Jeffrey Katz’s Sherwood Equities is cashing in a piece of the hot industrial market on Long Island, selling a nine-property portfolio to Blake Silverman’s firm.

Sherwood sold the 372,000-square-foot portfolio to the Silverman Group for $76 million, the Commercial Observer reported. The deal works out to about $204 per square foot for the properties, which are spread across Melville and Farmingdale.

Katz and his father, Ira, spent $5 million developing the portfolio in the 1970s. The Katz family has owned and operated the portfolio since then, frequently hitting occupancy rates above 90 percent. Occupancy across the portfolio stands at 98 percent and the average rent is $8.10 per square foot, about 50 percent below market value, presenting a value-add opportunity to the new owner.

The buildings are minutes from the Long Island Expressway, providing for access across the region. About 6 million consumers live less than an hour from at least one of the facilities.

A Cushman & Wakefield team including Adam Spies and Gary Gabriel arranged the transaction.

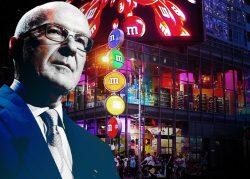

Sherwood has increasingly looked to diversify its investment and lending in the city. The firm was founded in 1949 by Ira and Howard Katz and now has a portfolio including office, retail, multifamily and hospitality. Jeffrey has played key roles in reshaping Times Square, Hudson Yards and the High Line.

Read more

Last year, Sherwood sold the retail space at 1600 Broadway to Paramount Group and an unnamed partner for $190 million. The three-story space is home to M&M’s World, which is locked into a 25,000-square-foot lease through 2036.

Silverman is a real estate developer and manager based in New Jersey. The company’s portfolio includes 25 million square feet across various sectors and it has 15 million square feet of industrial space under development.

The tri-state industrial real estate market remained hot in the first quarter, but economic headwinds and a pullback by Amazon have analysts predicting a slowdown in investment sales. Nevertheless, Long Island saw a 77 percent increase in investment volume during the quarter, according to CBRE.

— Holden Walter-Warner