Signature Bank is putting its performing loan on the landmarked McGraw-Hill Building up for sale one year before it’s scheduled to mature.

The lender has engaged with Newmark on marketing the $140 million loan at 330 West 42nd Street, the Commercial Observer reported. The floating-rate debt’s balance is approximately $241 per square foot and is slated to mature next May. The loan has a blended rate of 6.59 percent and a default rate of 24 percent.

It was not immediately clear why Signature is looking to sell the loan, but the bank has been reining in real estate lending and coping with the cryptocurrency crash, and the Midtown building’s future — like that of the office sector in general — is uncertain.

Deco Tower Associates, a consortium of private investors, owns the 33-story, 580,000-square-foot property, which sits vacant. Resolution Real Estate manages the building, recently initiating a $120 million renovation and repositioning.

MDeaS Architects redesigned the building to attract office tenants, creating open floor plans and adding outdoor terraces. Another possibility has emerged for at least part of the property, though: an apartment conversion.

In October, the New York Post reported the building’s ownership was exploring transforming a majority of the upper floors into luxury rentals, reserving the top couple of floors for amenities. The residences would largely be studios and one-bedrooms, while the bottom 10 floors would remain office space.

A conversion was also floated for the building back in 2018, though the offering memorandum at the time envisioned residences on fewer floors.

The building was the headquarters of the McGraw Hill publishing company from its completion in 1931 until the 1970s. Other tenants have included medical insurer Group Health and Marvel Comics.

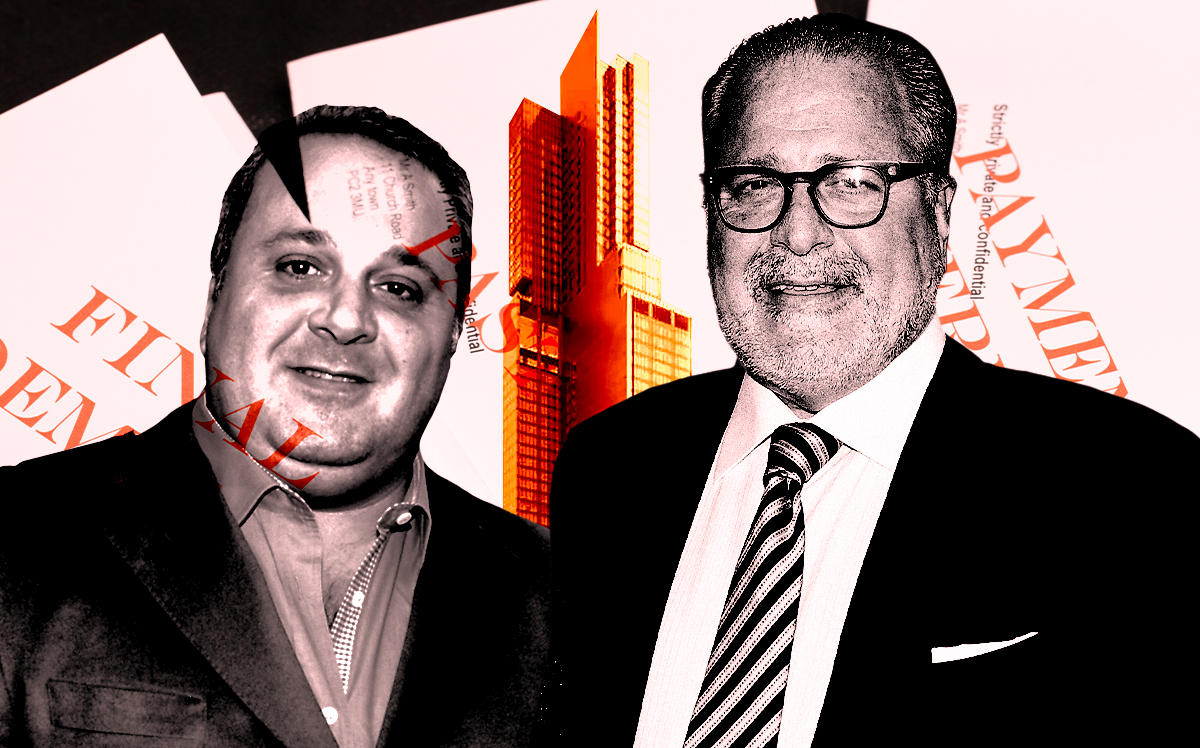

The loan is being marketed by Newmark’s Stolly-Roeschlaub team and the Spies-Harmon team. The high-profile broker teams have been working together since Adam Spies and Doug Harmon defected from Cushman & Wakefield. They are also pairing up to market an $85 million loan the Chetrit Group defaulted on at a shovel-ready development site at Hudson Yards.

Read more