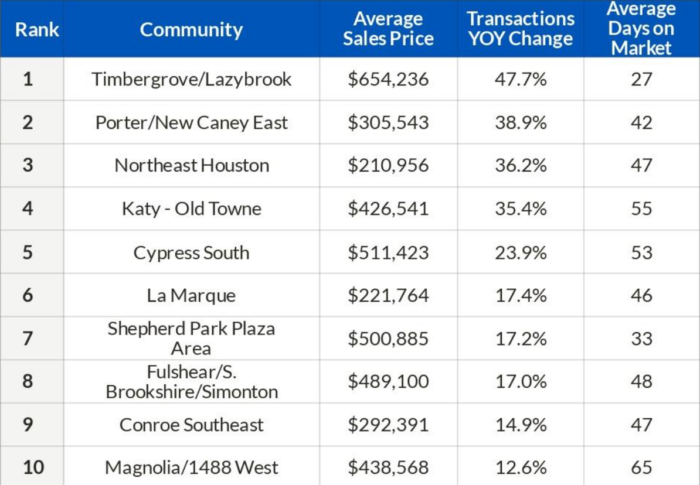

Houston’s shifting landscape is rocketing sales in a few of the city’s north and western submarkets.

Timbergrove/Lazybrook is the hottest community for home sales in Greater Houston. The submarket saw nearly a 50 percent increase in home purchases year-over-year in the second quarter, according to HAR.com.

The neighborhood lies within the Inner Loop, 10 miles northwest of downtown Houston in the Greater Heights. It has an average home price of $654,000, compared to the metro area’s $431,000 average, but it is one of the more affordable areas within the Inner Loop where Realtor.com estimates the median home price at about $639,000.

“There aren’t many neighborhoods in that price point that are inside the Loop where you can still get a decent-sized house that’s in good shape,” said Mark Fontenot of Martha Turner Sotheby’s, who lives in Oak Forest. “When my clients look here, it’s because it has a family neighborhood feel, which can be hard to find in the Loop, especially with a nice-sized yard.”

As interest rates have caused would-be homebuyers to opt for rentals, affordability in Timbergrove/Lazybrooks has made it an increasingly attractive option for those adamant on buying a home. Five out of the top 10 communities listed boast average home prices below the metro’s overall average.

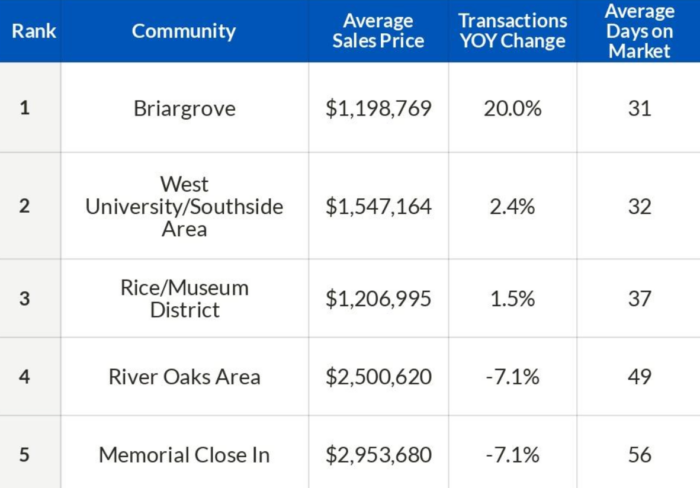

What’s hot in luxury?

Briargrove, near Uptown and West Oaks, topped HAR.com’s list of the most sought-after luxury communities. during the second quarter of 2023, drawing a 20 percent increase in transactions year-over-year.

The average home price in this enclave reached $1.2 million, the lowest average among the top five most desirable luxury areas.

“Youth” is the word most commonly associated with homebuyers in this upscale neighborhood.

It’s filled with “the children of Tanglewood and River Oaks” said Brian Spack of Martha Turner Sotheby’s International Realty.

Young professionals, first-time homebuyers and families with young kids are the predominant demographic that led to its explosive growth in the second quarter.

“Most come from the family money industry,” says Spack, who’s also a long-time Briargrove resident. “I always joke that you’re not really a Briargrove resident until you’re on your second home. I think for people who don’t have the budget for Tanglewood, Briargrove offers some of the same fashion of living. We have the same basic location as Tanglewood, but our homes are a lot more affordable.”

The luxury market performed better in the second quarter, with the three hottest neighborhoods logging net positive transactions year-over-year, a departure from the first quarter.

All but the top-performing luxury neighborhoods had net negative transactions year-over-year in the first quarter, and the “hottest” luxury communities were those least affected by a squeezing market.

Neighborhoods in the northern and western fringes of Houston are also garnering significant attention from buyers. Half of the hottest communities are north and west of Timbergrove and Lazybrook. Last year, for the first time, the metro’s population center moved out of the Inner Loop as it shifted northwest and toward the outlying suburbs.

Commercial real estate has already begun its exodus as the West Houston submarket has seen considerable gains in office, retail and industrial development.

Spring Branch will be the next Greater Houston neighborhood to glow up, Spack says. Its zip codes are 77055 and 77080.

“Those are going to top the list next year, because I’ve done more business this year, in that area, than I have collectively in my career,” he said. “That’s where everybody’s going. That’s where all the hot restaurants are going. That’s where the gentrification is happening. That’s going to be the next big, big thing.”

Read more