Despite high interest rates and the ULA transfer tax in the city of Los Angeles, investors poured big money into industrial properties in the Southern California market during 2023.

But it wasn’t the easiest year for industrial sales. A report from Matthews Real Estate Investment Service found that price growth and rent growth for Los Angeles industrial slowed in 2023. The report nevertheless was bullish on the market, saying certain investors are willing to pay premium prices for distribution or manufacturing space in the L.A. metro, where the average price is $340 per square foot, surpassing the national average.

Here are 10 of the biggest industrial deals for 2023 reviewed by TRD researchers.

Port of L.A. Distribution Center, San Pedro | CBRE Investment | $539 million

In February, BlackRock unloaded a portfolio of four warehouses which included the address of 400 Westmont Drive. The price penciled out to $296 per square foot. Little was reported about the deal. A CBRE property description said the distribution center had 51 dock-high doors and 65,000 square feet of office.

Los Angeles & Orange County Portfolio | DRA Advisors, George Urban Advisors, Five Horizons Advisors | $263 million

In April, Link Logistics, owned by Blackstone, traded a 851,131-square-foot portfolio of warehouses in Los Angeles and Orange County for about $308 per square foot. The buildings range in size from 7,580 square feet to 31,918 square feet, and are 98 percent leased, according to media reports.

The portfolio was part of the Southern California portion of Link Logistics’ giant $7.6 billion purchase of Glendale-based PS Business Parks in July 2022.

The Orange County sections of this portfolio can be seen from the intersection of the 5 and 405 freeways in Orange County. They include The Row and mixed-use development Plaza del Lago, both located in Mission Viejo.

12800 Culver Boulevard, Los Angeles| GI Partners| $211 million

In April, DirectTV unloaded two properties in Los Angeles’ Mar Vista district. One site hosted a large data storage center and comprised 181,315 square feet.

DirectTV’s former parent company, AT&T, purchased the properties for $6.5 million in 2010, according to data from CommercialEdge/Yardi Systems. GI Partners acquired the assets for its Essential Tech + Science Fund. The transaction penciled out to around $688 per square foot.

9400 Santa Fe Springs Road, Santa Fe Springs | Rexford Industrial Realty | $210 million

In July, San Diego County Employees Retirement Association unloaded a 595,304-square-foot industrial property in Santa Fe Springs for $353 per square foot. In 2015, the seller acquired the 45-year-old warehouse for $62.3 million.

The facility is 100 percent leased and occupied by two tenants, according to media reports.

3049, 3095 and 3163 East Vernon Avenue, Vernon | Goodman Group | $209 million

In July, Smithfield Foods, headquartered in Virginia, sold a 29-acre plant in Vernon where Dodger Dogs, a favorite at Los Angeles baseball games, were produced until 2021. The site packaged meat under the Farmer John brand.

Smithfield said it traded the meat-processing plant due to high business costs in California. It was forecast that the site would likely be redeveloped into an industrial park, according to sources familiar with the deal cited by the Commercial Observer.

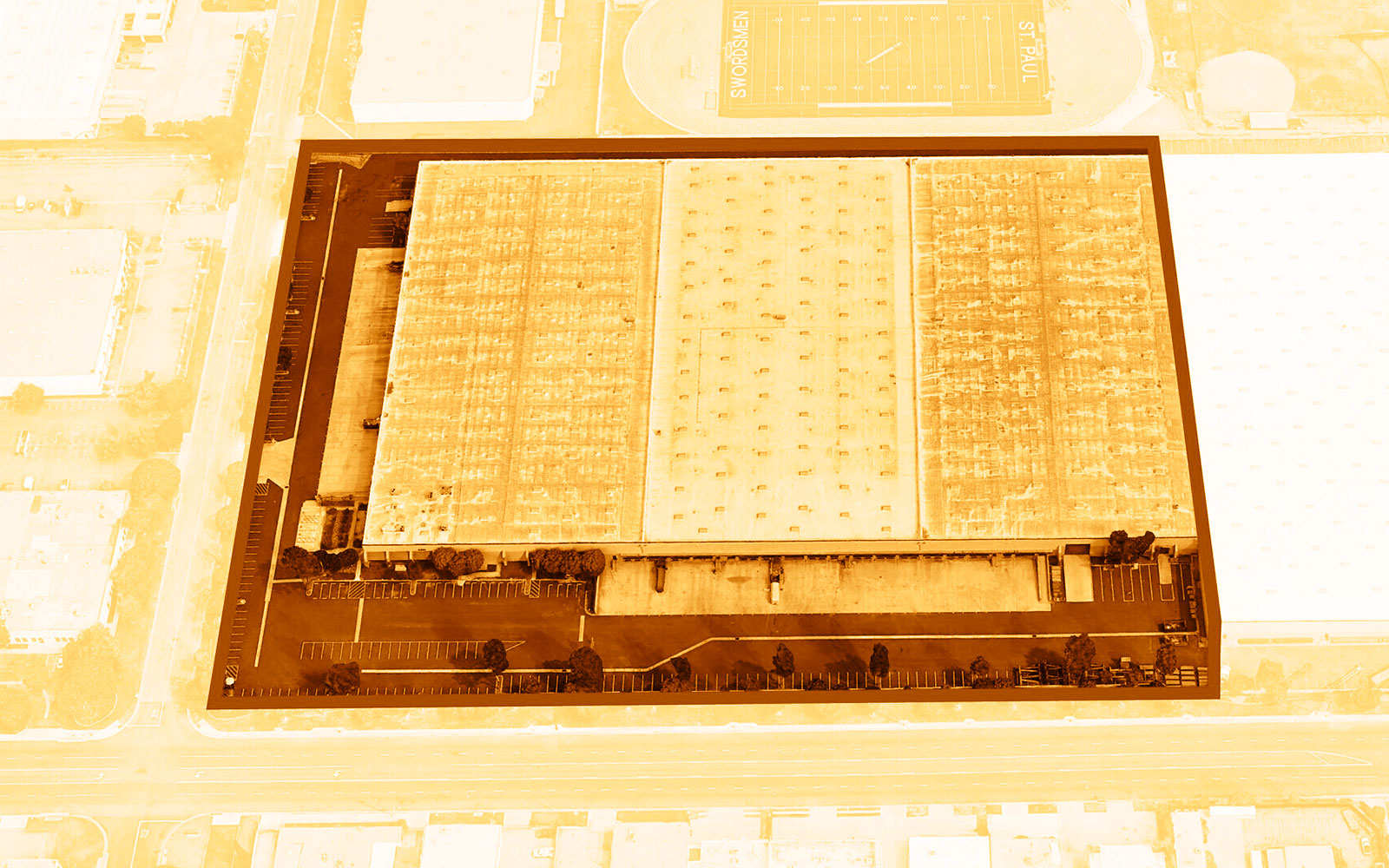

400 Union Pacific Avenue, Montebello and 4040 Noakes Avenue, Commerce | Dart Warehouse | $190 million

In October, Dart Warehouse, owned by Dedeaux Properties, acquired 99 Cents Only Stores’ 882,000-square-foot distribution facility in Commerce for about $238 per square foot. The trade will play out in a sales leaseback deal to give Dedeaux time to figure out what it will ultimately do with the space, said President Brett Dedeaux.

“We are looking at numerous alternatives, including a possible redevelopment of the site, which would include two of our adjacent buildings totaling more than 400,000 square feet, to create a state-of-the-art distribution campus with excess trailer parking, secured access and privatized streets,” Dedeaux said in a statement.

9000 Airport Boulevard, Los Angeles | Rexford Industrial Realty | $143 million

Around April, Rexford Industrial Realty acquired an 18-acre Hertz Car Rental lot in a deal that penciled out to $179 per land square foot, according to a company announcement..

Hertz will lease back the property for three years, during which time, the rent will increase 4 percent each year. The site is zoned for industrial use, giving Rexford the option to develop a Class A industrial development on the land near LAX or use it for outdoor storage, according to a Rexford statement.

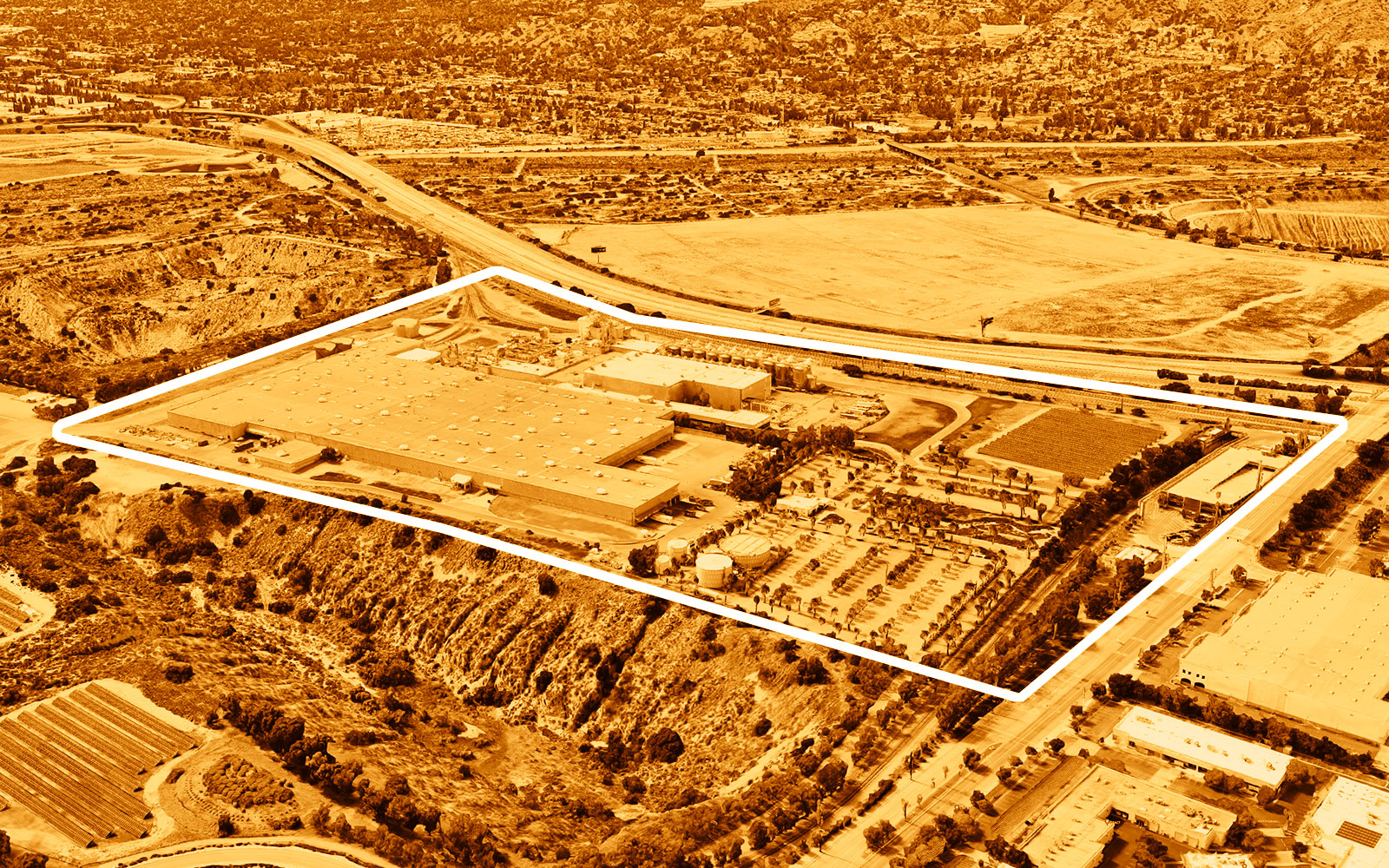

15801 West First Street, Irwindale | Rexford Industrial Realty | $120 million

In October, Rexford paid $120 million for a 993,000-square-foot beer brewing facility at 15801 West First Street. The seller was Pabst Brewing, based in San Antonio, Texas. The industrial REIT also issued a $125 million loan to Pabst, secured by a 150-acre industrial development site next door. The five-year, fixed-rate loan has an interest rate of 8 percent and includes a right of first offer for Rexford to buy the San Gabriel Valley property. The brewing facility was leased by City Brewing.

According to Commercial Observer, the combined $245 million investment was funded by proceeds from Rexford’s settlements and available cash. They are projected to generate 6.8 percent returns before interest payments.

Azusa Industrial Center, Azusa | IDS Real Estate Group | $84 million

In July, IDS Real Estate Group acquired a 432,500-square-foot campus of three buildings located at 975-985 West Eighth Street, 823-829 West Eighth Street and 875-935 West Eighth Street in the San Gabriel Valley city of Azusa, PGIM Real Estate’s debt fund provided financing for the properties.

Built in the 1980s, the campus is 100 percent leased. It features a total of 73 dock doors, truck courts ranging from 130 to 160 feet and clear heights ranging from 24 to 30 feet. The campus is located close to the 210 and 605 freeways.

John Reed Commerce Center, City of Industry | Long Point Realty Partners | $80 million

In September, Long Point Partners acquired a 275,000-square-foot development at 1201 John Reed Court in the City of Industry. The deal penciled out to $290 per square foot.

The property is 83 percent leased to 32 different tenants, according to a Cushman & Wakefield statement.

DWS Group, a German asset management firm, sold the property. The firm originally purchased the industrial park in 2007 for an undisclosed sum, according to property records,

Read more