Another building in Dallas’ Harwood District secured a major refinancing in December, as the rocky office market continues to recover.

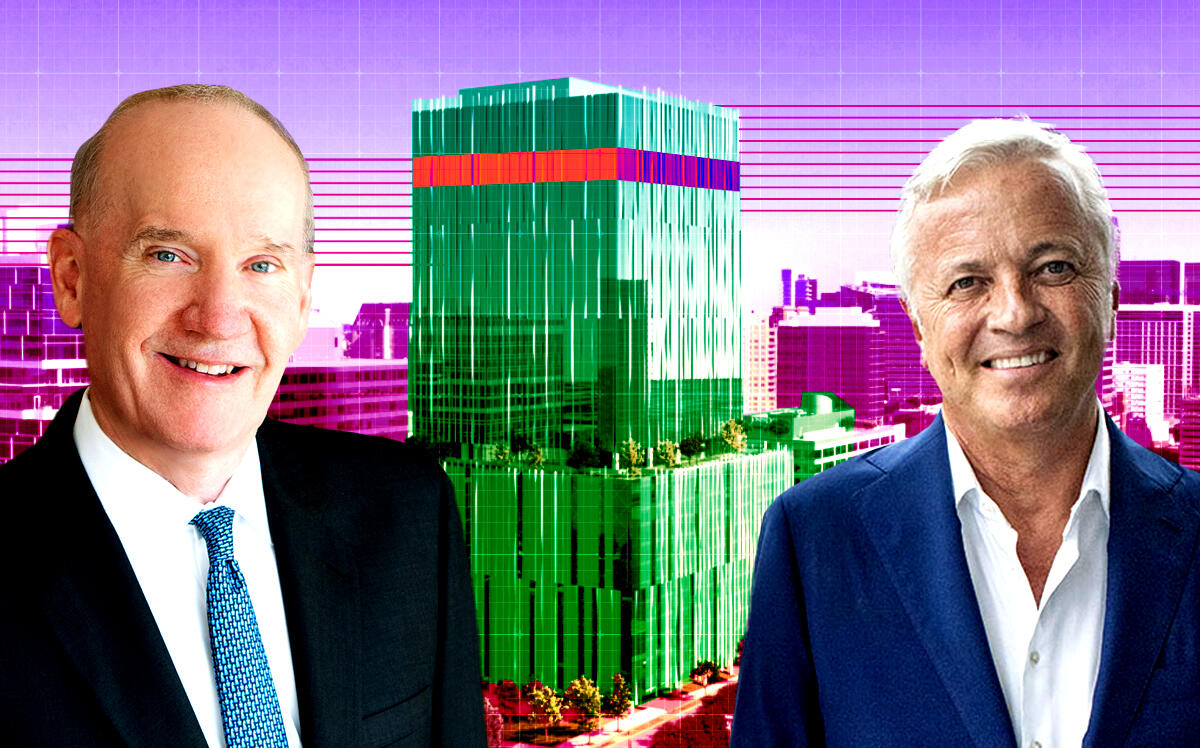

Gabriel Barbier-Mueller’s Harwood International refinanced Harwood No. 14, the newest and tallest tower in the district, with a $160.8 million loan, according to Dallas County records first reported by The Dallas Morning News. New York Life Insurance provided the financing on Dec. 18, with the deal recorded Dec. 23. A separate Harwood-affiliated entity owns the property.

Completed in June 2023, the 26-story office tower at 2801 North Harwood Street marked a design-forward expansion for the district. The 360,000-square-foot office tower was designed by Japan’s Kengo Kuma & Associates, with Dallas-based Corgan as architect of record. In addition to office space, the building includes restaurant space and a 17,000-square-foot rooftop and sky garden.

The refinancing lands amid a turbulent stretch for Harwood International. Over the past year, the developer sold four office towers to private equity giant TPG, unloading Harwood buildings No. 2, 6, 7 and 10 between early September and early October 2025. The four properties total roughly 900,000 square feet.

In November, law firm Jones Day, which was supposed to anchor the upcoming Harwood No. 15 at 3008 North Harwood, pulled out of the project, as previously reported by The Real Deal.

Earlier in 2025, Harwood also sold Harwood No. 4 to Spear Street Capital after defaulting on a loan, with the San Francisco firm planning multimillion-dollar upgrades.

The seven-story Harwood No. 1, the district’s original office building at 2651 North Harwood Street, reverted to lender First United Bank after a foreclosure auction in November, part of a series of at least four foreclosure threats faced by the developer, as Barbier-Mueller’s firm also took on a $100 million loan at the end of last year.

That same Harwood No. 1 has now found a new owner. Dallas-based Cawley Partners purchased the nearly 106,000-square-foot building from First United Trust following the foreclosure, with a $29.5 million acquisition loan, according to deed records. The sale price was not disclosed. First United Bank’s winning foreclosure bid was $27.2 million, while the Dallas Central Appraisal District values the property at $25 million.

Cawley plans to invest $10 million to modernize the building, built in 1984, updating common areas and adding 50,000 square feet of spec suites. The property is about 50 percent leased.

— Eric Weilbacher

Read more