After surviving a proxy fight, Whitestone REIT denied yet another takeover attempt.

The Houston-based retail investor rebuffed an offer from David Bramble’s MCB Real Estate that would have taken Whitestone private for $14 per share. Bramble already owns 4.69 million of the company’s common shares, 9.4 percent of the class.

“The board believes that your indicated offer price does not represent a fair valuation,” Whitestone wrote to Bramble in a June 10 letter declining the offer.

Bramble’s offer represented a 17 percent premium over Whitestone’s 60-day weighted average share price of $12.01. In its proposal, Bramble’s firm attached a letter from Wells Fargo offering up to $800 million in debt financing to fund the deal, on top of an undisclosed equity commitment from MCB.

“We are keenly aware of the challenges facing the company, such as access to growth capital, and believe that these challenges can best be addressed as a private company with a well-capitalized sponsor,” Bramble wrote in the offer letter.

MCB, founded in 2007, manages $3 billion in assets, according to the letter. That includes some 6 million square feet in retail properties.

Whitestone’s denial comes on the heels of a proxy battle with Erez Asset Management, which held 1.3 percent of the company’s shares. Erez complained that Whitestone declined an attempted takeover by Fortress Investment Group last year, even though the proposed price would have been a “significant premium to the market price,” according to an Erez news release.

“We are not opposed to selling the company or exploring strategic alternatives if they lead to maximizing shareholder value,” Whitestone said in a release at the time. “But we also do not want to shortchange shareholders by running a hasty sale process at the wrong time.”

Shareholders re-elected Whitestone’s board last month, denying Erez’s two outside nominees.

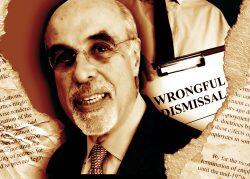

In 2022, the REIT fired then-CEO, James Mastandrea. He sued a year later, claiming he was wrongfully terminated because he was negotiating to sell the REIT.

Occupancy in Whitestone’s 50 shopping centers reached 93.6 percent in the first quarter. The centers are spread across Austin, DFW, Houston, San Antonio, Phoenix and Chicago. Meanwhile, average rents rose 7.2 percent from last year to $23.83.

Read more