The gateway to the Gateway City is about to get a makeover.

Newark’s Gateway Center opened in 1972 promising urban renewal for a blighted city. Encompassing a mall, hotel and office space, it was built with the goal of keeping employees and shoppers on the premises. But today, the complex’s darker spaces are not integrated with each other or the streetscape, and the outdoor areas don’t get much use.

As workplaces have evolved to offer co-working spaces, high-tech amenities and a myriad of dining options, buildings like those in the Gateway Center are well overdue for a makeover. That’s just what Onyx Equities has in mind.

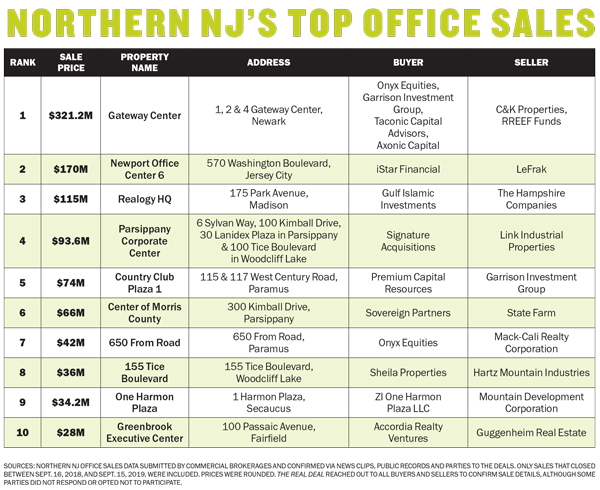

Along with a group of four other investors, the New Jersey-based company acquired 1.8 million square feet at One, Two and Four Gateway for $321.2 million in December 2018. It was the biggest office trade in Northern New Jersey over the last 12 months, according to an analysis by The Real Deal.

Now Onyx and its partners — Garrison Investment Group, Taconic Capital Advisors, Prudential Financial and Axonic Capital — are planning on pouring capital into the buildings to upgrade the complex inside and out, according to John Saraceno, co-founder and managing principal of Onyx, which is in charge of the planning and construction.

Starting in late 2019 or early 2020, the company plans to revamp the outdoor spaces and concourse, adding street-level retail and restaurants. It will also upgrade the buildings’ interiors, from the bathrooms to the common areas, as well as the buildings’ technology systems.

Saraceno predicts that the makeover will help employers bring in a talented workforce.

“They want to be able to attract not just today’s employee, but the next 15 years of employees,” he said.

In fact, Onyx has so much confidence in the property that it moved its own capital markets, asset management and construction divisions to One Gateway Center in July. Saraceno said the company has already attracted new talent that it wouldn’t have been able to get while still based in Rutherford.

“If you’re trying to grow a firm, you have to attract younger people and give them what they want in a workplace,” he said, adding that he would have never thought of investing in Newark 10 years ago. But the revitalization efforts that have already happened in the city, as well as its convenient location, helped to persuade him.

“If you’re trying to grow a firm, you have to attract younger people and give them what they want in a workplace,” he said, adding that he would have never thought of investing in Newark 10 years ago. But the revitalization efforts that have already happened in the city, as well as its convenient location, helped to persuade him.

Companies continue to be drawn to New Jersey as a cheaper alternative to Manhattan, where the average asking rent for Class A office space in the year’s third quarter was $79.80 per square foot, according to a report by Cushman & Wakefield. In contrast, the average rent for Class A space in northern New Jersey was $36.28 per square foot during the same time period.

Brand-new or renovated office space, especially on the New Jersey waterfront, is nearly fully occupied, according to real estate professionals. Some also say they have been seeing more offshore investment coming to New Jersey’s office properties, especially from the Middle East.

For example, Gulf Islamic Investments, with offices in Dubai and Abu Dhabi, purchased the Realogy HQ in Madison for $115 million. It was the third-priciest office sale in northern New Jersey during the period between Sept. 16, 2018, and Sept. 15, 2019, according to the The Real Deal analysis. The buyers were looking for strong cash flow and preferred buildings with a single tenant that would reliably come up with the rent.

“We’ve seen some real interest and large transactions being completed over the last 24 to 36 months,” said Jose Cruz, a senior managing director at Jones Lang LaSalle Americas. “Buyers range from locals to institutional investors to the larger private funds as well.”

Part of the reason for the heightened interest in New Jersey office space is price discovery on office spaces, he said. Buyers know more about how much they should pay than they did five years ago. It also doesn’t hurt that office properties often offer higher yields than multifamily or industrial, he said.

But the Garden State still suffers from a glut of supply left over from the 1980s and 1990s. These complexes, especially in the suburbs, fail to draw much interest since they aren’t near transit hubs and don’t offer workers much outside their cubicle walls, brokers said.

Some of those outdated office complexes are even being demolished or repurposed for industrial or other uses. For example, Onyx bought a 160,000-square-foot office building two years ago, knocked it down and replaced it with a 92,000-square-foot industrial space. Other properties, like the Gateway Center, are undergoing significant upgrades including enhanced dining options, outdoor space and co-working areas.

Tech and today’s tenants

High-tech amenities are perhaps the most important draw for many office tenants. It was one of the main areas that Alfred Sanzari Enterprises focused on when the company overhauled its 670,000-square-foot Glenpointe office campus in Teaneck. The multimillion-dollar project included adding a new outdoor space, renovating the fitness center and converting unused common areas to co-working spaces with better seating, lighting and charging stations.

Glenpointe also brought in Better Spaces, a tenant amenity service. Through its app, tenants have access to yoga and meditation classes, workshops and special events like Ping-Pong tournaments and holiday parties.

Better Spaces has a physical presence in the atrium of the office complex, and the app notifies employees of events and gets their feedback on what’s working and what’s not.

“The entire experience is app-driven, so it allows the tenants a high degree of control over the programming while also providing our team with invaluable data on which experiences resonate with our tenants,” said Ryan Sanzari, COO of Alfred Sanzari Enterprises.

Sanzari also noted that the complex now uses Fooda, a pop-up food service that brings top local restaurants directly to the campus so tenants can enjoy new lunch options from a different restaurant Monday through Friday. Fooda also uses data to help provide tenants with more from the restaurants they enjoy most.

Of course, a space today is only as good as its high-speed internet connection, so the complex has updated all the wiring for better access.

Although the Gateway Center is just getting its renovations off the ground, Onyx Equities announced in October that the Gateway buildings are now equipped with the first deployments of Wi-Fi 6, the next generation of Wi-Fi. Newark is one of three locations in the United States offering this type of 10-gigabit connectivity.

Each access point deployed has a dedicated multi-gigabit internet feed, and tenants in all three Gateway buildings can now connect to Newark Fiber by GigXero, the fastest internet in the area.

The year’s top deals

The Gateway sale was one of three deals that closed for more than $100 million, according to TRD’s data. The deals ranked second and third took place in March and June of this year, and 2019 has already seen far more sales than last year.

“We’re already double where we were last year,” according to David W. Bernhaut, executive vice chairman at Cushman & Wakefield’s Metropolitan Area Capital Markets Group. “And a big part of that is due to some of these larger transactions and these $100 million-plus deals.”

So far in 2019, there have been 58 deals that collectively total $3.1 billion in sales volume, including closings and properties under contract, he said. That’s up from 35 office building sales greater than 100,000 square feet at the same point in 2018, for a total of $1.5 billion in sales.

Cushman & Wakefield represented the LeFrak Organization in its sale of the 350,000-square-foot Newport Office Center 6 in Jersey City. New York City-based iStar Financial bought the property for $170 million, making it the second most expensive on TRD’s list of the top 10 office trades over the last year. LeFrak is also looking to sell another building at the Newport complex, the 22-story Newport Center 4, which it’s currently marketing for $400 million, according to reports.

LeFrak’s Newport developments are part of a master plan it’s been developing for decades. Although the company did not respond to requests for comment about why it is divesting from some office properties, it opened the 41-story rental building Ellipse in the city in 2017.

Backing off of office space

Despite the uptick in sales volume, not everyone is bullish on the office market in northern New Jersey. The Hampshire Companies, a real estate investment firm based in Morristown, is getting out of the office sector altogether and reinvesting in multifamily, industrial and self-storage facilities. It sold one of its last remaining office properties, the aforementioned Madison headquarters of the real estate company Realogy, in June to an investment company based in the Middle East, Gulf Islamic Investments.

“The investment strategies they’re deploying are different,” said James Hanson, the president and CEO of Hampshire. “They are looking for cash flow on their equity and single-tenant deals. They’re not really looking for appreciation, per se. They’re looking for an alternative to something that can produce strong cash returns.”

Hanson said Hampshire only has one office property left and is looking to sell that as well. That’s because much of the existing office stock in New Jersey is no longer appealing to tenants, he said.

“Most of it was built either in the 1980s and ’90s, and you can’t really call it Class A anymore,” Hanson said. “There’s still enough demand that if you build it in a brand-new facility, you can find the right tenants. But people don’t want to be in the traditional office parks.”

175 Park Avenue in Madison

Mack-Cali Realty Corporation is also finishing the process of selling off suburban office space in favor of multifamily investments. That includes the No. 7 deal on the list, the $42 million sale of 650 From Road in Paramus to Onyx. The sale was part of the second phase of a Mack-Cali portfolio sell-off brokered by JLL, according to Cruz, who was part of the capital markets team that represented the seller on the deal.

Saraceno noted that some pockets of suburban office space are holding their own, with Bergen and Morris counties being two of the more dynamic markets.

Bergen County had the highest number of deals on TRD’s list, including the $74 million sale of Country Club Plaza 1 and Onyx’s purchase of 650 From Road, both in Paramus. These were the fifth and seventh most expensive trades, respectively, with 155 Tice Boulevard in Woodcliff Lake coming in at No. 8.

The deal for the Center of Morris County for $66 million ranked No. 6 on TRD’s list. State Farm Insurance sold the 400,000-square-foot space in Parsippany to Sovereign Partners in March, with Holliday Fenoglio Fowler acting as the broker for State Farm, which was advised by Transwestern Investment Group. HFF also represented the buyer.

The fourth most expensive office deal was the Parsippany Corporate Center. The three properties in Parsippany and another in Woodcliff Lake, sold for $93.6 million in April, according to TRD’s data. Signature Acquisitions purchased the properties from Link Industrial Properties.

“We’ve been enormously successful in Bergen the last few years,” Saraceno said. “I’m not exactly sure why, but I’m not giving back any of the tenants.”