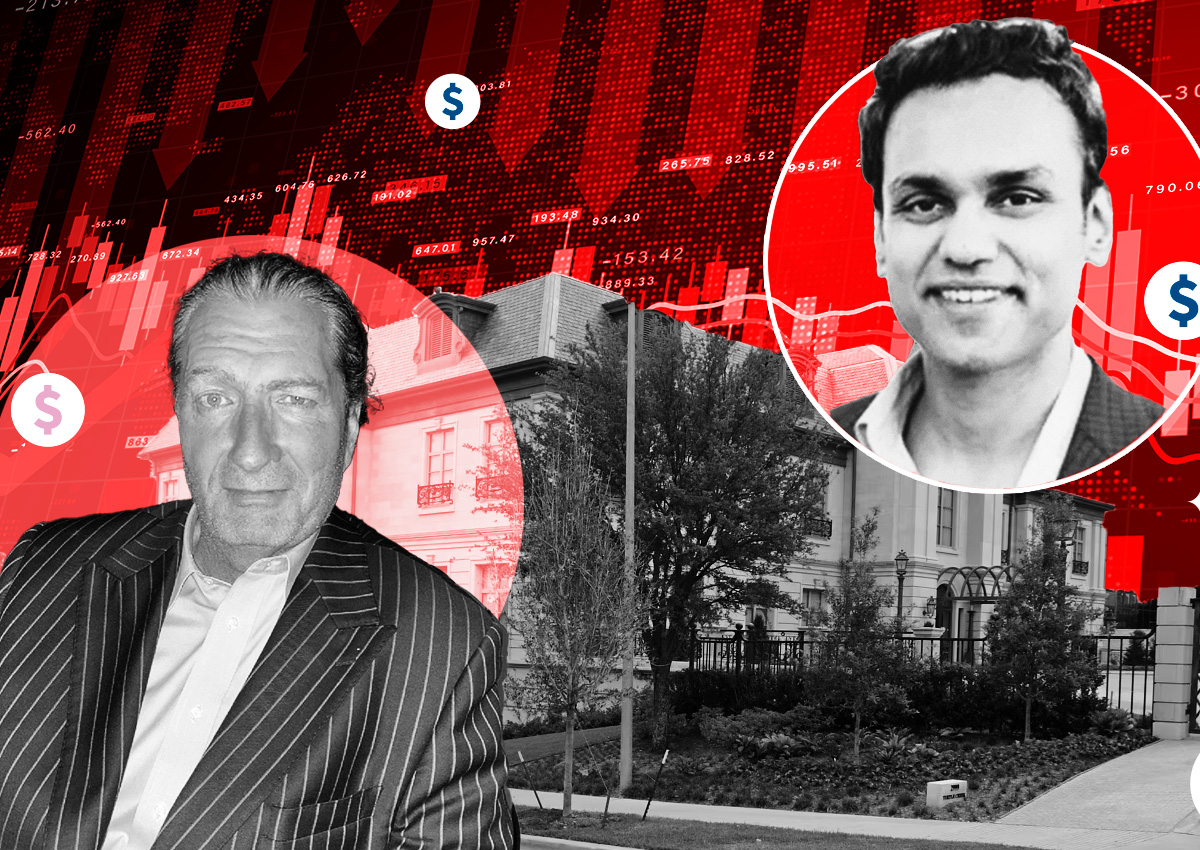

Dallas developer Timothy Barton has endured a slew of legal and financial heat since last year, and the pan just got a little hotter.

A U.S. district court in Dallas has mandated that more than 50 companies and partnerships owned by Barton go into receivership, the Dallas Morning News reported. This decision follows a request from the Securities and Exchange Commission, which has been pursuing the receivership of Barton’s businesses for the past year.

The SEC alleges that Barton, president of JMJ Development and CEO of Carnegie Development, orchestrated a fraud scheme that targeted more than 100 Chinese investors, resulting in losses exceeding $26 million.

In a Nov. 29 ruling, the court granted the SEC’s request to place Barton’s companies and associated properties under receivership. The SEC contends that Barton, along with associates Stephen T. Wall and Chinese businessman Haoqiang Fu, misappropriated the majority of investor funds for unauthorized purposes, including acquiring properties under different entities, paying undisclosed fees to Fu, covering expenses for unrelated real estate projects and financing Barton’s personal lifestyle.

Read more

Barton, Wall and Fu were sued by the SEC last year for violating securities laws, with Barton facing multiple felony charges. Barton has appealed the charges and maintained his innocence. The court, recognizing the extraordinary nature of Barton’s case, emphasized the need for caution in employing receivership but deemed it necessary in this instance.

The court has directed the receiver to assume control of assets from Barton’s business ventures and proceed with the sale of three properties. One notable property slated for sale is a development site on the Dallas North Tollway, acquired by Barton’s JMJ Hospitality in 2020 with plans for a high-rise hotel and residential building, the outlet reported.

Another property in Dallas’ Turtle Creek neighborhood that’s owned by JMJ has already been sold out of bankruptcy to investor HN Capital.

—Quinn Donoghue