After two years of decline, the city’s retail market is experiencing a sudden burst of activity.

After two years of decline, the city’s retail market is experiencing a sudden burst of activity.

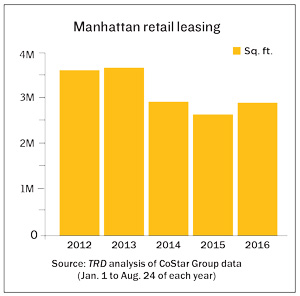

Retail tenants with an eye for a deal are making the most of the current oversupply, spurring a 10 percent uptick in Manhattan store leasing this year, according to an analysis of CoStar Group data by The Real Deal.

Overall, Manhattan retailers inked 1,027 deals for a total of 2.9 million square feet so far this year, up from 990 deals totaling 2.6 million square feet during the same period in 2015, the data reveal.

Make no mistake: This is not the go-go mood of 2012 and 2013, when high- and fast-fashion tenants were driving the market, signing deals to take over tens of thousands of square feet in buildings from Downtown to Upper Madison Avenue.

Now, with many global apparel brand expansion plans on hold or in reverse, it’s a more motley crew of tenants taking space, making smaller deals, often in secondary locations or for long-vacant spaces.

“It is either renewals or opportunistic [deals], and you are starting to see [fast food], and restaurants. And [deals] in emerging markets,” said Gary Trock, a retail broker with CBRE [TRDataCustom].

The situation is unusual. A half dozen brokers interviewed for this article stressed two apparently conflicting circumstances: That the market is soft, and that they are busy.

Several of the large deals inked so far this year underscore these trends. American Girl — which has called 609 Fifth Avenue home since signing a lease in 2001 that earned the brokers a Real Estate Board of New York award — signed a deal for 43,179 square feet across the street at 75 Rockefeller Plaza, where rents are lower.

Meanwhile, star chef Todd English signed a deal for 11,970 square feet at Kushner Companies’ retail condominium at 229 West 43rd Street, a space that had been on the market for six years, according to CoStar. The sportswear retailer Under Armour also took over a long-available space, signing a deal for the former FAO Schwarz space in the GM Building at 767 Fifth Avenue, which had been on the market for years.

As for the flurry of lower-end deals, brokers point to the bevy of vacant stores in neighborhoods that used to have few or no vacancies. Rents are leveling off and even coming down in some cases.

“The market is soft, there is more flexibility in deal terms,” said Robin Abrams, a broker at Lansco. She cautioned, however, that “when brokers say rents are softening, that does not mean tenants are paying one-third. [Rents] may be coming down 5 to 10 percent. That may induce tenants to pull the trigger.”

Local retailers and restaurateurs are taking advantage of the landlords’ deal-making mode, according to Chase Welles of SCG Retail.

“The local deals, the regular indigenous New York retailer, on First Avenue, Alphabet City, West Village are totally happening,” Welles said, “What is not happening is the 20,000-square-foot deal in Soho.”

The softness in the market can actually bring some additional work to brokers, according to Soozan Baxter, an independent retail consultant based in New York. That’s because large firms may cut their in-house staff to save money, then outsource the work.

“I think during lean times, retailers are more apt to rely on brokers than ever,” Baxter said.

Following the last recovery, firms such as JLL, Savills Studley and Eastern Consolidated launched new retail divisions, while other established companies like Kassin Sabbagh aggressively ramped up the number of its agents. But while deal volume has ticked back up in the past few months, brokers question whether there is enough activity to keep all the agents who joined the industry during the last boom occupied.

“All of a sudden, retail became hot. [But now] the market is slow and we are oversaturated with lots of retail brokers and new companies,” said Abrams. “How many retail brokers do we need in New York?”