City National Plaza office complex in Downtown Los Angeles received a $550 million refinancing from Morgan Stanley and Goldman Sachs in late March, just as the CMBS market seized up in response to the coronavirus pandemic.

Two months later, as the market began to recover, a $330 million piece of that loan was included in a single-borrower transaction known as MSC 2020-CNP, while smaller pieces have been included in several other conduit deals.

Financial disclosures associated with the securitization reveal details about the finances of the massive two-tower property at a time of uncertainty for the office market in both Los Angeles and nationwide.

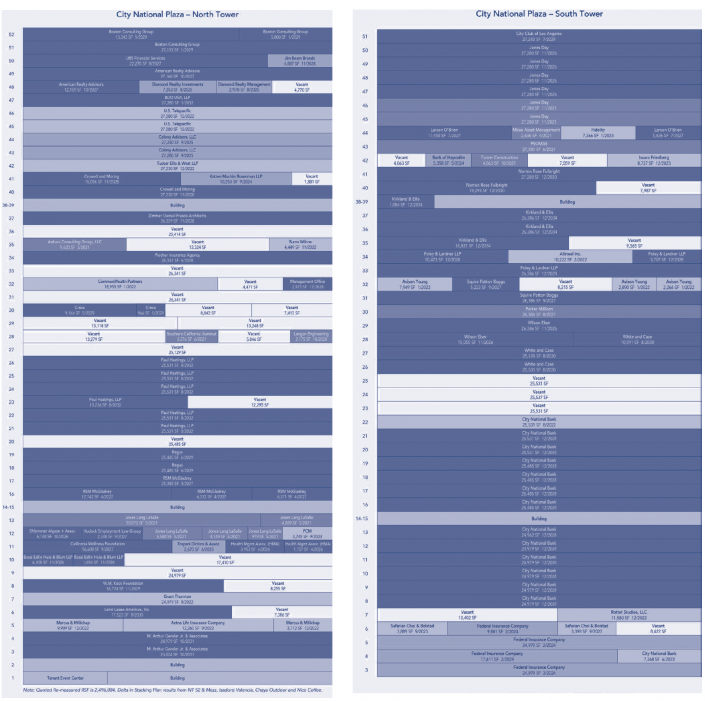

The complex has about 1.2 million square feet of office space and 123,000 square feet of retail, and was 81.4-percent leased as of March.

The largest tenant at the building is the complex’s namesake, City National Bank, which occupies a dozen floors in the south tower, accounting for 14 percent of the rentable space and 17 percent of the base rent. The top 10 tenants include four Am Law 200 law firms, with most tenants paying rent in the high $20s per square foot.

The priciest rent per square foot among large office tenants is paid by Boston Consulting Group, which pays $33.87 per square foot for the top two floors of the north tower. Meanwhile, law firm Jones Day pays just $23.79 a foot across six floors near the top of the south tower.

The property is owned by a joint venture of CommonWealth Partners and California Public Employees’ Retirement System. CalPERS, the country’s largest public pension fund, holds a 99.7-percent financial stake while a CommonWealth subsidiary manages the property. The venture acquired the property for $858 million in 2013.

Due to the coronavirus, all retail tenants at the complex were closed as of early May and most office tenants were working remotely. Law firm Paul Hastings, the second largest tenant, requested rent relief and a renegotiation of certain terms of its lease, as did nine other non-retail tenants representing 10.6 percent of rentable area and 13.6 percent of base rent.

The landlord collected 91.6 percent of base rent due for the month of April by the end of that month, and loan payments have remained current.

Other notable tenants at the property include brokerages JLL and Marcus Millichap, construction firms Lendlease and Turner Construction, and flexible office space provider Regus.

Office leasing activity in Los Angeles has slowed down dramatically as a result of the coronavirus pandemic, and market uncertainty has also put pressure on property valuations. The nearby US Bank Tower is now in contract to be acquired by New York’s Silverstein Properties for $430 million, a 34-percent price cut from the property’s pre-coronavirus book value.

More tenant rent deep dives:

Contact Kevin Sun at ks@therealdeal.com