After more than a decade of rock-bottom interest rates, real estate lenders and borrowers in New York City are in a precarious situation.

The rapid rise of rates and declining property values in some sectors have prompted lenders to be more selective about what sectors they lend in — and to whom. Most are sticking with current customers but being extremely cautious about adding new ones.

“Their expansion is very guarded. It’s more opportunistic,” said Valley National Bank executive Chris Coiley.

As a result, the volume of loan issuance has plummeted over the past year. Owners of properties with sinking values have found it difficult to refinance expiring debt, and holders of that debt have no good options for how to proceed.

This is especially true in the office sector, where the expansion of work-from-home policies has punctured occupancy rates, driven down rents and turned some lower-class office buildings’ debt into something resembling a toxic asset.

Lenders are trapped in the sinkhole. They can either allow borrowers to kick the can down the road over and over again, or foreclose on the properties. Lenders have little appetite for the latter because selling them wouldn’t cover the debt and most don’t have the bandwidth, financial flexibility or expertise to hold, renovate and re-tenant office properties to improve their valuations.

The situation leaves everyone involved with just one viable option — buy time in hopes that macro conditions improve.

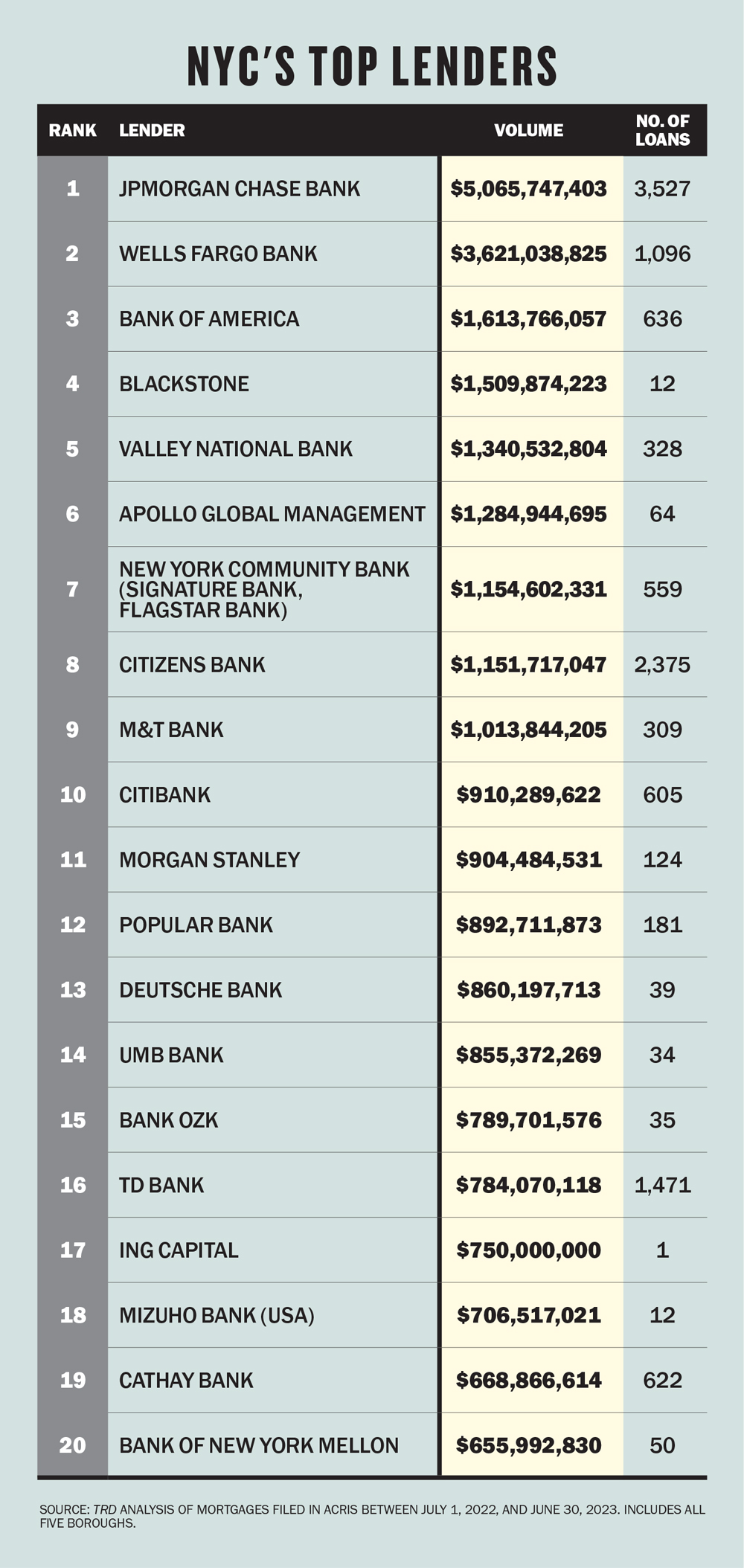

The Real Deal examined mortgages recorded in city records between July 2022 and July 2023 to rank the biggest lenders in New York City real estate. According to the data, the dollar volume issued by the top 20 lenders in NYC dropped to $26 billion from $30.5 billion in the previous year. The total number of loans for the top 20 dropped to 12,080 from 16,682 — a 28 percent decline.

Lenders’ individual rankings, meanwhile, were greatly affected by mergers and acquisitions. The banking crisis earlier this year led to some distressed banks being sold to other institutions.

“We’ll see a little more consolidation,” said Marcia Kaufman, CEO of Bayport Funding. “I think that’s normal. That’s a cycle, too. We’ve seen it in the past. They consolidate, and then there’s little guys that pop up again.”

Indeed, Signature Bank, which collapsed this year, had been launched in 2001 by an executive whose bank had been acquired in 1999 by HSBC.

JPMorgan Chase once again tops the list of most active New York City lenders, with nearly $5.1 billion issued on 3,527 loans. However, those numbers were inflated by the bank’s acquisition of the collapsed lender First Republic Bank.

First Republic issued $1.8 billion in real estate loans, without which JPMorgan’s volume would have been $3.3 billion. Even with First Republic’s loans, JPMorgan’s total fell by 25 percent, from 4,692 in the previous ranking.

Strip out the First Republic purchase and JPMorgan’s dollar amount would have been No. 2 behind Wells Fargo, which issued $3.6 billion on 1,096 real estate loans. Wells Fargo was second on the 2022 list.

Mergers and acquisitions affected other lenders in the top 20 as well. Valley National Bank jumped from No. 12 last year to No. 5 on the basis of its acquisition of the United States division of Israel’s Bank Leumi International. Combined, the two banks issued $1.3 billion in loans, primarily in multifamily, after Valley alone lent $844 million the year before.

Similarly, New York Community Bank jumped to No. 7 after not being ranked last year. Its purchases of Signature Bank loans and Flagstar Bank helped vault its dollar amount from $780 million last year to $1.2 billion this year, with almost all of it coming from the commercial sector. NYCB did not buy Signature’s multifamily loans, prompting speculation about the portfolio’s quality.

M&T Bank’s lending total jumped from $275 million last year to $1 billion. It purchased People’s United Financial in April 2022, but it’s unclear how much the acquisition juiced its real estate lending in New York City.

The largest lending deal of the year was by ING Capital, which handed Brookfield Properties a $750 million mortgage on 660 Fifth Avenue, formerly known as 666 Fifth Avenue. That was the only New York City real estate loan the firm issued for the entire year, but it was enough to rank it No. 17.

JPMorgan’s two biggest loans were for $200 million each. One went to the Durst Organization on its 51-floor office building 4 Times Square, which Durst developed in the 1990s. The other was to Josh Gotlib’s Black Spruce Management for a block of 408 rental apartments at 685 First Avenue in Murray Hill.

Wells Fargo scored four loans above the $300 million threshold, led by $385 million to SL Green for One Madison Avenue. Wells Fargo also issued a $189 million loan to SL Green for the property.

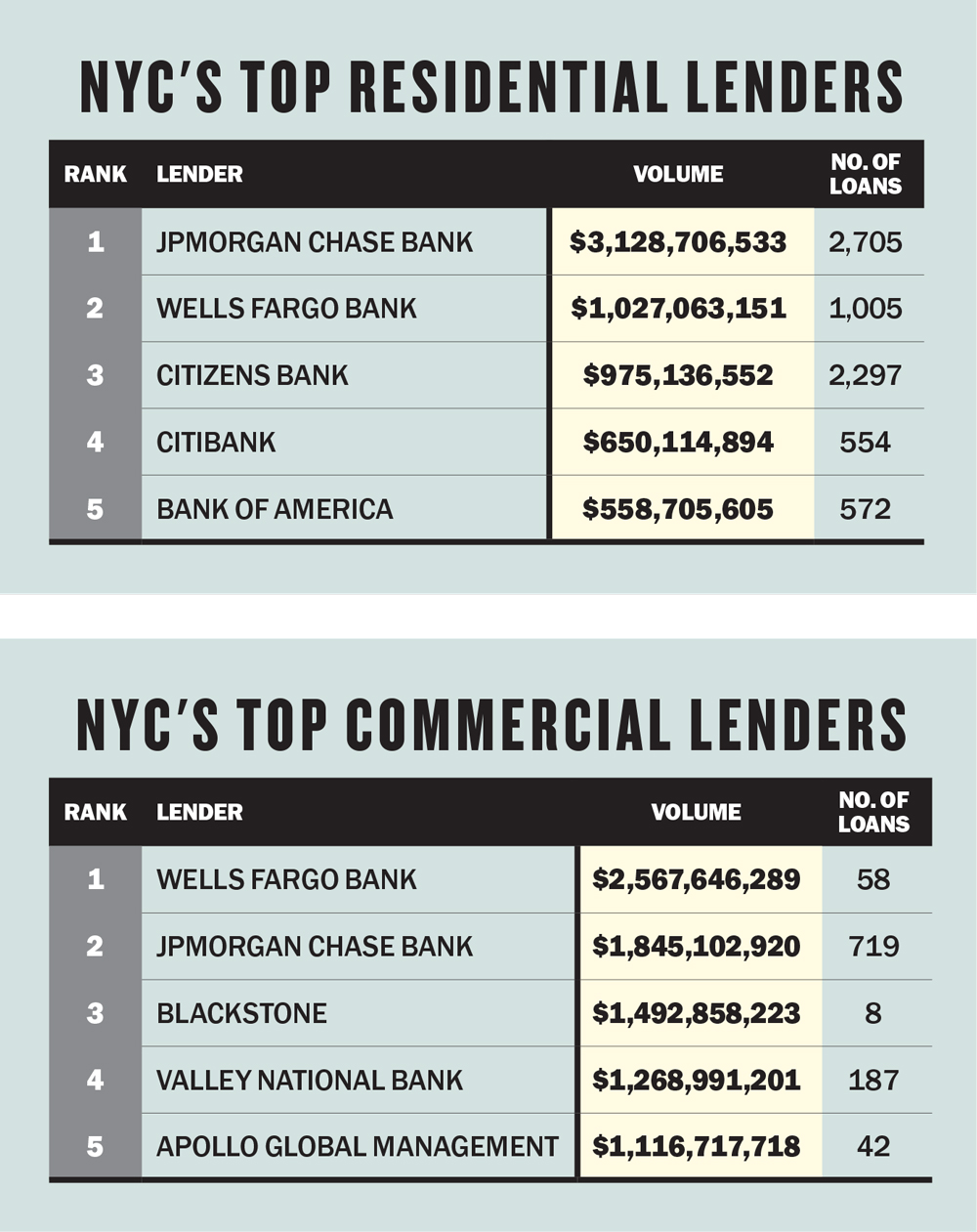

Breaking out residential loans from the total shows JPMorgan topping that category with $3.1 billion issued on 2,705 deals, and Wells Fargo at No. 2 with $1 billion on 1,005 loans. On the commercial side, Wells Fargo topped JPMorgan with $2.6 billion despite issuing only 58 loans. JPMorgan hit $1.8 billion on 719 loans.

Apollo Capital, part of Apollo Global Management, stepped up its real estate lending over the last year with $1.3 billion, of which $1.1 billion went to commercial properties. It issued just $232 million in real estate loans the prior year.