The far-reaching impacts of multifamily distress has driven a wedge between a pair of investors that went on apartment complex shopping spree from 2020 to 2022.

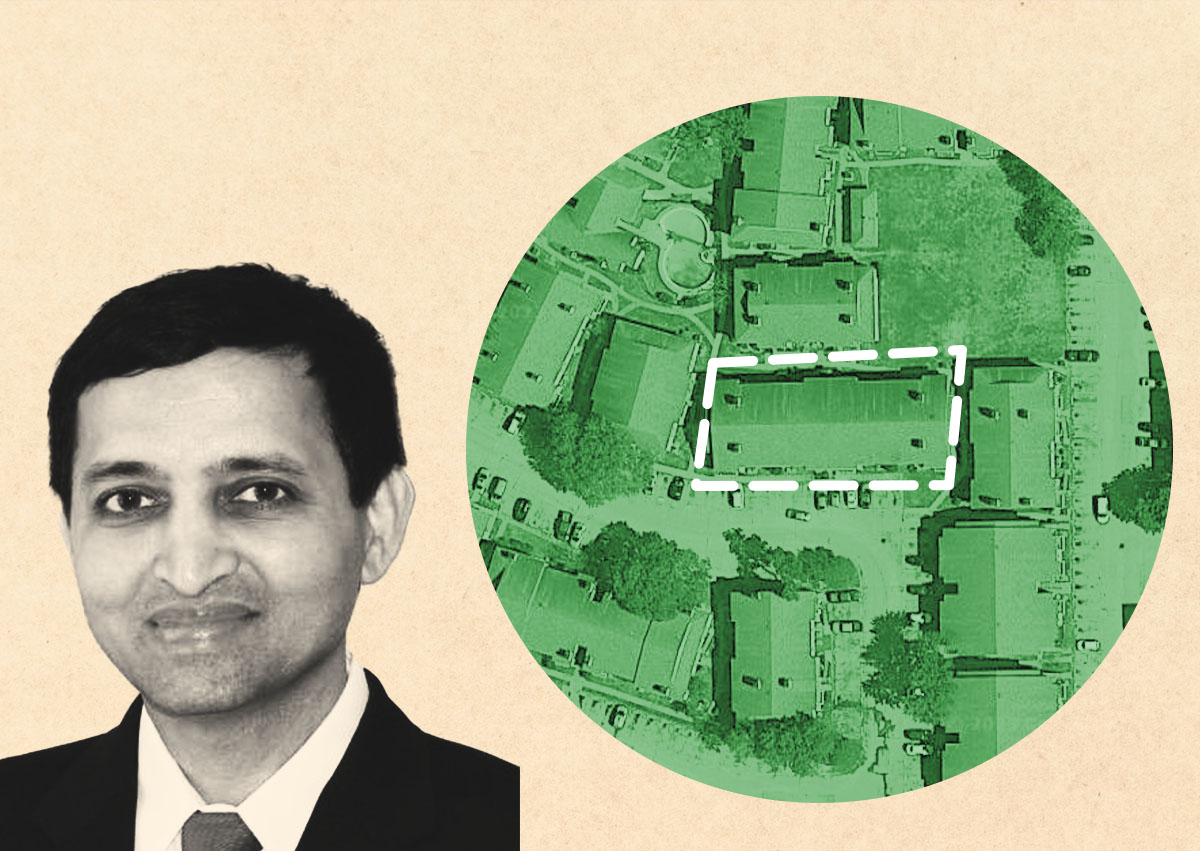

Dallas-based syndicator WindMass filed a lawsuit against New York-based investment firm Fundamental Partners in Dallas County District Court on June 28.

WindMass is accusing its investment partner in $250 million worth of Texas multifamily assets of conspiring to force the firm out of the partnership’s LLC agreements and cancel its promote interests.

In the lawsuit, WindMass writes that Fundamental has been operating the partnership’s companies as “an organ donor to Fundamental’s unrelated projects.”

Those so-called donations involve shouldering the burden of Fundamental’s distress, like paying insurance premiums made higher by Fundamental’s troubled assets and forking over fines for Fundamental’s delayed payments for capital calls, WindMass alleges.

Fundamental called WindMass’ claims false and said its former asset manager has “repeatedly breached contractual obligations and been removed from operational duties for cause,” in a statement.

“At Fundamental, we take immense pride in our near 20-year history of successfully revitalizing and investing in communities across the country and look forward to refuting these baseless allegations in court,” the statement said.

WindMass did not respond to requests for comment.

The two firms started purchasing property together in 2020.

In the LLCs set up to make the purchases, Fundamental served as the managing member, which was responsible for delegating the operation of the company to the administrative member, represented by WindMass. Both members were vested as promote interests.

The relationship started to sour when Fundamental began to have liquidity issues in 2023 – leading to the departure of experienced staff members, the lawsuit said.

Tipping point

Fundamental’s cashflow issues reached a fever pitch when a 3,200-unit Houston multifamily portfolio it invested in was foreclosed on.

Arbor Realty Trust foreclosed on a $229 million multifamily portfolio owned by Jay Gajavelli’s Applesway Investment Group in the spring of 2023 — an event that made a big splash in the commercial real estate world.

Fundamental purchased the four properties for $197 million at auction, the Houston Chronicle reported. Fundamental took over Applesway’s mortgages from Arbor on the properties. The lawsuit claims Fundamental lost $50 million in the foreclosure and poured an additional $30 million into the investment to salvage it..

In the wake of the fiasco, Arbor demanded that Fundamental acquire wind and storm insurance on the property equal to the property’s full insurable value.

Fundamental “concocted a scheme” and obtained an insurance policy that covered all of the properties in two of its funds, WindMass alleges. Some of these properties in question were WindMass investments.

WindMass claims it notified the insurer that it did not consent to the “scheme,” and argues it had to pay “substantially higher rates,” because its properties were included in a pool with high-risk properties like Applesway.

In the lawsuit, WindMass calls the situation “tantamount to insurance fraud” and “a turning point in the relationship.”

Capital calls, no answer

That’s when Fundamental started avoiding capital calls, the lawsuit states.

Per the arrangement in the LLC agreements, WindMass would identify capital needs and send recommendations to Fundamental; the partners would then discuss and agree on funding.

Multiple times in December 2023, WindMass claims it recommended a capital call and funded its share while Fundamental did not.

Fundamental allegedly either funded a lesser amount, provided money in installments or delayed payments, resulting in fines that Fundamental passed onto WindMass.

In one instance, Fundamental funded a required payment through a member loan at a 20 percent interest rate “forcing WindMass and its investors to bear the consequences of Fundamental’s incompetence,” the lawsuit alleges.

Fundamental got some help relieving its solvency issues when New York State Common Retirement Fund hired the firm to invest $375 million, according to the State Comptroller.

The firm then made moves to force WindMass out of the LLC agreements by issuing a series of “bogus” removal events.

WindMass believes this to be “a cash grab” for its promotes.

For example, one notice accuses WindMass of intentionally mismanaging funds without providing an explanation of the accusation. WindMass later learned the mismanagement allegation referred to a mistake on the part of the partnership’s property manager, Indio.

Fundamental then ordered lenders to remove WindMass as a promote member from the partnership’s agreements.

In June, Fundamental demanded WindMass execute multiple member loans with 20 percent interest. Now, WindMass claims Fundamental is starting to liquidate mutually held assets without its consent.

WindMass is asking for damages, interest, attorney’s fees and for the court to declare invalid the notices of removal and cancellations of WindMass’ membership interests.

Read more