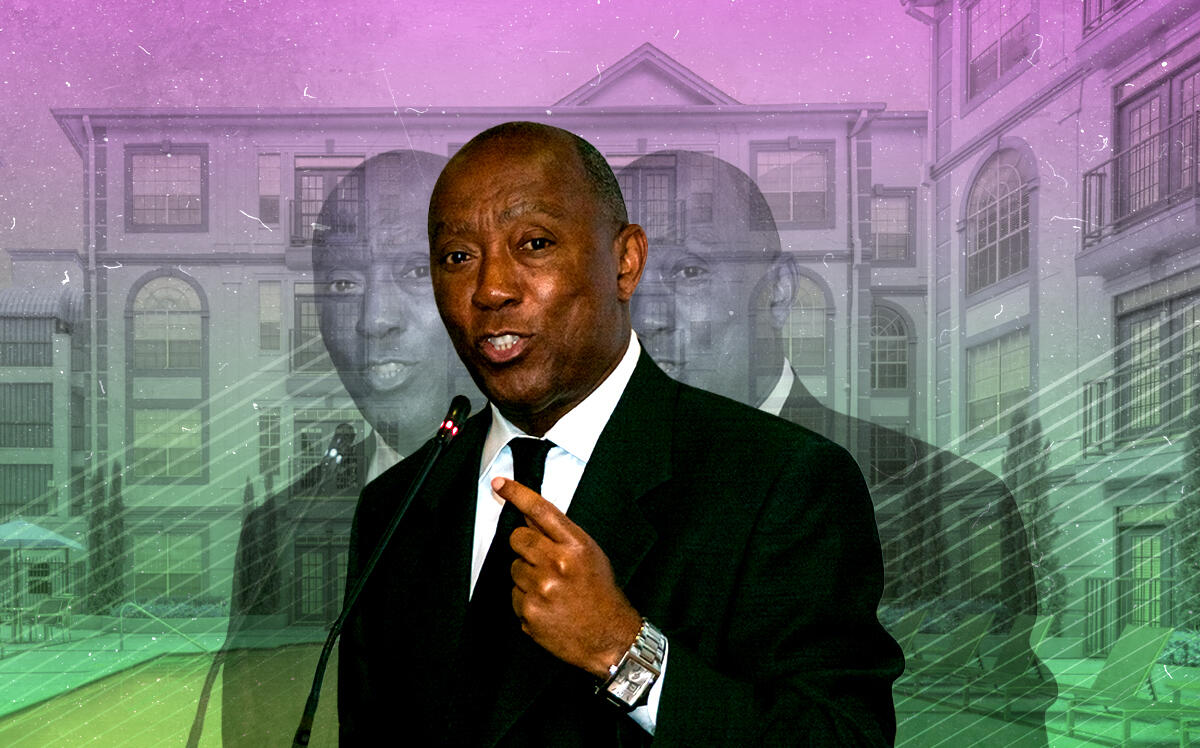

The Houston Housing Authority defied Mayor Sylvester Turner’s request to put a pause on tax breaks related to affordable housing.

On Tuesday, March 21, the HHA voted to move forward with 24 proposals that bring tax exemptions to select apartment complexes in exchange for affordable units, but Turner demanded the HHA not to exceed the 10 that were already agreed upon, the Houston Chronicle reported.

Fourteen of the 24 tax-break deals were given memorandums of understanding, meaning the HHA intends to follow through with the deals, but specific terms must be negotiated first. In January, Turner said he wanted to halt the various proposals in order to better understand the tradeoff, and he wrote a letter to HHA chairman LaRence B. Snowden a week before the vote, reaffirming his stance, the outlet reported.

“The priority at this point is to ensure that we establish and publish guidelines with criteria that is in the best interest of the city of Houston and its residents by ensuring housing affordability for those who need it most,” Turner wrote.

A state law passed in 2015 gave public facility corporations, such as local housing authorities, the right to create tax-break bills, which has led to a 13 percent increase of such deals, including the 10 that received final approval on Tuesday.

The HHA said its various tax-break agreements have led to 12,600 apartments with discounted rents, 5,000 being reserved for households making 60 percent or less of the city’s area median income. Of the 10 proposals approved recently, none of them appear to go beyond 80 percent of the area median income, which is considered affordable.

These discounted properties save roughly $1 million per year, according to HHA chief executive David A. Northern Sr. How the saved tax revenue affects others is at question, though.

The city already has a cap on the amount it can collect in property taxes, and the city typically meets that cap every year. Thus, municipal utility districts and less-wealthy school districts may take a hit as a result of less funding stemming from tax revenue.

–Quinn Donoghue

Read more