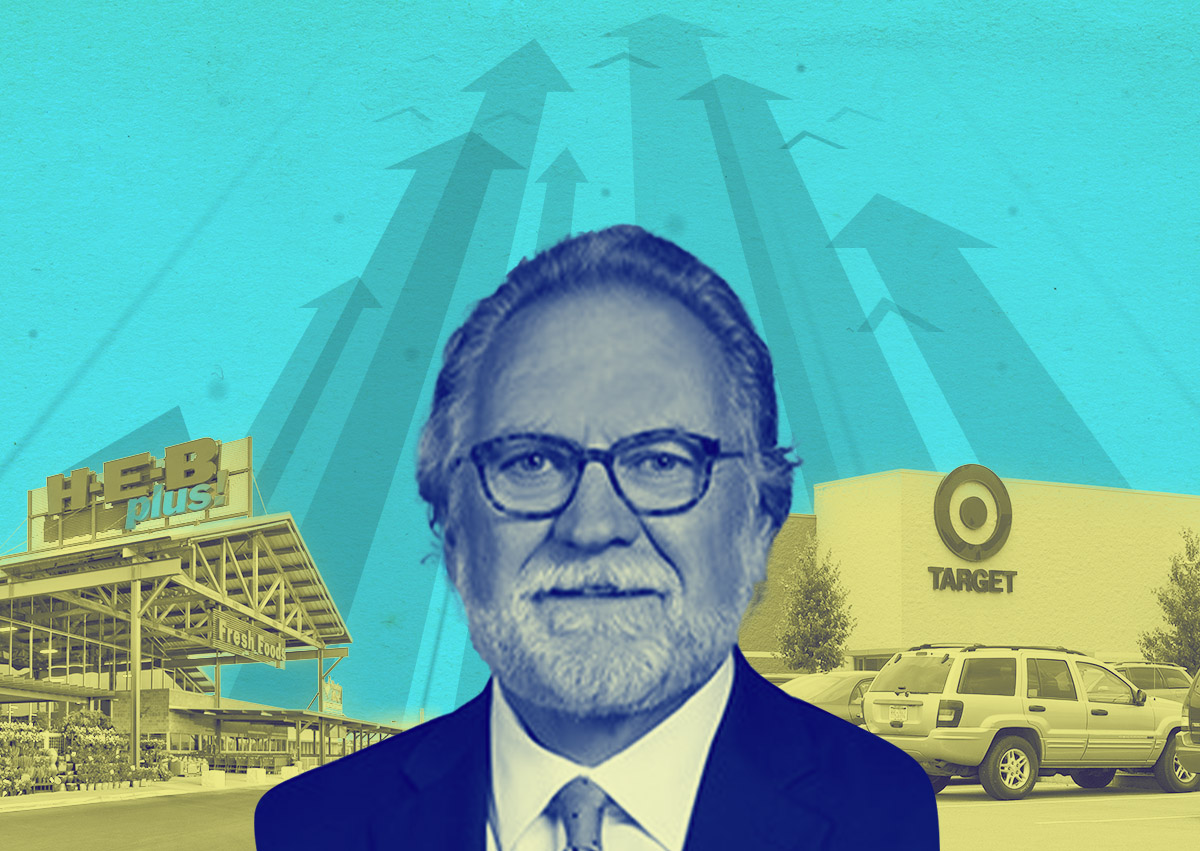

The October opening of Target at the Gates of Prosper, a shopping center that Jerry Jones’ Blue Star Land Holdings developed last year, provided one-stop shopping for residents of the booming town of Prosper, about 35 miles north of Dallas.

In real estate terms, the Metroplex’s first new-build Target in five years indicated something more significant.

“The market is now supporting the economics for ground-up retail construction, which is kind of a crazy thing to say out loud,” said Jim Dillavou, Lincoln Property Company’s national head of retail.

Between the Great Recession, the explosion of e-commerce and the economic effects of the COVID-19 pandemic, the last 15 years saw a deluge of dire predictions for the future of retail real estate. New construction all but stopped.

Retail availability is at an all-time low, as a result, and retail rents are stronger than ever.

Meanwhile, retail real estate is providing a reliable refuge for investment capital as multifamily and office fizzles out amid high interest rates and remote-work trends. In Dallas-Fort Worth, the fastest growing metro in the country, the reversal of fortune is even more pronounced.

It’s the inverse of trends that followed the Great Financial Crisis, Dillavou said.

“The occupancy levels and demand for necessity retail is as high as it’s been in my career,” he said.

Retail by the numbers

The mix of high demand and lack of availability has put incredible pressure on the market, especially in fast-growing Texas.

After all, housing development follows people, and retail is close behind.

The retail vacancy rate is 4.7 percent in Dallas-Fort Worth, according to Partners Real Estate. Low availability has pushed rents to a record high of $19.75 per square foot, a 9 percent jump since last year. That rent growth rate is more than twice the national average of 3.5 percent.

Rents are highest in North Central Dallas, where the average is $26.44 per square foot.

“Some retailers are paying more and biting into profitability to meet store count, while those with tighter rent thresholds are out of luck,” said Karla Smith of SRS Real Estate.

DFW’s rent growth is second only to Austin among big Texas metros. Here’s the picture in three other Texas metros:

Houston

- Vacancy: 5.1% (up 0.1)

- Rent: $20.43 (up 4.8%)

Austin

- Vacancy: 3.2% (flat)

- Rent: $26.52 (up 14.7%)

San Antonio

- Vacancy: 3.9% (down 0.2)

- Rent: $18.95 (up 4.8%)

Dealing with low inventory

When Toys “R” Us’ 2017 and 2018 bankruptcies left a wake of empty big-box stores across the country, strip mall vacancies were heralded as the beginning of the end for brick-and-mortar retail.

Less than a decade later, a retail chain’s bankruptcy can be a blessing to the rest of the market.

Take Bed Bath & Beyond. When the houseware emporium filed for bankruptcy protection in April 2023, its remaining stores were quickly backfilled with stores like Burlington Coat Factory and Hobby Lobby, Dillavou said. And, rents climbed.

That’s a reflection of retailers’ limited options.

Developers are scrambling to build, but, as is the story across sectors, high construction costs and financing challenges have drastically slowed project timelines.

Retail deliveries in Dallas-Fort Worth dropped 70 percent in the third quarter, year over year, from 1.7 million square feet to 523,000 square feet, according to Partners.

A capital win

The high-pressure environment has made retail real estate a win for investors.

Retail provides “safe and durable” returns for investors, and they’re able to get creative debt on these kinds of assets, Dillavou said.

Lincoln, based in Dallas, waded deeper into the retail business five years ago with the launch of Lincoln Retail Income and Growth Fund. In July, the company partnered with Paragon Commercial Group to bolster Lincoln’s West Coast retail real estate investment operation.

Lincoln is part of a strategic trend of purchasing and renovating retail properties built a few decades ago.

Updating shopping centers and strip malls is all about serving modern consumer needs, namely convenience, Dillavou said. That means streamlining online pick-up, adjusting parking and attracting tenants that consumers want. These days, that means food and beverage providers.

Single-person households made up 29 percent of all the nation’s residences in 2022; in 1960, that rate was just 13 percent, Census data shows. As a result of that demographic shift, people are eating out more than ever, said Brandon Svec, national director of retail analytics with CoStar.

What’s next

While ground-up development is rare, retailers are waiting for the next Bed Bath & Beyond.

Experts are closely watching the potential merger of grocery giants Kroger and Albertsons. If approved, stores could consolidate and leave big boxes available, Svec said.

“Other than grocery-anchored centers or entertainment venues, there are few large developments underway in Texas,” Smith said.

Due to the high demand for retail space, Dillavou expects more new construction, like the development at the Gates of Prosper, isn’t far off.

“We will see more if debt markets stabilize,” he said.

Read more