Non-bank mortgage lenders have jumped head first into the large-loan markets in Brooklyn and Queens as banks pull back, a review of city records by The Real Deal shows.

Non-bank mortgage lenders have jumped head first into the large-loan markets in Brooklyn and Queens as banks pull back, a review of city records by The Real Deal shows.

San Francisco-based ACORE Capital, Los Angeles-based Mesa West Capital, and Midtown-based Two Harbors Investment Corp. — all direct lenders — originated loans of more than $50 million on cash-flowing commercial properties in the past year. Those were the largest loans in the two boroughs that the three firms had ever made, according to records.

Overall, 10 non-bank lenders dove into the Brooklyn and Queens commercial markets between Sept. 1, 2015 and Aug. 31, 2016, providing nearly $824 million, or 18 percent, of the $4.5 billion of debt issued in deals of $50 million and above in the two boroughs, TRD’s analysis found.

They picked up that slack from more regulated financial institutions, which saw a small decrease in deal volume.

“We have seen a tremendous spike in demand for private debt in these areas,” Daniel Nadri, of the New York-based direct lender Titan Capital, said.

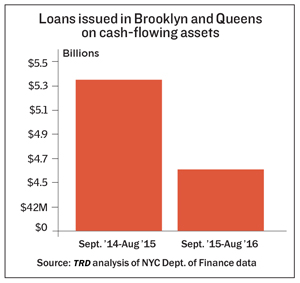

But even as a growing number of non-bank lenders stepped in, the wider market dipped over the past year. Lending during the 12-month period declined by nearly 18 percent from the $5.3 billion of debt originated in the same period a year ago.

“In general, the increase in the regulatory nature of banks is problematic for them,” said Marc Warren, a debt broker with Ackman-Ziff Real Estate Group. One of the biggest concerns for bank lenders is the ongoing rise in property values in the outer boroughs, he said, noting that when an owner seeks to refinance a property and the value has doubled within five years, the banks “sometimes have difficulty.”

Overall though, “regulators prefer cash-flowing transactions,” Warren explained.

TRD analyzed more than 160 loans of $50 million and up issued on cash-flowing commercial properties in Brooklyn and Queens, excluding loans issued on new construction and major rehabilitations, plus any loans on military bases, airports, hospitals and utilities facilities. (We included only the amount of debt that was recorded with the city, and analyzed each loan as of the date it was recorded.)

All in all, the largest lenders on cash-flowing commercial assets in Brooklyn and Queens since January 2013 were New York Community Bank with $1.5 billion, Wells Fargo with $1.4 billion, and Bank of America with $801 million, records show.

But it’s the new entrants that tell a story of change in the two outer boroughs.

The non-bank lender that originated the most debt was ACORE — a venture started by four ex-Starwood Property Trust executives in mid-2015. The firm utilizes capital from the Japanese insurance company Tokio Marine Holdings. ACORE financed Westbrook Partners and Innovo Property Group’s $195 million acquisition of a 650,000-square-foot warehouse in Long Island City, Queens, that is mostly occupied by the New York City Housing Authority on a lease that runs to 2020. The sponsors borrowed $131.9 million to purchase the building at 24-02 49th Avenue from Cammeby’s International Group and the Fruchthandler family in July 2016.

Meanwhile, the mortgage real estate investment trust Two Harbors — affiliated with asset management firm Pine River Capital Management — lent Mark Karasick’s 601W Companies $82 million secured by a large warehouse at 75 20th Street in Brooklyn’s Greenwood Heights neighborhood in April 2016.

And Mesa West lent $67.5 million to Ashkenazy Acquisition for its 300,000-square-foot Douglaston Plaza shopping mall in Queens in December 2015.

Big banks, however, still hold the biggest loans in the two boroughs.

The largest commercial debt deal in Brooklyn and Queens over the past three years was from the French investment bank Natixis, which provided $315 million on One Court Square, also known as the Citibank Building, to a group of borrowers led by the real estate investment firm Savanna in September 2015.

Meanwhile, the largest commercial loan within the past year was a $265 million deal from Morgan Stanley to Blackstone Group for its retail and parking condominium units at the Shops at Skyview Center in Flushing, Queens, in June 2016. The mortgage replaced a $195 million short-term loan that Morgan Stanley provided Blackstone to acquire the property in July 2015.

No one is counting out the big banks. But industry sources say debt funds and other direct lenders will continue to gain an edge with commercial loans over $50 million.

“I don’t think it’s a function of banks not wanting to lend,” said Michael Gigliotti, of the capital markets brokerage HFF. “I think they are less competitive on long-term paper and large deals because of syndication,” he noted in reference to banks increasingly teaming up on large loans to mitigate risk.