Woodbranch Management lost this game of musical chairs.

After a lender repeatedly failed to sell two distressed office buildings in San Antonio’s Medical Center, a federal bankruptcy judge has ordered the landowner to take control of the distressed property.

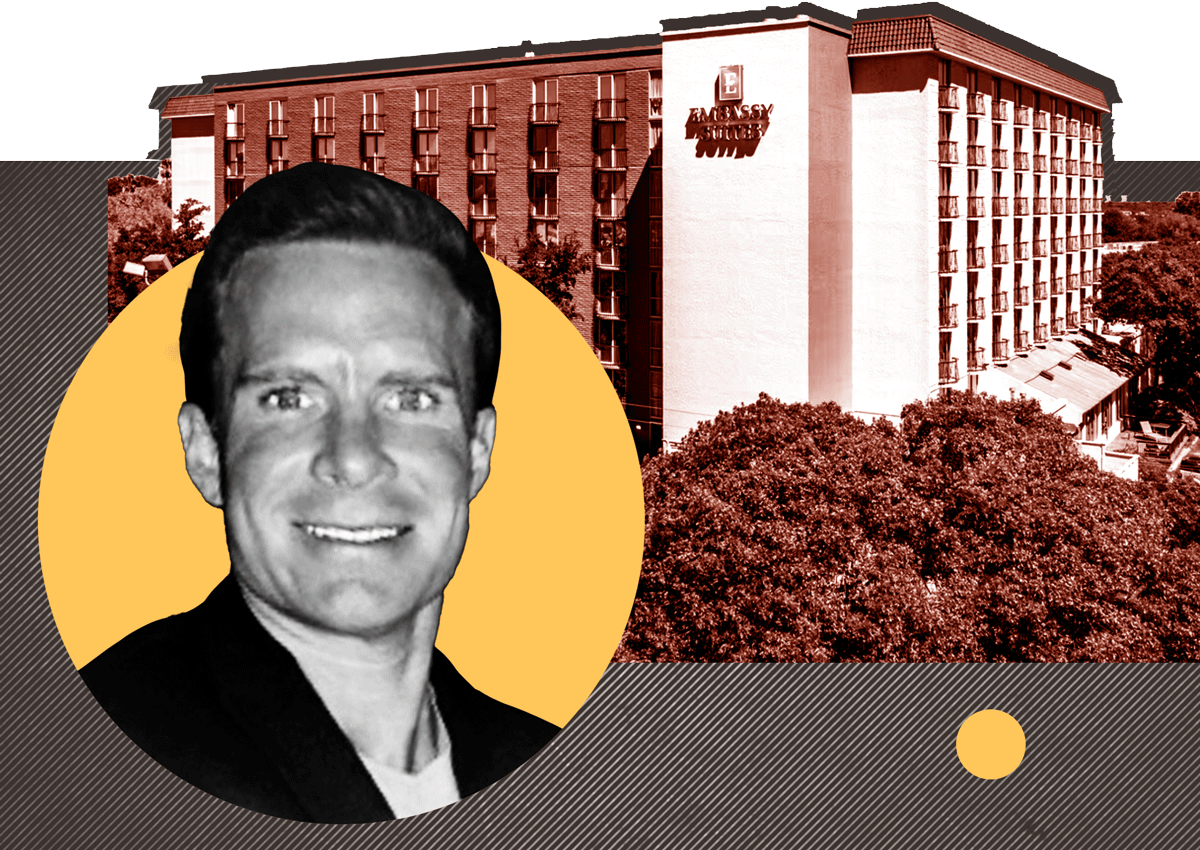

Houston-based Woodbranch is now the court-appointed owner of Highpoint Tower I and II at 8401 Datapoint Drive, the San Antonio Express-News reported. Woodbranch already owned the land beneath the buildings, and a lack of interested buyers has forced the firm to assume the site.

An LLC tied to Georgia-based Richmond Honan, defaulted on a $51 million loan from Capital One and filed for bankruptcy in August 2022. The Richmond Honan venture also owes roughly $1.4 million to specialty finance company First National Assets.

Capital One tried to sell the buildings three times but was unsuccessful, highlighting the historically low demand for office space amid pandemic-fueled remote work trends, which have caused vacancy rates to soar. Hiked interest rates and a tight lending climate have compounded office woes this year.

A buyer would have to pay at least $30 million for a sale of the Northwest Side property to go through, according to a sales procedure document filed earlier this year. Capital One does not intend to submit a credit bid to acquire the site itself.

“Despite months of marketing efforts, no viable third party bidder has appeared for a sale of the debtor’s interests under the ground lease and related assets,” attorney Robert Harris told the outlet.

Woodbranch’s lawyer, Jeff Carruth, said one bidder came forward with a $1.5 million cash offer for the property and pledged to cover approximately $2 million in property taxes.

The two buildings have a combined value of over $38 million, according to the Bexar Appraisal District. While there has been some improvement in rental income, with over $220,000 reported in the August monthly operating report, a year-to-date net income loss of $14.6 million remains, the outlet reported.

A motion to dismiss the bankruptcy case is scheduled to be heard in November, and the property is currently being marketed by Newmark.

—Quinn Donoghue

Read more