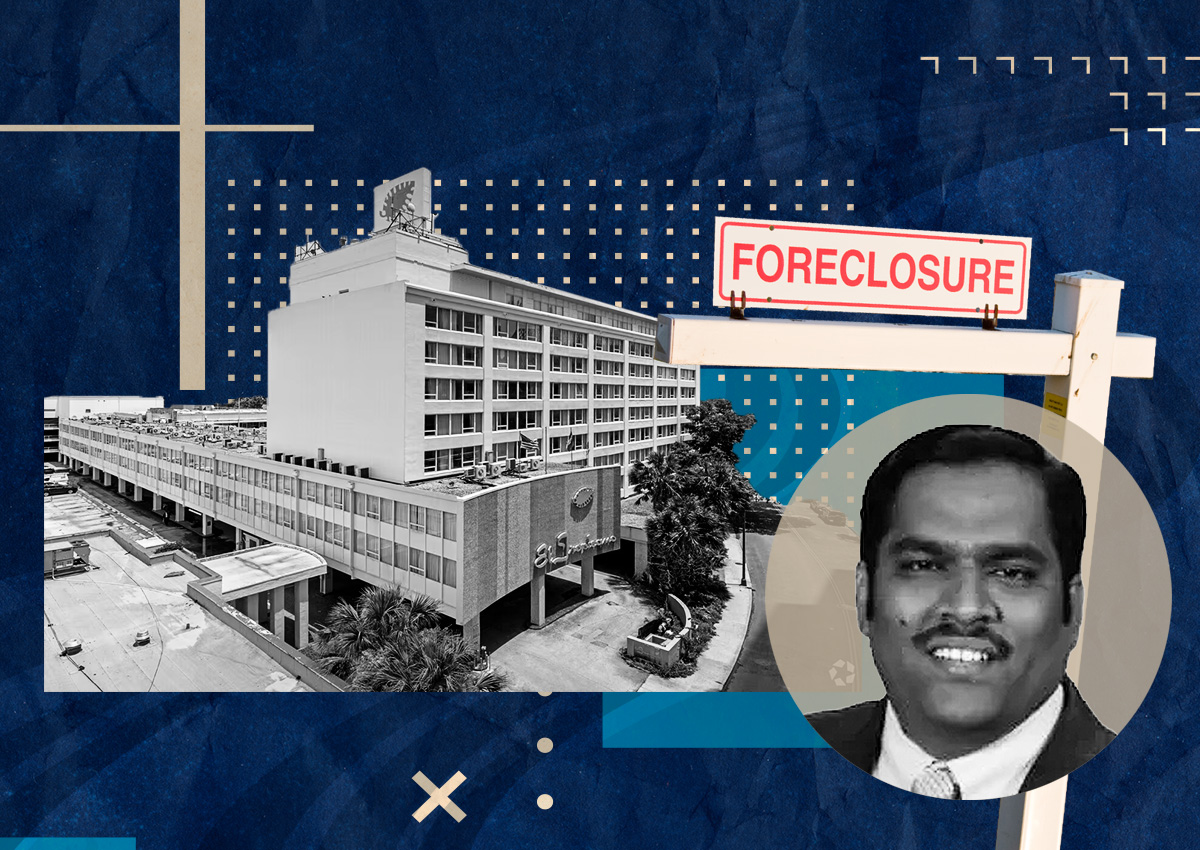

Foreclosure is looming over a San Antonio office building, marking the latest sign of distress in the Alamo City.

San Francisco-based RBL Real Estate has no plans to pay off its $15.3 million debt balance on the Alamo Plaza, located at 9601 McAllister Freeway near the San Antonio airport, when it comes due in October, the San Antonio Business Journal reported.

As RBL prepares to default on its loan, the firm is exploring two options to evade foreclosure: selling and refinancing. Both would be difficult to pull off given the beleaguered state of San Antonio’s office market, which has been pummeled by the remote-work era.

High office vacancy rates would make it tough to sell the 12-story McAllister Plaza. Unless a buyer has enough capital to perform an office-to-resi conversion or another type of redevelopment, most investors will likely steer clear of an office acquisition.

Refinancing the property would also be challenging amid high interest rates and a tight lending climate. Many banks view the office sector as a weak asset class and are unlikely to dish out a loan with favorable terms.

McAllister Plaza has some positive features, though. The 192,000-square-foot building has an occupancy rate of 91 percent, far better than the city average of roughly 84 percent. Moreover, net operating income was about $2.5 million in 2022, marking its best year ever, the outlet reported.

RBL, led by CEO Joe Blum, bought the building in 2007. It took out an $18 million loan from Citigroup in 2013, and the loan was later acquired by a CMBS trust arranged by Goldman Sachs Mortgage Securities Corporation. The mortgage was transferred to special servicer Rialto Capital in July.

Office distress is becoming increasingly apparent in the Alamo City. Last month, Brass Real Estate was more than 90 days delinquent on its $57 million loan tied to the Brass Professional Center at 4400 Piedras Drive.

In the multifamily realm, the Wyndhaven apartment complex, near Fort Sam Houston, recently went into foreclosure.

—Quinn Donoghue

Read more