Fallout from L.A. developer Robert Shapiro’s fraud scheme continues to accumulate, with the latest wrinkle surfacing this month when a trust charged with recovering assets for the scheme’s victims reached a $25.5 million settlement with one of Shapiro’s former law firms.

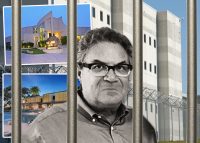

Three years ago, Shapiro was sentenced to 25 years in prison for orchestrating one of the largest Ponzi schemes in U.S. history. His firm, Woodbridge Group of Companies in Sherman Oaks, attracted investors with a promise to buy luxury real estate and sell it at a profit, with hundreds of properties in Aspen and Los Angeles.

The Woodbridge Liquidation Trust, a group that formed out of bankruptcy orders amid the collapse of Shapiro’s scheme, had brought its case in late 2019, soon after the investment manager was sentenced, against numerous firms that were utilized by Shapiro’s company.

“The law firms and attorneys that are defendants in this complaint aided and abetted numerous securities violations and fraudulent acts,” the suit alleged. “Some drafted offering documents replete with false statements that they knew were false. Some prepared negligent legal opinion memorandums to be shared with investors. Some assisted Shapiro in concealing his fraud.”

The recent settlement came with one of those firms, Denver-based Davis Graham & Stubbs, and one of its partners. The settlement was disclosed in the trust’s filings with the Securities & Exchange Commission.

According to the complaint, in 2016, as Colorado investigators began circling around Woodbridge Group of Companies, the firm retained Lee Terry, a partner at Davis Graham & Stubbs who has extensive experience with securities law.

Terry and his law firm facilitated the continuation of Shapiro’s fraud, according to the complaint. When a lead state investigator met with Terry and questioned him about the legitimacy of Shapiro’s enterprise, the lawyer misled the investigator, and then called Woodbridge investors who had also been contacted by investigators to reassure them that their investments were safe, the suit alleged.

To help fend off more problems from regulators, Terry and the law firm also helped draft a new financial product “that would deceive investors and regulators into believing there were third-party borrowers,” according to the suit, while Terry also “bragged to [a Colorado investigator] about his deep connections with the Colorado Division of Securities, with the obvious implication that he would go over [the investigator’s] head if necessary.”

Additional comments Terry made within the law firm made it clear “Terry could help Woodbridge pull the wool over [the investigator’s] eyes,” the suit states.

Read more

Terry and Davis Graham & Stubbs did not respond to an inquiry from TRD.

The settlement amounts to another financial victory for the Woodbridge Liquidation Trust. Earlier this summer the trust, which has filed hundreds of suits against supposed beneficiaries of Shapiro’s scam, reached a $4 million settlement with one Shapiro investor who was allegedly aware of “numerous troubling facts” related to Shapiro.

Shapiro’s $1.3 billion Ponzi scam, which promised returns on luxury property investments in Beverly Hills and Aspen, mostly targeted elderly victims and stretched on for five years.