The developer behind Westchester County’s largest hotel project in 20 years, D’Wayne Prieto, is naturally optimistic about growth in the suburbs. The principal of Dobbs Ferry-based Ward Capital Management has a clear vision — and clear opinions — on why now is the right time for his two projects: a 225-key TRYP by Wyndham hotel in New Rochelle’s rapidly revitalizing downtown, and a smaller TRYP property on Long Island, on the Bayville waterfront.

“A lot of the hotels [in the New York City suburbs] are stale, they are cookie-cutter. Staying there feels like a chore,” Prieto declared. “These areas are underserved for aspirational hotel product. We’re building something that is extremely exciting.”

The New Rochelle TRYP — a fully financed $77 million project, which was approved by New Rochelle officials in July — includes enticing features like a rooftop restaurant and deck with hydro pool, trendy workout equipment from the Mirror in the rooms and a swanky lobby lounge area. However, Prieto said, “this is not the W or the Ritz-Carlton. It’s fancy, flashy and hip, but it’s for the masses; the average Joe can stay here.”

Prieto is focused on creating conditions that keep the clients coming: Both properties are limited-service hotels with attached event centers. The Bayville project (a renovation of the Tides Motor Inn, which will yield 80 rooms total) includes a large waterfront catering facility. The New Rochelle TRYP will have a 34,000-square-foot event space. Rooms there are also a smart mix: 75 extended-stay options and 150 regular rooms. “It allows us to curtail our risk,” Prieto explained.

These projects are not the only ones making a splash in the ’burbs. The tony town of Montclair, New Jersey, saw the recent debut of a 32-key luxury boutique hotel, the George, developed by makeup mogul Bobbi Brown and her husband, Steven Plofker, and Marriott’s 159-room MC Hotel. On Long Island, new hotel developments in Manhasset, Syosset, and Smithtown are all on the books.

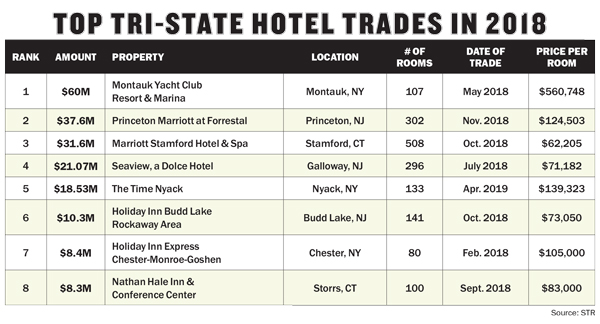

And hotels are still trading for lofty sums. The biggest hotel transaction in the region over the last year was the $60 million sale of the Montauk Yacht Club Resort & Marina, according to information provided by hotel analytics firm STR (see chart). The property has become a part of the Gurney’s Resorts brand.

And hotels are still trading for lofty sums. The biggest hotel transaction in the region over the last year was the $60 million sale of the Montauk Yacht Club Resort & Marina, according to information provided by hotel analytics firm STR (see chart). The property has become a part of the Gurney’s Resorts brand.

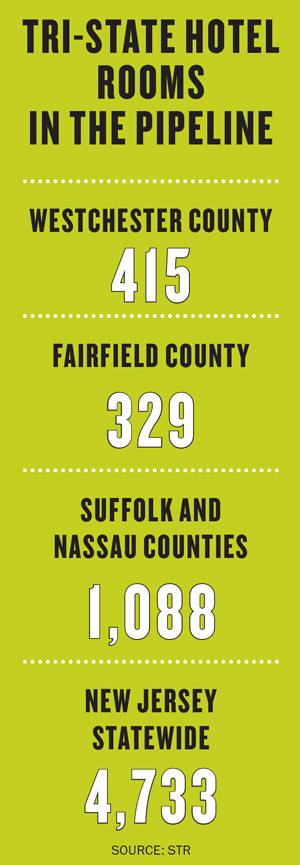

The pipeline for new hotel rooms in the suburban New York City market is also robust (see sidebar), but the overall outlook for success is not necessarily rosy.

A tough prognosis

High construction costs, a lack of suitable project sites and limited community support for development are the major impediments facing suburban hotel developers, according to Bradley Burwell, senior vice president for hotel brokerage and investment sales at CBRE Hotels.

“It is notoriously difficult to develop in many of these suburbs due to local pushback and tough municipal governments,” he explained. Despite frequent NIMBY concerns, Burwell feels that because “debt is inexpensive and equity capital is abundant,” now is a smart time for investment in suburban hotel properties.

“Construction costs are up due to both labor and material costs increasing over the last two years, but that will likely not come down much, so most developers are not waiting if they are ready to go,” he added.

Existing hotels in the region are contending not only with these typical challenges associated with being in New York City’s backyard, but also with forces disrupting the industry at large.

“We’re doing okay, but we’re not seeing the 2-3 percent increases year over year that we would normally see,” reported Sean Meade, president of the Westchester Hotel Association, who points a finger at least partly at the presence of Airbnb, which has added some 10,000 rooms to the lodging pool in the lower Hudson Valley, according to data from the New York State Hospitality & Tourism Association. “We used to compete against each other, but our main competitors aren’t hotels anymore,” he added.

Another drag on hotel outlook in the NYC suburbs has to do with a surge in supply of hotel rooms in Manhattan and the other boroughs. In 2018, 17 new hotels opened with a total of roughly 3,800 rooms added to the city’s supply, according to NYC & Company.

“In years past, it was harder to find hotel rooms in the city, so the suburbs used to get a ton of business from overflow. That compression is gone. It’s much easier to find available, affordable hotels in Manhattan now, so that’s been a challenge,” Meade explained.

Data from STR bears out Meade’s point about an overall hit to demand: Occupancy rates in Westchester for the first six months of 2019, for example, show a 1.7 percent dip compared to the same period in 2018, while RevPAR (revenue per available room) is down 3.2 percent. The numbers game is similar throughout the NYC suburban area, with most markets posting declines.

“When you boil it down, demand is weak to flat” throughout the region, said Bobby Bowers of STR, who noted that the trend is in line with nationwide numbers. “In general, hotel performance has been pretty sluggish throughout the U.S.”

Interestingly, while Long Island currently posts one of the healthiest occupancy rates in the region, at 71.3 percent, the projection for the next few years is far from stellar, according to the May 2019 Quarterly Hotel Monitor from real estate sales platform Ten-X Commercial. Placing Long Island as one of its top three “sell markets,” the report predicted declines in occupancy (to 70.6 percent) for 2019, with room rates (to $143.83) and RevPar (to $102.10) dropping by 2020.

“RevPAR on Long Island is performing well right now, but room rates are at a peak and they don’t have much more to run,” the report’s author, Matthew Schreck, a senior quantitative strategist for Ten-X Commercial, told the Long Island Business Times.

Reasons to be cheerful

Bright spots are apparent across the New York City suburban region — often in specific niches. In Fairfield County, for instance, the extended-stay market is going strong, according to Ginny Kozlowski, Connecticut Lodging Association executive director.

“The Central Connecticut region has about 20 hotels in the pipeline and a lot of extended stay, as Connecticut has been underserved in that market,” she said. Driving the need is an increase in contract-based employment in the region, particularly in the health care sector, Kozlowski explained. Marriott is making a solid play in this realm, opening Residence Inn extended-stay properties in downtown Stamford in 2018 (surprisingly, that city’s first extended-stay hotel) and in South Norwalk this past May.

“When it comes to product, ‘lifestyle’ brands are what developers and investors are focusing on,” added Burwell. “The ones that retain the most value are affiliated with Hilton, Marriott or IHG. A good example of a brand that is doing very well is AC, one of Marriott’s new brands. Developers and investors alike love them.” (AC properties are in the pipeline in Syosset, Long Island, and Jersey City, Morristown, and Bridgewater in New Jersey, according to STR.)

Independent boutique hotels also seem to be having a moment in upscale Big Apple backyards, like Montclair, where Brown and Plofker own the George, a design-centric property that opened in April 2018. Plofker reports that occupancy has been strong (for a week in early August, close to 90 percent, with rates ranging from $250 to $450) and that demand is coming from all segments: “leisure travelers, people [looking for access] for Montclair University, even because of weather problems at the airport. We’re getting guests from further away than I anticipated,” he said.

The town, and the unique vibe of the property itself — a historic inn with bold, modern interiors thanks to Brown’s creative direction and brand partnerships with hip names like Casper mattresses, SMEG appliances and One Kings Lane furnishings, among others — are the draw, according to Plofker. “Montclair is active, increasingly culturally busy, and there is a lot going on. We’re delivering a unique experience, and guests seem to be happy with it,” he said.

Overall, however, established chains — in some cases, the “stale, cookie-cutter” product Ward Capital Management’s Prieto is battling against — are the most prevalent players in the region. The list of pipeline projects in Westchester, Fairfield, Long Island and New Jersey is dominated by familiar brands: Hilton Garden Inn, Holiday Inn Express, Hampton Inn and SpringHill Suites, among others.

As always, proximity to Manhattan remains a selling point for current and would-be suburban hoteliers. Jersey City, for instance, has seen renewed vigor in its hotel sector, with opened-since-2017 properties including a Hyatt House, a Residence Inn by Marriott and a Holiday Inn Express & Suites. Hospitality expert Kim Lindell, a vice president with HVS Philadelphia, noted in an April 2019 HVS Market Pulse report that “much of the new development in Jersey City is clustered in the Downtown and Journal Square districts, which are proximate to transit hubs.” A surge in residential and commercial growth in Jersey City suggests that the reputation of the city is improving, she wrote, adding that “continued demand growth should bode well for area hotels.”

Development overall has been high in the region — the New York metro market has led the U.S. in hotel construction for the last four or five years, accounting for around 10 percent of hotel construction activity for the country as a whole, according to Bowers of STR — and that enthusiasm spreads. It doesn’t shock Bowers that so many projects are underway and in the pipeline in the region despite somewhat iffy hotel performance.

“It’s always the case where if you’re a developer and you can get money for a hotel project, it’s going to be done,” he noted. “If [some entity] is funding a project, they must believe in the development. They may think existing supply base is not what it should be in order to remain competitive, or that the project is simply in a great location that makes sense.”

Overall, change may be the only constant for the hotel industry in the bridge-and-tunnel region surrounding New York City. Deep pockets and strategic planning will likely pay off for developers, but challenges remain in keeping up with shifts in consumer behavior and regional economic forces.

“Everyone in our industry is adapting to an ever-changing environment. Consumers are changing their habits; the corporate meetings market has changed; and alternative lodging options continue to grow,” noted Kozlowski of the Connecticut Lodging Association. “Consumer confidence is high, which helps on leisure side; but we need business confidence as well. We’d all like to grow a bigger pie.”