Source: PropertyShark

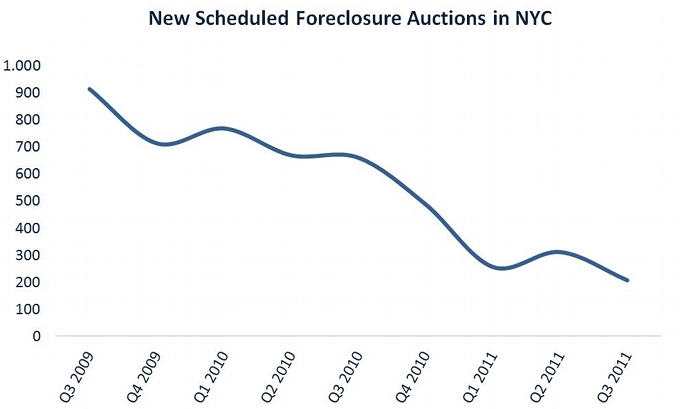

New foreclosure auctions in New York City plummeted during the third quarter, according to a PropertyShark.com report released today, but that’s far from a sign of an improvement in the housing market.

Just 207 new foreclosures were filed in the third quarter, down 33 percent from the 311 filed in the second quarter, and down 69 percent from the 659 new filings in the third quarter of 2010. About half the new foreclosures were filed on co-ops.

Queens led all boroughs with 82 foreclosures, or 39 percent of the city’s foreclosures. However, the number was still 28 percent less than it was last quarter, and 79 percent below the figure recorded in the prior year quarter.

In Manhattan and Brooklyn the quarter-over-quarter decrease was 45 percent, while Bronx saw a 26 percent decline. Staten Island foreclosures remained constant.

However, PropertyShark said the decreases were not necessarily due to an improved market. Instead, they were likely caused by the increased pressure on banks and lenders to pay close attention to the paperwork involved in foreclosure filings, thereby slowing the process.

“We believe the drop is due to increased legal pressure on the banks by the state and federal governments,” said PropertyShark founder Matthew Haines. “As we enter a new recession, we expect homeowners to continue to have trouble making payments on mortgages that continue to far exceed the value of the underlying houses.” — Adam Fusfeld