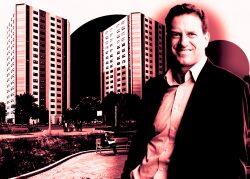

New Jersey-based KABR Group has expanded its New Jersey portfolio, picking up a mid-rise luxury apartment building in Bayonne.

The private equity real estate firm purchased “19 East” for $49.6 million from joint sellers Ingerman Group and Verde Capital. KABR bought the 138-unit building in part with a $35 million fixed-rate loan with Kearny Bank.

Constructed in 2018, the six-story apartment building, located at 19 East 19th Street, consists of 24 studios, 74 one-bedroom units, and 40 two-bedrooms equipped with island and breakfast bars, quartz countertops and washers and dryers.

The property also features a fitness center, garage parking, a game room, two furnished outdoor terraces and business centers on every floor.

Read more

The building is located in Bayonne’s commercial district and a block away from the Hudson-Bergen Light Rail station at 22nd Street.

Ken Pasternak, CEO and chairman of KABR Group, touted 19 East in a statement as “a new building with best-in-class amenities” in a “rapidly evolving millennial neighborhood.”

A JLL team including Steven Klein and Matthew Pizzolato represented the buyer, and another JLL team including Jose Cruz and Michael Oliver represented the seller.

Cruz, in a statement, called the property “one of the first institutional quality assets to trade in Bayonne” and said it drew interest from regional and national bidders.

KABR teamed up with FCA-Orbita Group last month to purchase interconnected five- and six-story buildings spanning 620,000 square feet on Jamaica Avenue in Queens for $73.5 million.