Trending

Manhattan rents rise, with room to go higher

The Manhattan apartment rental market has been heating up for months, and

second-quarter market reports released today by residential brokerages Citi

Habitats and Prudential Douglas Elliman show skyrocketing rents. Now, the question is how long the rent increases will continue.

The Citi Habitats report, which covers all transactions brokered by the firm in the second quarter and takes concessions into account, shows a year-over-year increase in price of about 10 percent for Manhattan apartments. The

average rent for a one-bedroom apartment in Manhattan was $2,672 and two-bedroom units

averaged $3,757 per month, up 9.2 percent and 10.8 percent, respectively, from the second

quarter of 2010. But three-bedroom apartments experienced the largest price

increase over last year — 11.3 percent — and now rent for $4,985 on average.

The most expensive area was the West Village where one-bedroom rents reached $3,457, followed by Soho and Tribeca where one-bedrooms netted $3,454 on average. The least expensive areas were Upper Manhattan and the Upper East Side, where rents averaged $2,621 for a one-bedroom apartment.

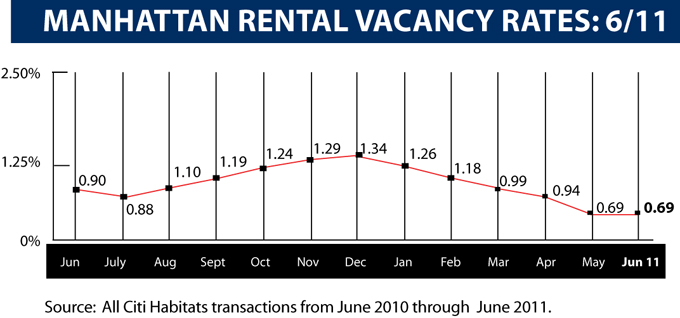

Meanwhile, the borough’s vacancy rate was 0.72 percent for the quarter, the lowest

rate since the firm began tracking the statistic in 2002. Last quarter’s vacancy rate

was 1.08 percent, and the rate stood at 0.97 during the same period a year ago.

“Looking at the numbers, I am surprised at how fast the vacancy rate came down and

prices went up,” said Gary Malin, president of Citi Habitats. Malin attributed this, in part, to a lack of new rental inventory, and

New York’s relative immunity from the high unemployment rate because of the

diversity of jobs available in the city.

Most of that rapid increase occurred in April. Compared to

the first quarter of 2011, rents have increased by about 5 percent across all units, according to the Citi

Habitats report. Most of those increases came in April when prices for studios

and bedrooms jumped 3 and 4 percent from their March figures. Since

then, rents have shown modest month-to-month growths of 1 percent or less.

“Owners can’t continue raising prices at such a crazy pace every month,” Malin said. He added that “you’ll see

another two months of price appreciation, for sure,” but by the time the busy spring

and summer season ends, prices will flatten. “We have to see what happens with

unemployment and the economy as a whole,” he said, noting rumors of impending

layoffs on Wall Street.

But Jonathan Miller, the president of appraisal firm Miller Samuel and the preparer

of Elliman’s report, believes prices still have a long way to rise before they peak.

According to Elliman’s second-quarter report, which covers sales by all firms thanks to data from the Real Estate Board of New York, the average rental unit in Manhattan costs $3,455 per month when

taking landlord concessions into account.

But adjusted for inflation the 10-year peak rent was $4,973, achieved in the fourth-quarter of 2006, and rents are still 39 percent below that level.

Miller said he believes rental demand has been spurred by potential buyers who opt to

rent due to an inability to obtain financing for a purchase. And he doesn’t see that

situation changing in the near future.

“While rents are rising at a respectable pace, we’re not at some unattainable height,”

he said. “There’s still a lot of wiggle room for upward increases.”

Most of the increases come from

a “complete collapse” in the number of landlord concessions, according to Miller. Last year at

this time, 60 percent of all new leases included some kind of landlord concession,

and even as recently as the first quarter of 2011, 36.8 percent of rentals included

concessions. In the second quarter of 2011 that figure came all the way down to 3.4

percent.

The number of new rentals rose 28.6 percent from last quarter and 51.5 percent

year-over-year to 8,572, according to Elliman. Miller and Malin both

attributed that to rising rents and fewer concessions, which led tenants to seek better deals.