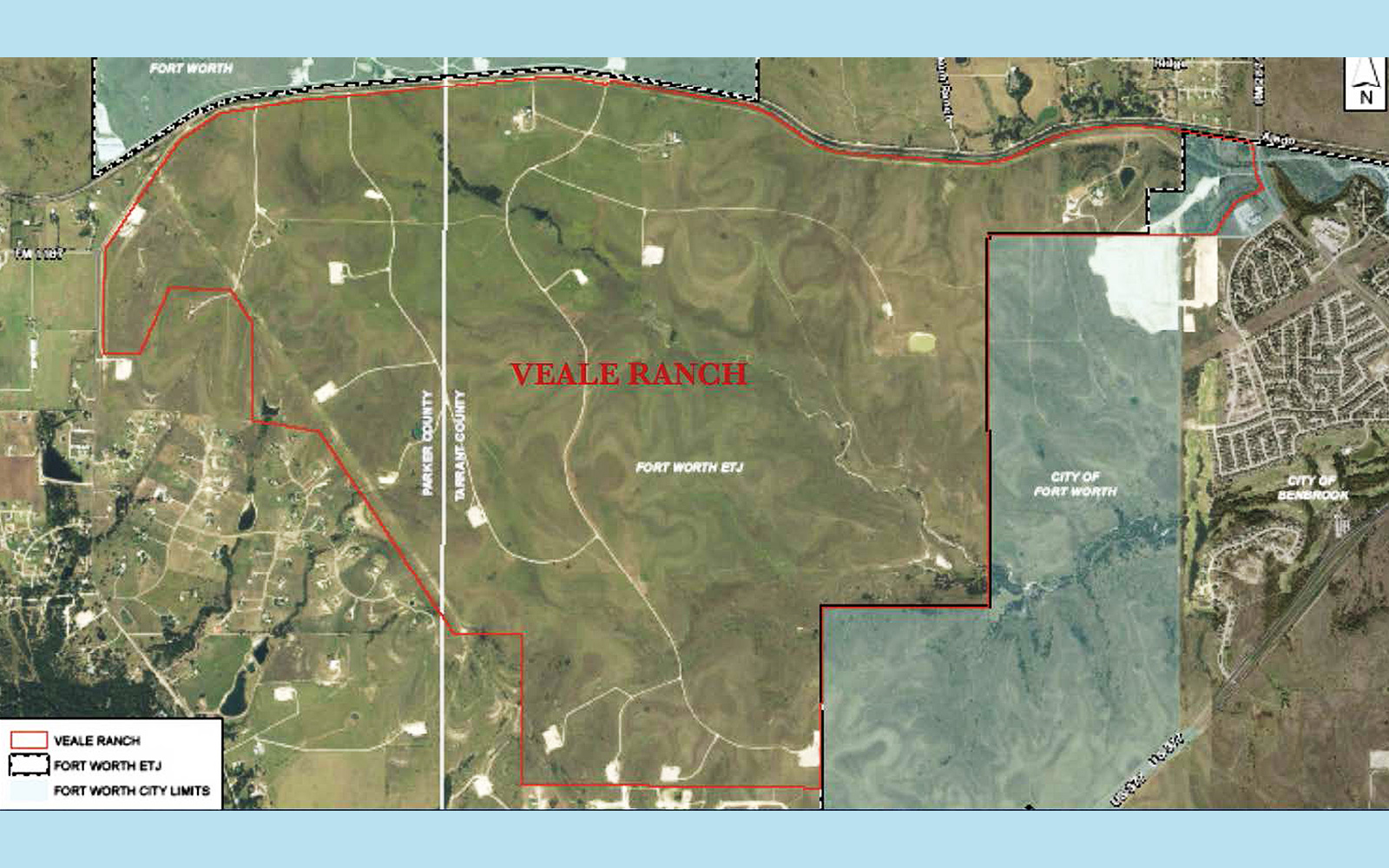

The City of Fort Worth is considering tax incentives to shape 5,200 acres that include the former Veale Ranch into a $3 billion development in Tarrant and Parker counties.

PMB Capital Investments owns the property, just west of Fort Worth. Commercial, residential and institutional development is planned in multiple phases spanning 50 years.

The Fort Worth City Council this week will consider creating a Tax Increment Reinvestment Zone that would contribute 65 percent of increased property taxes to the Veale Ranch TIF, the Dallas Business Journal reported. TIF, or tax increment financing, funds can be used for public improvements, such as sewer and storm drainage, streets and sidewalks, park or plaza spaces and affordable housing.

Dallas-based PMB has an agreement with Fort Worth to develop parcels known as Veale Ranch/Team Ranch, Rolling V South, Rockbrook and Ventana South, the outlet reported.

The development agreement calls for the creation of a Public Improvement District, or PID, a quasi-governmental taxing entity that can raise public funds for infrastructure costs.

The TIF and the PID could remain in effect for 25 to 30 years after the acreage is annexed to Fort Worth, the outlet reported.

Because the development would be enormous and expensive, the city is waiving certain provisions of its own PID and TIRZ policies, the outlet said.

The city could also issue bonds to cover some of the improvements. The bonds would be levied against each completed phase of the Veale Ranch PID.

Besides future bond funds and what’s in the development agreement, the city could choose to use existing TIF funds and other economic development devices for Veale Ranch.

Read more