Farzin Parang interpreted Brandon Johnson’s victory speech in Chicago’s mayoral race as his invitation to the negotiating table.

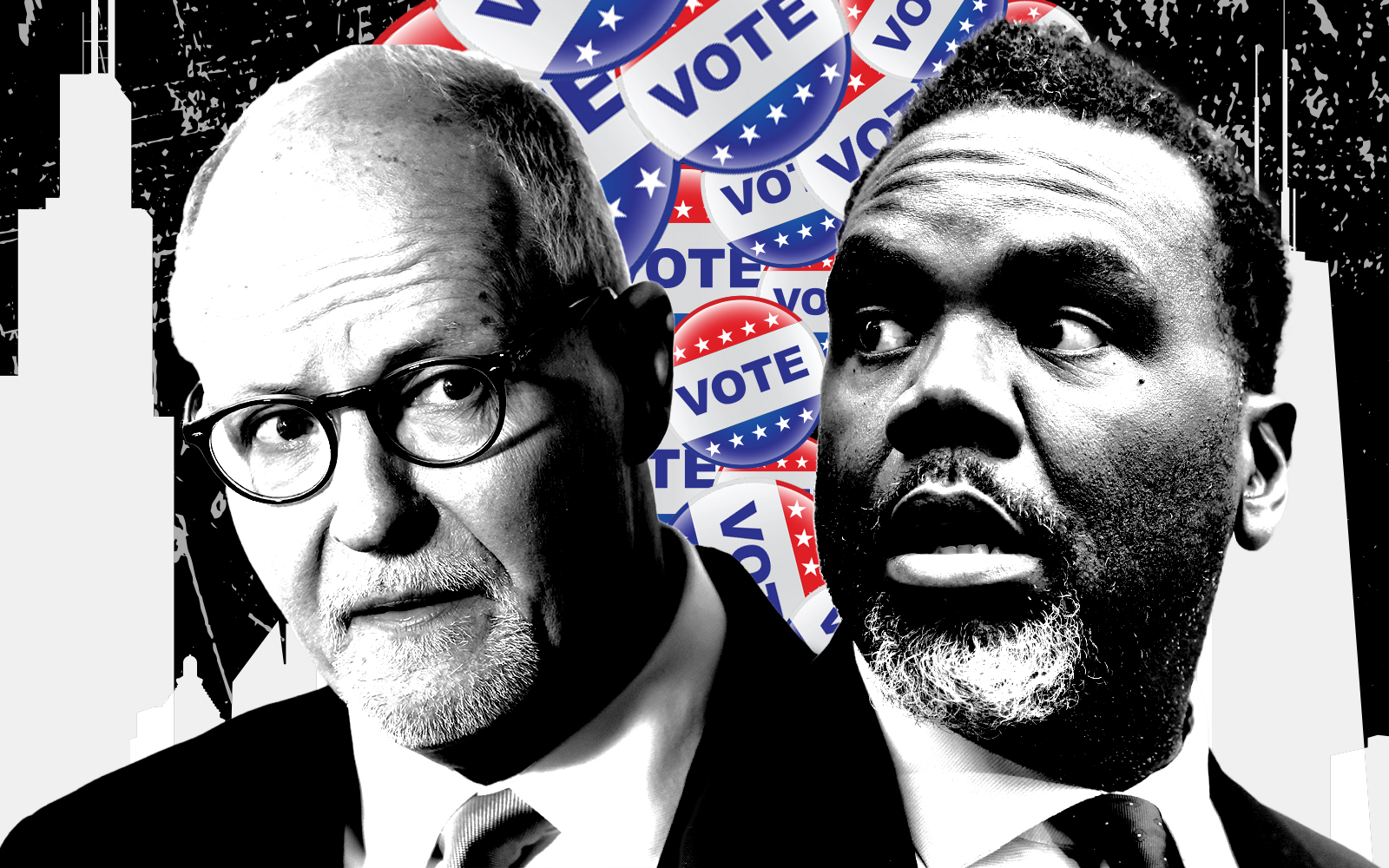

As the progressive Johnson takes over city government, commercial real estate players are on edge. Many have raised serious concerns with Johnson’s proposals — such as more than tripling transfer taxes on property sales of $1 million or more — and coalesced around his opponent Paul Vallas in the run up to this week’s election.

Yet Parang, head of the Building Owners and Managers Association that represents landlords of downtown office towers, was struck with a sense of opportunity by Johnson’s victory speech, especially the mayor-elect’s desire to work with Vallas voters and “invest in people.”

“The mayor-elect has indicated that he wants to kind of represent everybody in the city, and so we will take that at face value and take him up on that,” Parang said. “Whatever your agenda is, if you want it to be sustainable growth and invest in people, you want our industry to be strong.”

His organization is now getting ready to engage an administration that many in real estate predicted would deter investment from the city. Parang plans to emphasize efforts to kill the transfer tax pitch, while also getting involved in conversations around Johnson’s proposals for a new “head tax” on large employers whose workers commute into the city — which would be paid by the tenants of BOMA’s members — and raising taxes on hotel stays.

“It would be self-destructive to kind of kick our industry while it’s down,” Parang said. “A lot of people fall into this trap where they think, ‘Oh, it’s a big building, and therefore it’s like this big business.’ And then they sort of load up all of these assumptions that they might have, visceral thoughts they have about big business, into our industry that don’t apply.”

Downtown office vacancies are at record highs. Many people are still working at home three or more days per week, leaving buildings devoid of foot traffic and retailers in the Loop that are desperate for more customers. Landlords are facing financial distress as some lenders vie to take back skyscrapers whose owners have fallen behind on debts.

Parang plans to raise all these points in a full-throated argument against hiking transfer taxes, while also pointing out the policy could contribute to a loss of value for commercial buildings, which would translate to a larger tax burden on residential properties. Because commercial properties are taxed at a higher rate than homes, homeowners are taxed $2.50 more for every $1 that comes off a commercial building’s assessed value. Johnson has, however, vowed to avoid raising the city’s property tax.

“If you’re trying to make homeownership more affordable, then across the board you want to support our industry,” Parang said. “Growing our industry is the most effective opportunity to make property taxes sustainable.”

Plus, he plans to point out to Johnson and supporters of the transfer tax hike that even the discussion of further raising taxes would be detrimental to the market by repelling investors who would otherwise consider buying Chicago property, even if the policy itself may not be extremely harmful to property values.

Investors make decisions on where to deploy their capital “based on maybe not as rigorous an analytical approach as you might think,” Parang said. “There is a broader rhetorical issue and optics and perception and marketing of Chicago issue when we have such high taxes. The opportunity of lost investment is the same thing as lost value.”

Read more